Lights, Camera, Agenda: Biden’s Regulatory Cast

Stepping into office with leading and supporting roles open across the government’s top financial regulators, the Biden administration was given a unique opportunity to reshape the financial regulatory landscape. Nominating four members to the seven-member Federal Reserve Board and promoting another to a key position, the Biden Administration has already made an outsized impact on the institution. With Jerome Powell as Chairman, Lael Brainard as Vice Chairman, Sarah Raskin as Vice Chair for Supervision, and Lisa Cook and Philip Jefferson as Governors, the Fed is expected to most immediately shape the implementation of the Basel III Endgame (better known as Basel IV) as well as potential Supplementary Leverage Ratio (SLR) reform. At the same time, it intends to address administration goals, such as competition in the banking industry and climate-related financial regulation, that would directly impact financial issuers.

What Will Basel IV Implementation Look Like?

Delayed by one year due to the pandemic, the Basel IV phase-in period is set to start on January 1, 2023, but could be delayed further. The final iteration of Basel III mainly focuses on adjusting the calculation of risk-weighted assets to improve the comparability of banks’ capital levels and preventing capital shortfalls which can occur when using internal models.1 While the framework has been agreed upon, the Federal Reserve is yet to finalize capital rules for its implementation.2 Indications from the Fed have suggested that they intend the final rules to be capital neutral, even suggesting that tweaking the G-SIB surcharge or Stress Capital Buffer to achieve this would be on the table.3 As the Fed continues to mull over the final rules, Biden’s nominees might again start pushing to impose more burdensome requirements. For example, in her prior term as a Fed Governor, Sarah Raskin had a strong hand in implementing the Dodd-Frank Act, specifically driving the board to impose stricter guardrails on banks.4 This could place downward pressure on banks’ profitability and make implementation more cumbersome.

How Relieving Will SLR Relief Be?

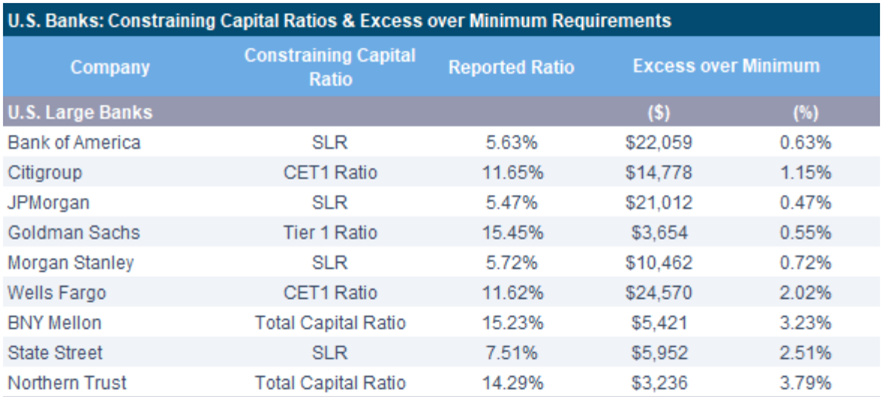

To facilitate lending and prevent disruption to treasury markets, the Fed introduced a temporary exclusion of Treasury securities and cash held at the Fed from the denominator of the SLR (Tier 1 Capital / Total Leverage), which lapsed in March of 2021. Coupled with ballooned bank balance sheets, many banks became restrained by minimum SLR requirements, revitalizing talks of permanent SLR relief as this is meant to be an additive, not constraining measurement.5 In 2019, the major custody banks received SLR relief in the form of excluding deposits at qualifying central banks from the SLR denominator.6 What potential SLR relief could look like for other banks will be heavily influenced by the new Fed governors, particularly Raskin, as Powell has stated he would give a “degree of deference”7 to her position. Reining in SLR relief would force banks to pursue more restrictive lending practices, particularly at times when the Fed is aggressively expanding its balance sheet. It is also worth noting that SLR relief would have knock-on effects on other leverage-based capital ratios which share the same denominator, allowing banks to more efficiency deploy capital, aiding profitability.8

The constraining capital ratio is the ratio that is least above its minimum requirements as measured by bps as of end of Q3 2021.

The minimum SLR requirement for the banks listed above is 5%.

