It’s Not Easy Being Green Part 3: ESG & Cash, an Unlikely Couple

The old saying that the only constant is change rings true in the realm of ESG investing. The pace at which the ESG landscape continues to shift is remarkable, and it routinely leaves government organizations, companies and investors struggling to keep step. Perhaps unsurprisingly then, there is now a demand for greater consistency and transparency across the space. From all angles, regulators and independent standard setting organizations have been driving to develop uniform disclosures of ESG data to ensure investors apply ESG integration processes in a consistent manner, which we highlighted in our Three (+1) Themes to Watch in 2022.

The question now becomes: how and why should cash investors integrate longer-term ESG factors into their investment approach in this rapidly changing landscape? The answer starts with a solid foundation built from defining your sustainable investing approach, selecting the appropriate data or data vendor and conducting a robust materiality assessment, which we detailed in our prior blogs, It’s Not Easy Being Green Part 1: Choosing A Direction and It’s Not Easy Being Green Part 2: What’s Important?. These give an investor the footing to create a consistent output from their ESG integration process, which can then provide a number of credit related benefits while allowing treasury professionals to contribute to their company’s ESG goals.

Mean What You Say & Say What You Mean

In March, the SEC proposed a rule to enhance and standardize climate-related disclosures in companies’ reports and registration statements. They followed up on May 25th by proposing two lesser publicized, but equally impactful rules intended to mitigate greenwashing by funds and investors. The SEC proposed an amendment to the Fund “Names Rule” which currently requires certain funds to invest at minimum 80% of assets in accordance with the investment focus that the fund’s name suggests. The amendment extends this rule to funds whose names suggests its investments are based on certain characteristics such as ESG characteristics. The proposal also expands reporting and recordkeeping requirements for ESG funds.

The SEC’s proposed ESG Disclosures for Investment Advisers and Investment Companies would require additional disclosures of ESG strategies in fund prospectuses, annual reports & brochures, require disclosures regarding the impacts of proxy voting for ESG-focused funds, and require environmentally focused funds to disclose greenhouse gas emissions associated with investments. While the specifics of these rules may differ following the public comment period, they represent the SEC’s first major steps towards standardized ESG rules for investors and issuers.

As ESG reforms begin to pick up steam, it is becoming clear that they will be focused on ensuring ESG investing principals are being applied in a manner consistent with stated company policies rather than making sure they are applied uniformly across asset and fund managers. Kelly Gibson, former head of the SEC’s ESG task force, indicated as much when she stated potential future rules would focus on making sure “advisors are doing what they say they’ll do.” This sentiment manifested itself this spring when the SEC levied a $1.5M fine on BNY Mellon Investment Advisor Inc. The SEC had discovered that practices in some of the advisors’ mutual funds did not mirror the ESG reviews which were claimed in investor communications, the SEC has also opened a similar investigation into Goldman Sachs’ mutual fund business. And across the pond, DWS Group’s offices were raided due to allegations of greenwashing in their mutual funds.

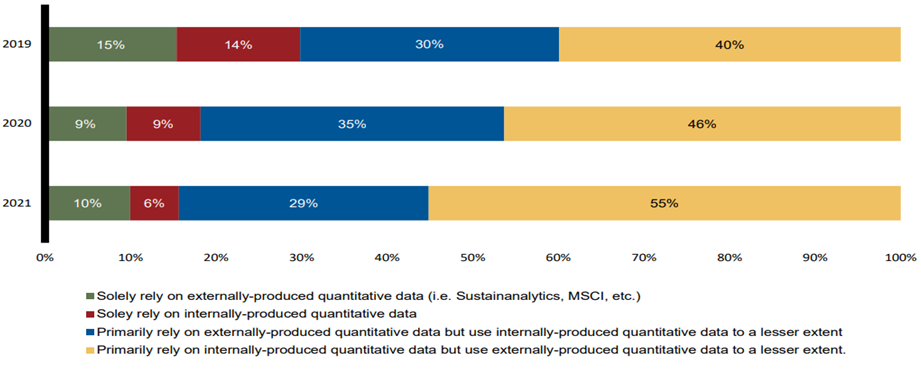

This emphasizes the need for a well-established and well-communicated process for incorporating ESG factors into investment policies. To meet this standard of consistency and transparency, more asset managers and rating agencies have decided to develop some form of proprietary ESG score, often derived from both internally and externally sourced ESG data. This approach has the dual benefits of ensuring robust underlying data from a credible provider (which is particularly important as ESG data is not currently standardized), while granting firms the ability to steer materiality towards their specific investing goals.

