June Month-end Portfolio Update

Yields Rise

Welcome to the third quarter and the second half of 2023! Treasury yields rose across the curve during the second quarter, led by the 2-year note which rose 87 basis points to 4.90%. The rise in yields was a result of solid economic data, elevated inflation, and a Fed signaling a “higher-for-longer” monetary policy narrative. In its latest economic projections, the Fed is forecasting two more quarter-point rate hikes this year, although the market is predicting only one more 25 basis point rate hike in 2023. The Fed funds futures market is pricing in an 80% probability of a 25 basis point rise to 5.25%-5.50% at the July 26th FOMC meeting and then for the Fed to remain on hold for the remainder of the year.

The minutes from the June FOMC meeting showed that “almost all participants judged it appropriate or acceptable to maintain the target range for the federal funds rate at 5% to 5.25%. Some participants indicated that they favored raising the target range for the federal funds rate 25 basis points at this meeting or that they could have supported such a proposal.” This reinforces the idea that a hike in July may be likely.

Source: Bloomberg

2% GDP – What Recession?

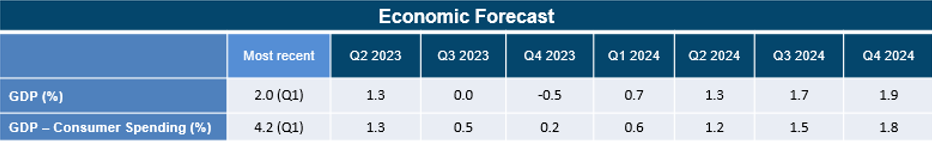

The first quarter GDP final reading trounced estimates, rising +2.0% which was revised up significantly from the second estimate of +1.3% released last month. The upward revision was primarily attributed to an increase in personal consumption rising 4.2%, the strongest reading in nearly two years. Looking at economists’ forecasts (see chart below), the median estimate is for only one negative GDP print in the 4th quarter of this year with a return to positive GDP readings throughout 2024.

We also saw an improvement in weekly jobless claims – after three consecutive weeks above 260,000, weekly initial jobless claims fell last week to 239,000, marking the biggest single week decline since October 2021 and ending a run of five consecutive weekly gains. Looking ahead, this Friday the latest employment report is expected to show nonfarm payrolls rising by 225,000 and the unemployment rate declining to 3.6%. For the economy to remain on solid footing, a healthy labor market will likely be a key contributor, as consumer spending comprises approximately 75% of GDP.

Source: Bloomberg

Source: Bloomberg

Upbeat Housing Data

One of the sectors most impacted by the Fed’s rapid increase in rates since March 2022 has been housing. However, recent data has shown that some releases have nevertheless exceeded expectations:

- Housing Starts rose 21.7% vs -0.1% expected – largest monthly gain since 1990

- Building Permits rose 5.2% vs +0.6% expected – a 7 month high

- Existing Home Sales rose 0.2% vs -0.7% expected

- New Home Sales +12.2% vs -1.0% expected – up over the past 3 months to highest level in over a year

- NAHB Housing Market index rose to 55 vs 51 expected – a one year high

Despite these solid readings, there was one below expectation reading from pending home sales, which declined 2.7% vs -0.5% expected. The average 30-year fixed rate mortgage is 6.75% and 6.91% for jumbo loans, so affordability and financing costs continue to be a major headwind for this sector.

Busy June for Powell

Federal Reserve Chair Powell had a busy June. In addition to the FOMC meeting, he also delivered his semi-annual testimony to the House Financial Services Committee and the Senate Banking Committee. Powell described an economy that is still strong, with inflation running too high, and repeated that most officials think interest rates will need to go higher to tame prices. He said the Fed is in the unusual situation of “overachieving” on its employment mandate with the jobless rate running near multidecade lows. Towards the end of the month Powell also spoke at a conference with other fellow central bank leaders from the Bank of England, Bank of Japan and the ECB. When asked whether Fed officials now anticipate they will raise rates every other meeting after skipping the June FOMC meeting, Powell said that may or may not happen and that he wouldn’t rule out consecutive rate increases. He also reiterated that most Fed officials’ forecasts show they expect to hike at least two more times this year.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.