LIBOR No More

LIBOR entered its next phase on January 1st, 2022. The date marked when no new financial contracts could be priced off LIBOR, which underpinned more than $200 trillion in loans , contracts, and derivatives as of the end of 2020. LIBOR (the London Interbank Offered Rate) will still be published as a reference rate for legacy contracts until June 30th, 2023, but after this point, it will cease to exist. In short, the endgame is close and, in many ways, has already arrived.

LIBOR’s Replacement

The Secured Overnight Financing Rate (SOFR) was selected by the New York Fed’s Alternative Rate Reference Committee1 (ARRC) to replace LIBOR. SOFR is a broad measure of the cost of overnight borrowing, using Treasuries as collateral. Unlike LIBOR, SOFR is an actual market rate rather than a theoretical estimate of a bank’s cost of borrowing. It is underpinned by close to $1 trillion in daily transactions2, making it a robust estimate of funding costs.

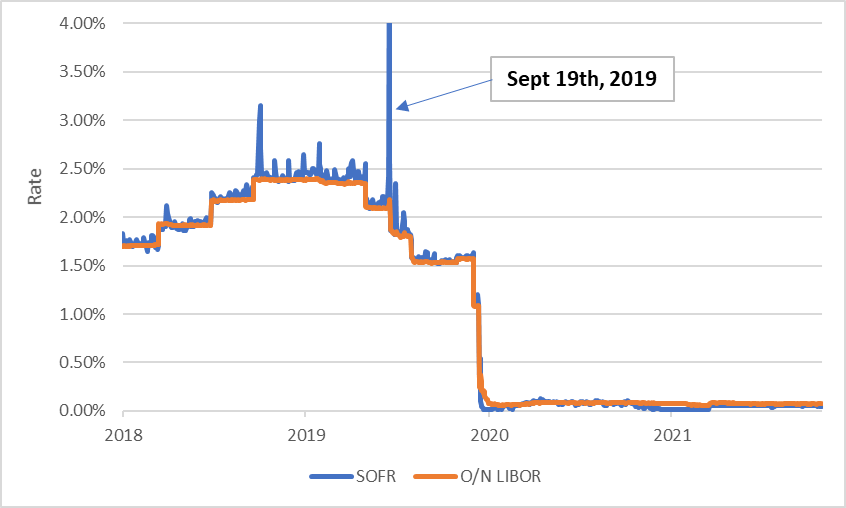

As we noted in our August 2019 research report, Moving from LIBOR to SOFR, it’s also a fundamentally different rate from LIBOR. It is solely an overnight rate, whereas LIBOR existed at various tenors. It is also a risk-free rate, rather than a credit-sensitive rate. This difference means that while SOFR tends to track LIBOR quite well, there are periods where the two can diverge. As illustrated by the one-day blowout on September 19, 2019, disruptions to repo markets can cause SOFR to rise while LIBOR stays put.

Figure 1: SOFR vs. Overnight LIBOR

Source: Bloomberg Data

Secondly, the two rates may react differently during periods of heightened credit stress. During these periods, LIBOR tends to rise as banks become less willing to lend to one another, whereas it’s possible for SOFR to fall in such an environment as investors flock to Treasuries.

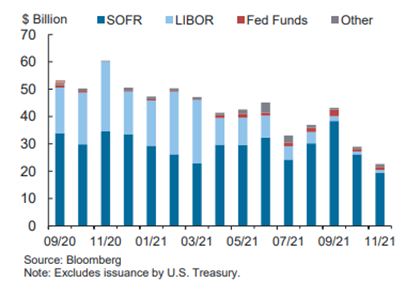

Floating Rate-Notes

For cash investors, the primary impact of SOFR is via their holdings of floating rate-notes (FRNs). Once obscure, the market of SOFR FRNs is now quite large. SOFR FRNs used to primarily be issued by government sponsored enterprises (GSE’s), but they steadily overtook LIBOR notes in corporate debt markets throughout 2021.

Figure 2: Floating Rate Note Issuance

Source: ARRC 2021 Year End Progress Report

This trend has only further accelerated in 2022, with 99.5% of non-Treasury floating rate note issuance year-to-date linked to SOFR3. Nevertheless, the stock of outstanding LIBOR FRNs remains large, at more than $500 billion. Of this stock, debt with a maturity past the end point of LIBOR will need to undergo a change in reference rate. This change will be governed by the individual debt contract’s fallback language, which determines the new rate and spread level relative to LIBOR.

