June Employment Report: Labor Market Cools at a Steady Pace

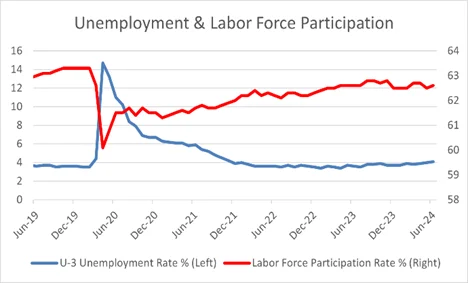

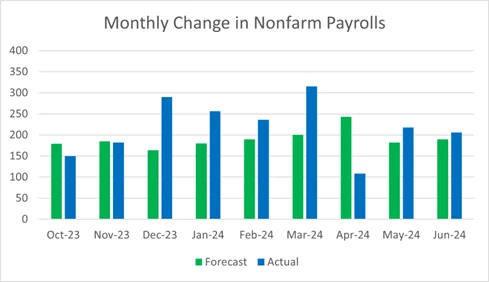

The economy added 206K non-farm payrolls in June, slightly more than anticipated, but the strong headline number was largely offset by softer aspects of the Labor Report. Non-farm payrolls in May and April were revised down by a combined 111K, netting this data release to 95K new jobs. Additionally, the unemployment rate rose 0.1% to 4.1% when it was expected to hold steady. The unemployment rate has risen 0.5% over the past year, signaling a material cooling within the labor market. Despite the steady loosening of labor conditions, the JOLTS survey released earlier in the week indicated there remained 0.8 job openings for every unemployed person in May, suggesting employment prospects remain strong. However, this metric has also materially risen over the past year.

A cooling labor market complicates the Fed’s outlook, as the FOMC will increasingly need to consider their policy’s impact on the labor market, rather than focusing solely on returning inflation to their 2.0% target. While the new data complicates the Fed’s path, a slowly cooling labor market is consistent with the soft-landing scenario the FOMC is trying to engineer. Average hourly earnings rose 0.3% month-over-month, slower than the previous month’s pace, which is a key driver of inflation. This, coupled with the June CPI report, indicates disinflationary progress continued during the month. But as the labor market loosens, the risk the FOMC keeps rates too high for too long increases, which could unnecessarily pressure economic activity.

Fed- The June employment report did little to change rate cut expectations. Markets continued to price in just about two 0.25% cuts in 2024, the first coming at the FOMC’s September meeting. However, the odds of a rate cut in September rose to over 75%. Continued soft inflation and employment reports will give markets and the FOMC greater conviction that a lower policy rate is appropriate.

Rates- Interest rates fell across the curve in line with the expectations that continued soft inflation and labor market data could drive the FOMC to cut sooner and more frequently than otherwise. While the yield on the 2-year Treasury note fell 0.08% and the yield on the 10-year Treasury bond fell 0.07%, short-term rates remained largely stable as the data does not significantly change the immediate outlook.

Credit- A softening labor market could increase pressure on household finances as employment prospects weaken. This in turn could lower consumer spending which accounts for roughly 2/3rds of GDP. Although there have been signs that lower income consumers are curtailing spending, the labor market and spending as a whole remains strong.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.