Source: CreditSights

Whole-Of-Government Climate-Change Approach Includes the Fed

President Biden’s whole-of-government approach to addressing climate change is a key element of his nominations. While climate-related financial disclosures and regulations have been on the Fed’s dashboard for some time now, Biden’s nominees might accelerate the process. Both Lael Brainard and Sarah Raskin have been outspoken proponents of climate-related regulation, with Raskin stating in a 2021 Op-Ed published by Project Syndicate that “Regulators must move faster in preparing firms within their jurisdiction to weather climate effects.”9 Such preparations could take the form of a measurement like CRISK, which is the presumed capital shortfall of financial institutions in a climate stress scenario. The results of this test could be used to adjust capital requirements.10 While these ideas remain in their infancy, the new Fed cast should accelerate the timeline for their implementation, emphasizing the importance of monitoring the climate risks of financial issuers.

Rain on the M&A Parade

In July of 2021, President Biden issued an executive order calling regulatory agencies to review and update procedures for banking merger oversight.11 Amid a record year for bank mergers, his worries were echoed by fellow Democrats including Chair of the House Committee on Financial Services Maxine Waters who called on the Fed, OCC and FDIC to halt the approval of large bank mergers until approval procedure reviews were completed.12 Internal battles at the FDIC over bank merger procedures, as well as Randal Quarles’ term as Vice Chair for Banking Supervision lapsing in October, have led to a backup of pending acquisitions.13 Biden’s nominees to the Fed Board will play a major part of already pending and future bank deals. Their influence on deals may be signaled by Lael Brainard’s track record of emphasizing concentration risk when reviewing bank acquisitions.14 This could dampen the appetite for further acquisitions in an industry where scale is increasingly critical, potentially widening the gap between large financial institutions and those with room left to grow.

1See Aptivaa’s article on the implications of Basel IV reforms. https://aptivaa.com/insights-blogs/basel-iv-what-does-it-mean-for-banks-

2See KPMG’s article Basel 4 – The Final Countdown? https://home.kpmg/xx/en/home/insights/2021/10/basel-4-this-time-its-final.html

3See mlex’s June 2021 article, US Fed Aims to Adopt Last Basel III Part by January 2023 With Capital Neutral Calibrations Across System. https://mlexmarketinsight.com/news-hub/editors-picks/area-of-expertise/financial-services/us-fed-aims-to-adopt-last-basel-iii-part-by-january-2023-with-capital-neutral-calibrations-across-system

4See Sarah Raskin’s 2012 speech at the Graduate School of Banking at Colorado, Bolder, How Well is our Financial System Servicing Us? Working Together to find the High Road. https://www.federalreserve.gov/newsevents/speech/raskin20120723a.htm

5See American Banker’s November 2021 article, The Big Decisions Awaiting Biden’s Fed. https://www.americanbanker.com/list/the-big-decisions-awaiting-bidens-fed

6See Cov Financial Services’ April 2019 article, Agencies to Revise SLR to Exclude Custodial Deposits at Central Banks. https://www.covfinancialservices.com/2019/04/agencies-to-revise-slr-to-exclude-custodial-deposits-at-central-banks/

7See Elizabeth Warren’s press release on the Senate Committee on Banking’s November 30th hearing. https://www.warren.senate.gov/newsroom/press-releases/at-hearing-warren-presses-federal-reserve-chair-powell-on-vice-chair-for-supervisions-authority-to-take-tough-regulatory-action

8See CreditSights’ November article, U.S. Banks: 3Q21 Regulatory Capital & TALC Review https://www.creditsights.com/articles/419121

9See Sarah Raskin’s 2021 Op-Ed, Changing the Climate of Financial Regulation, published by Project Syndicate. https://www.project-syndicate.org/onpoint/us-financial-regulators-climate-change-by-sarah-bloom-raskin-2021-09

10See the New York Fed’s September staff report, Climate Stress Testing. https://www.newyorkfed.org/research/staff_reports/sr977

11See Joe Biden’s July Executive Order on Promoting Competition in the American Economy. 11See Joe Biden’s July Executive Order on Promoting Competition in the American Economy. https://www.whitehouse.gov/briefing-room/presidential-actions/2021/07/09/executive-order-on-promoting-competition-in-the-american-economy/

12See the House Committee on Financial Services December release, Waters Calls on Fed, FDIC, and OCC to Halt Mergers and Acquisitions over $100 Billion. https://financialservices.house.gov/news/email/show.aspx?ID=CWRRGI26ELG3KXMYL73UMHJNPQ

13See American Banker’s December article, Partisan Battle Brewing Over FDIC’s Bank Merger Policy. https://www.americanbanker.com/news/partisan-battle-brewing-over-fdics-bank-merger-policy

14See American Banker’s November 2021 article, The Big Decisions Awaiting Biden’s Fed. https://www.americanbanker.com/list/the-big-decisions-awaiting-bidens-fed

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.