June FOMC: Expect Fewer Rate Cuts

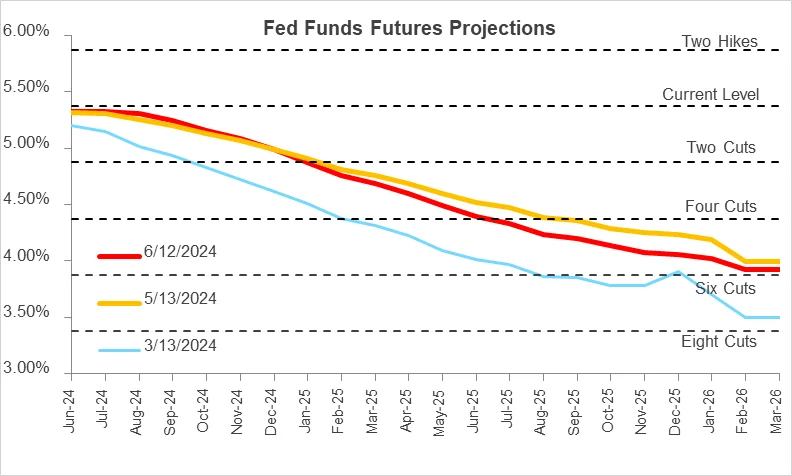

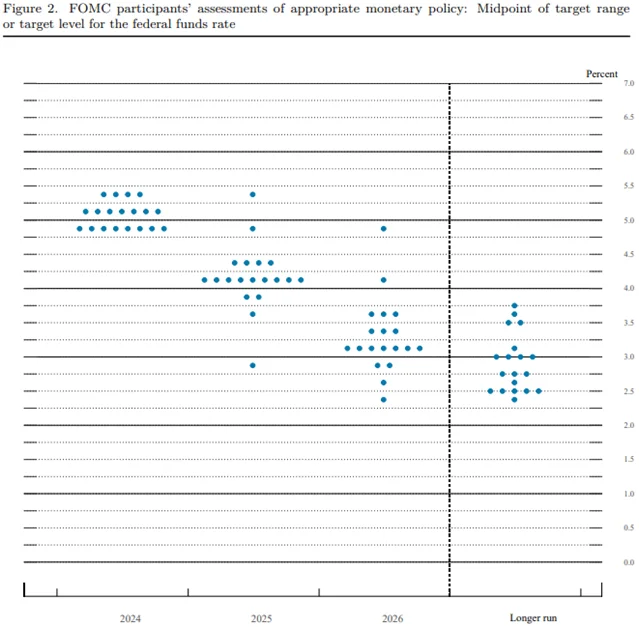

Yesterday, the FOMC left the fed funds rate unchanged at 5.25%-5.50%, as expected. The committee noted modest further progress towards the Fed’s inflation target, an improvement from the lack of progress noted at the previous meeting. The Fed published an updated Summary of Economic Projections (SEP), which projected just one rate cut through the end of 2024, compared to three cuts projected in the march SEP. Although this is slightly less than the two cuts projected by the market, the upward revision to the projected Fed Funds rate should come as no surprise given Committee members’ consistent comments on inflation remaining more stubborn than expected in early 2024. The number of cuts projected through 2026 remained unchanged, though the longer-run estimate of the Fed Funds rate moved up 0.2%. This may be indicative of a belief among committee members that the natural rate has risen. The Committee also revised inflation expectations higher for 2024 and 2025 by 0.2% and 0.1% respectively, with minimal revisions to employment levels and no change to expected real GDP growth.

Despite the committee signaling that monetary policy may remain tighter relative to March expectations, higher rates have nonetheless had a tangible impact on economic activity. Headline inflation continues to trend downward, and real GDP, albeit still strong, has also moderated. While payroll growth has remained solid, the unemployment rate has risen 0.4% since the start of the year. The Fed feels the economy is still healthy enough to withstand current rates, but any shock to employment or growth may compel the Fed to adjust its strategy more quickly.

Fed- The upward revision to the FOMC’s rate projections was well choreographed, but the change was more hawkish than market forecasts. The market is pricing in an 88% chance of a second rate cut in 2024, which is more dovish than the one cut projected by the updated SEP. This in part reflects yesterday’s lower-than-expected inflation reading from the CPI.

Rates- Rates were volatile yesterday but ultimately ended lower on the day. A weaker than anticipated May CPI caused rates to fall across the curve in the morning, but some of the rate compression was reversed following the FOMC’s press release and SEP. The 2-year Treasury yield initially fell 0.15% but then rose 0.08%, ending the day at 4.77%. The 10-year Treasury yield fell 0.08% to 4.32%. The move in rates suggests the market gave more weight to the lower inflation reading than the Fed’s more hawkish tone.

Credit- Higher-for-longer interest rates may put upwards pressure on firms’ funding costs, but economic growth and resilient consumer spending have counterbalanced this headwind to date. However, maintaining a higher level of restrictive policy may increase the likelihood of a policy misstep which could tip the economy toward recession.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.