July Mid-Month Portfolio Update

Soft Labor Market & Inflation Releases

June’s Employment Report was released on July 7th, showing an increase in non-farm payrolls of 209,000 vs. expectations for 230,000, marking the first time that payrolls have come in below market projections in the past 15 months. Additionally, payrolls were revised downward by a total of 110,000 in the prior two months. However, average hourly earnings came in higher than expectations as employers increased wages to compete for workers. Although the payroll gain was below consensus, it was a strong reading nevertheless. With wage growth and a decline in the unemployment rate back to 3.6%, signs seem to point to a still-solid labor market.

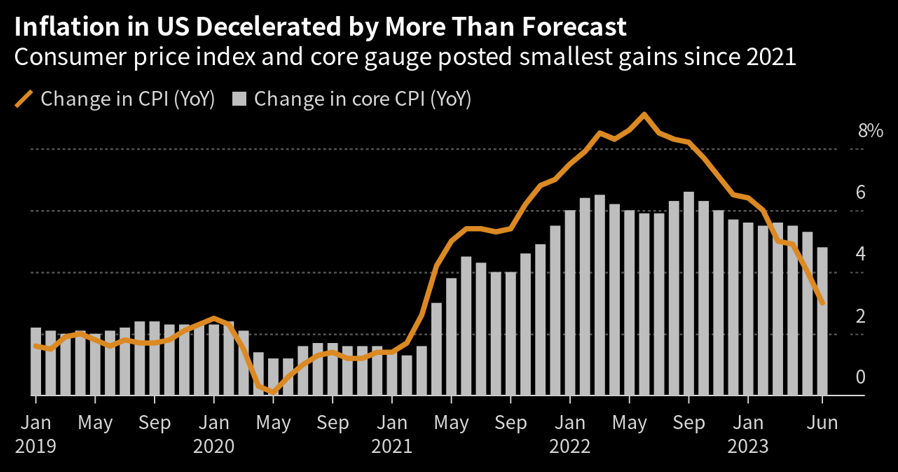

Investors received some welcome news on the inflation front with CPI coming in lower than expectations for both headline and core inflation last month. On a year-over-year basis, headline CPI declined below 4% for the first time since the beginning of 2021 to 3%. Core CPI declined below 5% for the first time since the end of 2021 to 4.8%. For the month of June, both headline and core inflation rose by 0.2%, marking the lowest monthly increase for Core CPI since February 2021.

Source: Bloomberg

One and Done for the Fed?

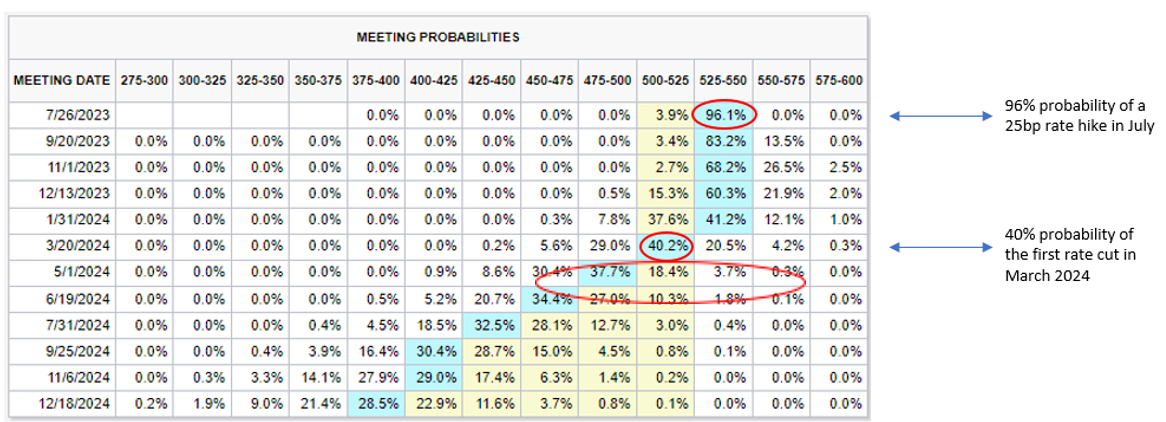

Despite weaker than expected payrolls and a decline in inflation growth, the Fed still appears to be concerned with elevated price pressures and is poised to likely raise rates by 25 basis points at their July 26th meeting, bringing the federal funds rate to a new range of 5.25%-5.50%. Even prior to the employment and inflation reports, the market was already pricing in an approximate80% probability of a hike, which has since increased to over 96%. Looking ahead, the market is anticipating that the Fed will be on hold for the remainder of the year after the likely July hike and expects the first rate cut to occur by March of 2024.

