July FOMC: A Balanced Approach

Yesterday, the FOMC left the range for the Fed Funds Rate unchanged at 5.25% – 5.50%, as expected. While the overall stance remains unchanged from June, Chair Powell was clear the committee is taking a more balanced approach by no longer overemphasizing the inflation side of its mandate. The Committee’s statement noted that the FOMC “is attentive to the risks to both sides of its dual mandate.” This replaces the previous language about remaining “highly attentive to inflation risks.” In his press conference, Powell explained that “we are getting closer to the point” at which a cut will be appropriate, but “we are not quite at the point.” He emphasized that Fed officials still require greater confidence that disinflation will continue. Powell did not pre-commit the FOMC to cut rates at its next meeting on September 18th but suggested that it “could be on the table as soon as the next meeting” if the totality of the data supports a rate cut.

Recent economic indicators show that activity continues to expand at a solid pace. GDP growth moderated to 2.1% in the first half of the year driven by private domestic final purchases (PDFP). In the labor market, supply and demand conditions are becoming more balanced. Payroll job gains averaged 177,000 per month in the second quarter, a solid pace though lower than the first quarter. The unemployment rate edged up but remains low at 4.1%. Overall, labor market conditions have returned to pre-pandemic levels—strong but not overheated. Total PCE prices increased by 2.5% over the 12 months ending in June, with core PCE prices rising by 2.6%, just above the Fed’s 2.0% target. As always, decisions will continue to be made meeting by meeting, carefully assessing the balance of risks when considering any rate adjustments, but yesterday’s statement and press conference reinforced the market’s confidence that a cut is highly likely in September.

Takeaways for Cash Investors

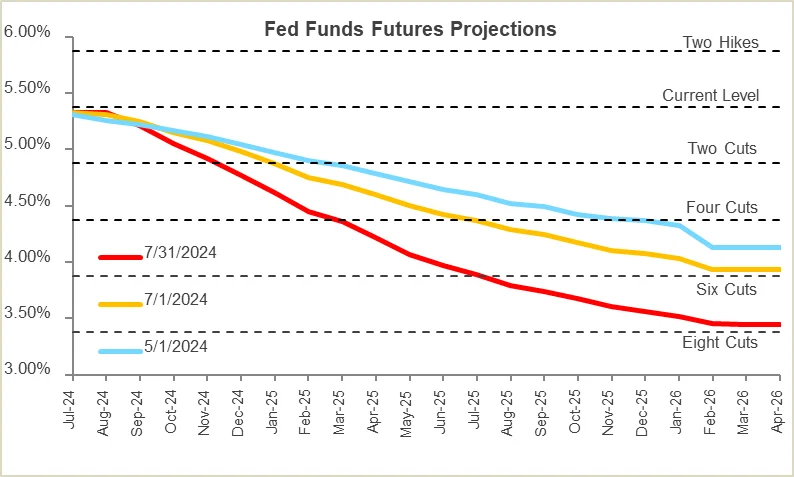

- Fed: Second-quarter disinflation progress, a softening labor market, and policymakers’ statements all suggest a September rate cut is in the cards. Fed funds futures are now pricing in a 100% chance of at least a 0.25pp cut in September, and mostly priced in a total of three cuts before year-end.

- Rates: Treasury yields fell after the meeting. The yield on the 10-year Treasury bond fell 0.03% to 4.11% and the yield on the 2-year Treasury note declined 0.02% to 4.34%, reaching their lowest levels in more than 4 months.

- Credit: Given the backdrop of a soft landing, companies are expected to see good earnings growth, and default rates are likely to stay low. Potential rate cuts could ease financial conditions allowing companies to more easily re-finance maturing debt and allow households to more cheaply supplement incomes through borrowing supporting credit profiles.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.