January 2025 Month-End Market Update

Despite a Wild January, Treasury Yields Ended Little Changed

This past January will be one that many of us will never forget. The month started with massive wildfires in Southern California, the inauguration of President Trump, DeepSeek’s disruption of the technology sector, and the first U.S. commercial airline crash since 2009. At month-end, the markets’ attention was primarily focused on tariffs and the associated uncertainty, including which countries they would be imposed on, the size of potential tariffs, the timing and the industries and goods to be targeted.

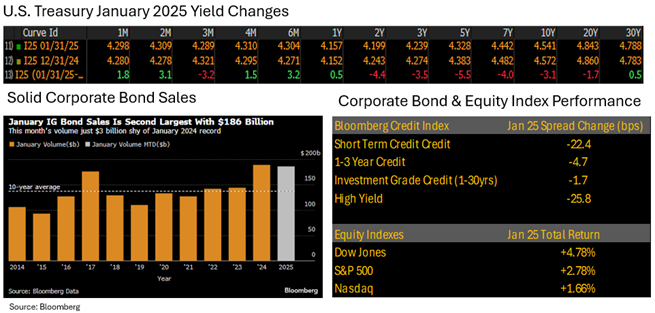

Despite this considerable uncertainty, Treasury yields closed little changed for the month. Risk assets did well with investment grade and high yield credit spreads tightening and equity indexes rising. The S&P 500 hit a new record high and closed above 6,100 for the first time ever. Even the new issue bond market was close to setting records: both new issue investment grade corporates and ABS had the 2nd largest January of issuance on record.

Looking ahead, tariffs are likely to be the ongoing focus of the markets. Here are the latest tariff headlines:

- Trump officially announced this past weekend 25% tariffs on all imports from Canada and Mexico (10% on energy goods from Canada) and a 10% additional tariff on all goods from China. They were all in line with previous messaging from the Trump administration.

- However, after calls on Monday February 3rd with both the President of Mexico, Claudia Sheinbaum, and the Prime Minister of Canada, Justin Trudeau, Trump agreed to delay the tariffs against both countries for one month allowing negotiations with both countries to continue.

- This could be a sign that Trump is threatening the use of tariffs as leverage in negotiations as both Mexico and Canada have agreed to combat illegal migration and drug trafficking at the border.

- Trump is expected to have a call with China’s President Xi Jinping despite the US following through with 10% tariffs. China has retaliated with tariffs on $14 billion worth of American products as well as other measures

Source: Bloomberg

Fed Policy is “in a really good place”

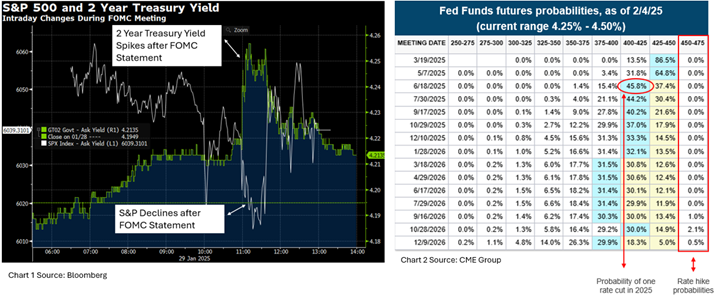

As expected, the Fed kept rates unchanged at their January 29th FOMC meeting but changes to their official statement caused some volatility in the markets:

- In the official FOMC statement, the committee removed a portion of their statement that said inflation has made progress toward the Committee’s 2% inflation objective. This was viewed as slightly hawkish and caused equities to sell-off and bond yields to rise.

- During the press conference, Fed Chair Powell was asked about the removal of this statement, and he downplayed the change saying the Fed just decided to “shorten” that part of the statement and it was “not meant to send a signal.” This caused markets to reverse with equity markets recovering some of the sell-off along with Treasury yields declining and finishing mostly unchanged on the day (see chart 1).

Powell reiterated they are in no hurry to adjust their policy stance and as rates are now “significantly less restrictive” than they were before the cuts in 2024. He said that “policy is well positioned” and “in a really good place”, all of which are hawkish statements and point to a Fed on hold.

As with all market participants, the Fed is in a wait-and-see mode regarding the political uncertainties that lie ahead, most notably tariffs. The good news is that the Fed is in a good position from a monetary policy perspective: if the economy struggles from here, they can accelerate rate cuts (the Fed is currently factoring in 50 basis points of rate cuts in 2025). If inflation not only remains sticky but reaccelerates, they have the ability to hold rates longer or even raise them. In fact, the Fed funds futures market is now factoring in the possibility of hikes in 2026 (see chart 2). Although the probabilities are low, it is now another risk factor to monitor. As of 2/4/25, the futures market is pricing in only one 25 basis point rate cut in 2025.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.