Q: How Do You Form Your ESG Insights?

Source: Russell Investments Annual ESG Manager Survey

This framework will be the standard for the foreseeable future. Parallel to traditional financial data, ESG investors will continue to be able to apply underlying data, which will be increasingly uniform, in a multitude of fashions so long as they (as per Kelly Gibson) “are doing what they say they’ll do.” Even as the underlying ESG data is driven towards homogeneity, what matters most is that an investor’s approach to applying these metrics remains consistent. For these reasons credible ESG models should be built on a well-defined sustainable investing approach, consistent data, and a robust materiality assessment to ensure its effectiveness and persistence through regulatory implementation. These principals allow cash investors to pursue an ESG investment strategy, while ensuring capital is invested thoughtfully and consistently.

A Long-Term Problem Affecting Short-Term Investors

ESG’s inherently long-term time horizon and fixed income investors’ lack of voting rights may seem to make ESG and cash investing an unlikely couple. However, robust integration of ESG metrics offers significant benefits outside the scope of traditional credit analysis, allowing treasury teams to meaningfully contribute to their company’s ESG goals.

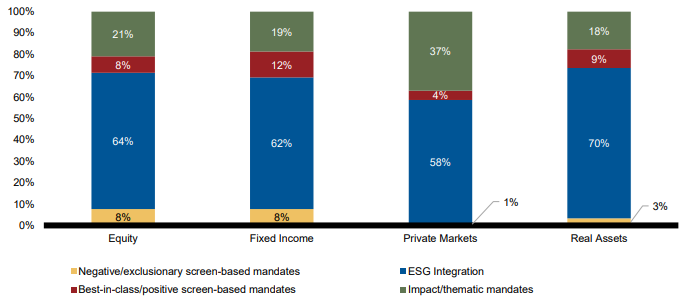

All credit analysts are ESG analysts to an extent. However, many ESG factors have traditionally only been qualitatively followed, which can lead to an inconsistent application of their significance. ESG integration allows investors to quantitively apply these factors leading to a more consistent view of their impact on an issuer’s credit quality and enabling them to more effectively communicate the metrics’ impacts to clients. This provides the benefits of a more holistic approach to credit analysis, leading to a better understanding of an issuer’s risk exposures. It’s for this reason that ESG integration has become the dominate form of sustainable investing across asset classes.

Q: Which Type of ESG/Responsible Investing Products Ae You Seeing the Most Interest And/or Growth Over the Past 12 Months?

Source: Russell Investments Annual ESG Manager Survey

ESG integration into equity investing is often used to identify potential growth opportunities as well as risk factors. Cash investors can borrow from equity investors’ paybook by utilizing ESG data and analysis to mitigate downside risks associated with a given issuer. In a 2019 research piece, BlackRock found ESG integration to be a useful tool for identifying new downside risks, thereby adding value to the credit analysis process. Similarly, Robeco found in a 2021 report that ESG factors had a material impact on 24% of company profiles, in most cases a negative impact, highlighting ESG integration’s ability to identify downside risks which would have otherwise been missed by only looking at traditional financial data. Even though ESG risks tend to have a long-term focus, integrating these factors into investment processes can identify companies less likely to succumb to black swan events in the near term, aligning ESG factors with cash investors’ time horizon.

Despite the nature of fixed income securities, in recent years there has been a shift towards active ESG investment within the fixed income space. In Russell Investments’ 2021 Annual ESG Manager Survey 42% of fixed income managers who have regular meetings with issuers responded that they include ESG as a part of their discussions, up from 24% in 2019. Even managers who do not meet with issuers can actively incorporate ESG into their portfolios. This can be accomplished by putting significant emphasis on an issuer’s overall ESG profile, or by selecting particular topics or themes which the client wishes to emphasize. This allows for a client’s portfolio to be more heavily weighted towards issuers who produce solid ESG metrics, away from issuers with poor ESG track records, or excluding issuers with poor ESG track records all together.

ESG risks are becoming increasingly important to issuers’ credit profiles and are only growing more financially material as time goes on. The dash for intuitional investors to meet demand for ESG products has led to a subsequent regulatory push to ensure that ESG integration techniques are as robust on paper as they are in practice. This ongoing expansion has revealed numerous ways which ESG can be beneficial to a range of investors. While ESG integration may seem at odds with cash investing on the surface, it can add meaningful value to cash portfolios and allow treasury professionals to adhere to their company’s overall ESG goals.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.