It’s Not Easy Being Green Part 1: Choosing A Direction

Fixed income investors have been slower to adopt sustainable investing practices than their equity counterparts, as only in recent years has responsible fixed income investing become a hot topic. (Sustainable investing was one of our three themes to watch for in our article “2020 Vision – Watch the Fed, Repos and ESG Investing.”) Different timetables in the adoption of responsible investing have left fixed income investors with less-developed capabilities in this department, but they are starting to ask questions about how asset managers and owners can create a more positive impact with their investment decisions. The path to responsible fixed income investing can be noisy and uncertain. However, the first steps a company takes in the socially responsible investment integration process can help lay a solid foundation in a developing field.

Rising Activity

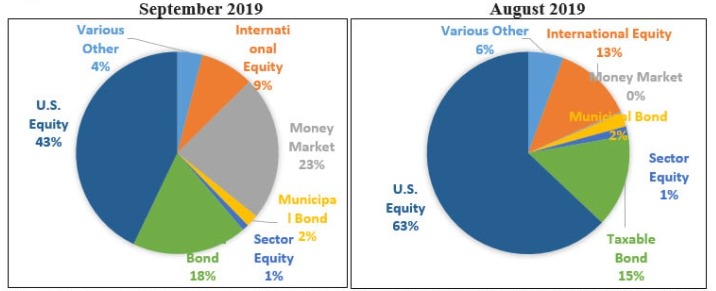

While the fixed income world has been slower to develop a formal approach for responsible investing, recent years have seen a rapid expansion of sustainable fixed income offerings, including a spree of socially responsible prime, government and municipal money funds launched in 2019. These launches gave the money fund category considerable market share in the sustainable investment fund space.

Source: Sustainable Investing

The rise in sustainable fixed income investing has been pushed not only by investors’ heightened sense of responsibility to direct funds to impactful and ethical issuers, but also the realization by many asset managers and treasury practitioners that high-performing ESG issuers are better positioned to mitigate long term risks, avoid black swan events and perform well in the long run.

Choosing the Right Path

The inverse relationship between ESG performance and credit risk has led asset owners to engage managers in a conversation about the responsible investment integration process. The first phase of this conversation focuses on what definition of sustainable investing is most appropriate for your company, with the three most common being:

- Socially responsible Investing (SRI)

- Impacting Investing

- Environmental, Social, & Governance (ESG)

You can read more about the granular details of these types of sustainable investing in our “Demystifying ESG Investing” white paper.

Capital Advisors Group has focused more closely on an ESG approach. Given its goal of measuring the total risk which stems from material ESG issues, we feel it is most appropriate for fixed income investing. As such, the focus of this piece will be on ESG investing.

After an appropriate framework has been identified, managers can then begin to target organizations best suited to help them integrate ESG considerations into their investment processes. Commonly, third-party ESG data providers such as MSCI, Vigeo Eiris and Sustainalytics are used to collect, condense and interpret the data and information required to determine the relative ESG performance of a given issuer. These providers offer ESG ratings, relative rankings and raw data, formatted much like the credit risk analysis provided by a rating agency. In fact, many rating agencies have begun to explicitly integrate ESG analysis into their reports, and even provide third party ESG ratings.

However, the universe of third party ESG data and rating providers is muddled by a lack of standardization, which can often make choosing a partner difficult. Third party providers diverge on appropriate data gathering techniques, methodologies and even what issues are relevant for measuring ESG performance. The diversity of approaches taken to measure ESG performance places a responsibility on the investor to understand which providers best suit their goals. Considerations in this process include:

- How does each provider measure ESG performance?

- Is the methodology used robust, transparent, and consistent?

- Will you as a manager be confident in the ESG data and rating methodology, and be able to present it to your clients?

- Does the ESG provider cover your universe of credits?

The need for standardization is becoming more understood, thanks to organizations such as the UN’s Principles for Responsible Investment (PRI), the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). However, the sustainable investing industry remains fragmented. Therefore, asset managers should apply these considerations in order to narrow down what data and rating providers will be most aligned with their ESG integration process. Then managers can begin to conceptualize how a given provider’s metrics can be integrated into their investment processes, which we will discuss in a later installment of this series.

Conclusion

As asset owners and managers think about the ESG integration process, they must take steps to understand what framework and which data providers will best fit their ESG integration plans. This can be the first step toward successful development of ESG investment capabilities. That said, this process is not to be hastily undertaken, given the myriad of aforementioned risks. After a deliberate and thoughtful process in choosing your direction, the benefits for both asset managers and owners should be clear. Integration should make investors more confident that the true credit risk of an investment is being captured and provide assurance that their capital is being thoughtfully allocated towards a responsible company.

1https://www.sustainableinvest.com/money-market-funds-and-sustainable-investing-happy-together/

2https://www.ssga.com/library-content/pdfs/insights/ESG_in_fixed_income.pdf

4https://www.morningstar.com/insights/2019/09/06/esg-fixed-income

5https://russellinvestments.com/us/blog/esg-considerations-in-fixed-income

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.