Janet Yellen Confirmed as Secretary of the Treasury

The Federal Reserve held its first meeting of the new year and affirmed their commitment to a near zero interest rate environment, saying “The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic.” The Fed indicated that they will continue to buy $120 billion of Treasury and Agency mortgage-backed securities on a monthly basis for the foreseeable future, with the goal of supporting markets. Chair Jerome Powell also confirmed that the central bank is intent on boosting employment, and “the productive capacity of the economy”, saying “I’m more concerned about that than the possibility, which exists, of higher inflation.”

Q4 GDP

Gross domestic product grew at an annualized rate of 4.0% in the final three months of 2020, capping off a tumultuous year for the US economy. The positive quarterly result is somewhat misleading as production shrunk by 3.5% over the year, the most severe contraction measured in the post-World War II era. However, on an optimistic note, the Congressional Budget Office has released new economic forecasts which predict a faster than expected economic rebound given vaccine distribution and stimulus packages. The CBO estimates that GDP will grow by an average annual rate of 1.7% through 2024.

Janet Yellen Confirmed as Secretary of the Treasury

Former Fed Chair Janet Yellen made history with her appointment as the first female Secretary of the Treasury. During her Senate confirmation hearing, she urged Congress to pass a sweeping stimulus package to provide relief to families, businesses and communities hardest hit by the downturn. “It’s really critically important to provide this relief now,” she told members of the Senate Finance Committee. Yellen also acknowledged that the trajectory of US debt is unsustainable but insisted that avoiding economic damage is the greater priority at this critical stage of the economic recovery.

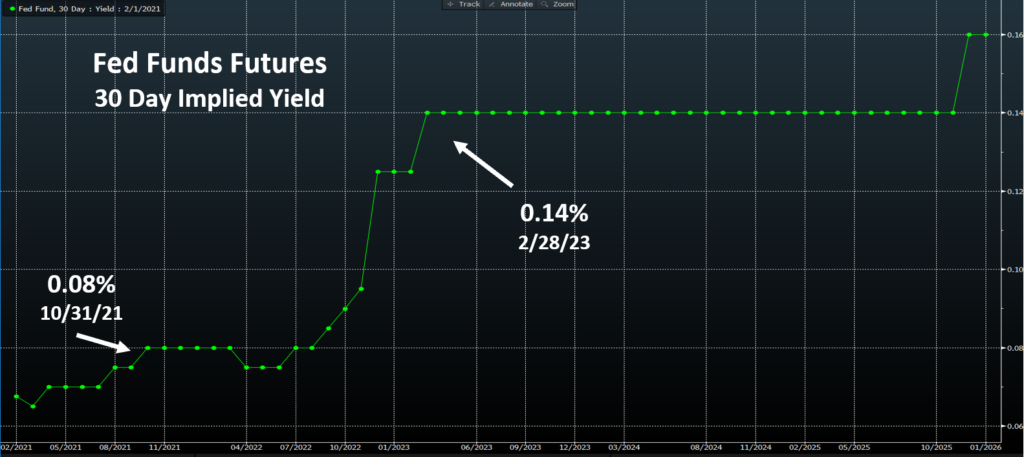

Fed Funds Futures Contracts

Fed funds futures contracts are not currently pricing in interest rate hikes within a two year horizon.

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.