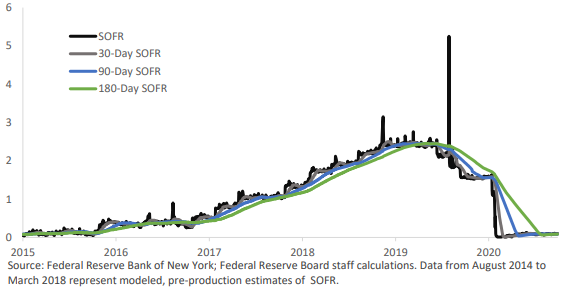

Term Rates

The primary difficulty with using SOFR is that it’s an overnight rate subject to idiosyncratic volatility. However, looking at SOFR over a longer-period of time smooths out this volatility.

Figure 5: Movements in SOFR vs. SOFR Averages

Source: ARRC User’s Guide to SOFR

Until recently, there was no effective way to “term-out” SOFR. The ARRC’s initial recommendations were to calculate SOFR in advance or in arrears. SOFR in advance is the average SOFR rate over the prior period, so for instance, 3-month SOFR = Average observed SOFR rate over the prior 3-months. And SOFR in arrears is the average of SOFR over the current period; 3-Month SOFR = Average observed SOFR rate over the next 3 months.

Both approaches have obvious drawbacks. SOFR in advance can be determined ahead of time but is inherently backwards looking. SOFR in arrears, on the other hand, is forward looking but cannot be determined ahead of time and is operationally difficult to implement.

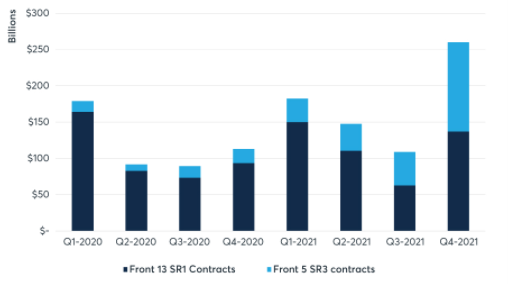

Therefore, the most substantial development of last year was the ARRC’s endorsement of forward-looking Term SOFR rates. These Term SOFR Rates are determined by the trading in SOFR futures contracts, where the price of the contract corresponds to the expected SOFR rate over the life of the contract. They are published by CME Group in terms of 1, 3, 6, and 12 months4.

Term SOFR rates are the natural solution to the problems posed by reliance on an overnight rate. They are forward looking, observable, and incorporate a term premium like LIBOR or other non-overnight rates. Given the ARRC’s endorsement, it’s expected that their usage will increase substantially, though this at least partially depends on the size and depth of the futures market activity. Trading picked up substantially in Q4’21 but is still relatively shallow.

Figure 6: Daily Trading Volume of SOFR Futures Contracts on CME

Source: CME Group

Questions for 2022

The end game for LIBOR is mostly set, and the first month’s worth of data suggests that its sunsetting will not be as bad as was once feared. Even so, there are some outstanding questions:

1. Will there be any challengers to SOFR?

The sheer extent to which SOFR has taken over the market is surprising. This is especially true in the bank space5, where there are viable alternatives to SOFR that are credit-sensitive, such as the Bloomberg Short-Term Bank Yield Index or Ameribor. Even with these alternatives, bank regulators have stated their explicit preference for SOFR, and their customers (especially on the corporate side) seem to prefer it.

2. What’s the solution to the problem of poor fallback language in LIBOR contracts?

While not universal, there are a significant number of contracts with unclear or non-existent fallback language. This portends the possibility of disruption from uncertainty over the transition rate. The states of New York and Alabama addressed this issue via legislation that allows them to impose a universal fallback rate on these contracts. Similar legislation is making its way through Capitol Hill: The Adjustable Interest Rate (LIBOR) Act of 2021 would allow for the imposition of a fallback rate based on SOFR. The bill passed the House in December by a margin of 415-9. It has yet to be called by the Senate, presumably because it is not an administrative priority, but the vote margin in the House indicates that this is a non-partisan issue.

3. Will there be any market disruption?

SOFR is progressively becoming more integrated into financial markets, and the publication of forward-looking rates makes it easier to use. That being said, there are risks. A bifurcation of demand for LIBOR and SOFR securities could lead to a reduction in liquidity of LIBOR-based contracts, which in turn could have knock-on effects for financial markets.

1 Find out more about the ARRC here: https://www.newyorkfed.org/arrc

2 Daily SOFR rate and volume found here: https://www.newyorkfed.org/markets/reference-rates/sofr

3 According to Bloomberg Intelligence as of 1/26/22

4 Term rates published here: https://www.cmegroup.com/market-data/cme-group-benchmark-administration/term-sofr.html#

5 As of 1/26/22 90% of leverage loan issued in 2022 had been priced off SOFR according to Bloomberg Intelligence

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.