Source: CME Group

Fed Speakers – Mixed but Tilted Hawkish

Recent comments from Fed members have been primarily hawkish, even after the lower inflation reading:

- Cleveland Fed President Mester said that rates need to move up further and that she was supportive of a rate increase in June (when the Fed paused).

- San Francisco Fed President Daly said inflation is still too high and that a couple more rate hikes are likely needed to curb inflation.

- Fed Governor Waller said that he sees two more 25 basis point hikes this year but also suggested that good news could lead the Fed to cease rate hikes after this month.

- Atlanta Fed President Bostic has deviated from the broader consensus saying that he is comfortable with being patient and that monetary policy right now is clearly in restrictive territory.

Attractive Commercial Paper Yields

With a 25 basis point rate hike fully priced in for the July FOMC meeting along with some of the recent hawkish Fed speeches pointing to the possibility of even another rate hike later in the year, front-end yields have continued to rise and may offer attractive investment opportunities. Yields from 2 years to 30 years are factoring in future monetary policy, growth, and inflation expectations. With the Fed forecasting over 200 basis points of rate cuts and inflation moderating towards 2% through 2024 and 2025, yields on the longer end of the curve are below short-term rates.

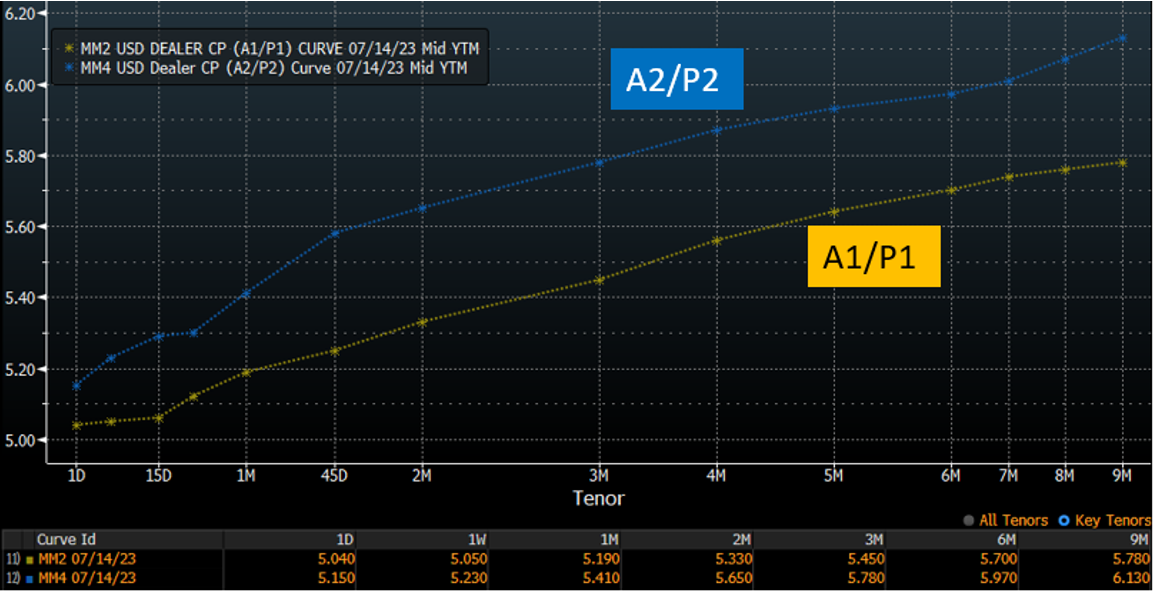

Commercial paper may also offer some attractive yields for both A1/P1 and A2/P2 paper. Commercial paper is typically issued with maturities from as short as 30 days out to 365 days. The chart below highlights the yield ranges across the curve for both A1/P1 and A2/P2 issuers. For example, as of 7/14/23, A1/P1 issuers with maturities from 6 to 9 months were yielding in the 5.70% to 5.78% range. These represent high quality non-financial and financial issuers that may offer attractive diversification for some cash portfolios.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.