Investment-Grade A and BBB Securities Now A Viable Option for Many Cash Investors

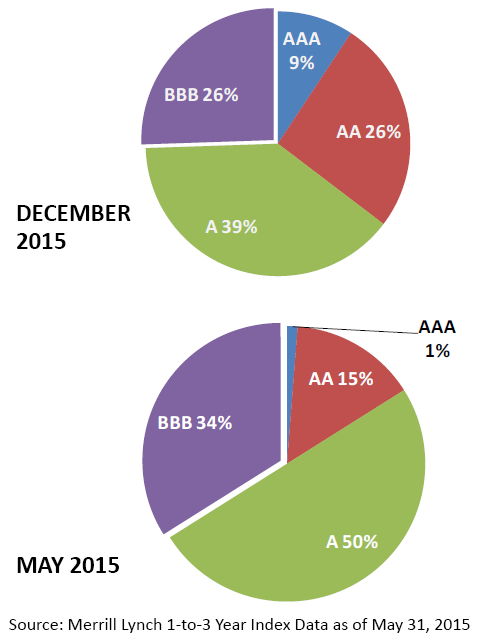

A supply shortage of investments suitable for short-term corporate cash management is looming, exacerbated by new Dodd-Frank and Basel III banking regulations and upcoming money market fund reforms. As bank deposits and money funds become less available and less attractive, treasury professionals will be considering other investment-grade securities. However, they can expect to find a shortage of securities with AAA and AA ratings that many could depend on in the past. As a result, corporate treasurers will have to consider other investment grade ratings to put their corporate cash to work.

The good news is that there is a large and growing pool of investment-grade corporate debt with A and BBB ratings. While there is more potential risk, supply of these lower-rated securities are plentiful. When chosen properly, many may prove to be adequate investment-grade vehicles for corporate cash investors.

The good news is that there is a large and growing pool of investment-grade corporate debt with A and BBB ratings. While there is more potential risk, supply of these lower-rated securities are plentiful. When chosen properly, many may prove to be adequate investment-grade vehicles for corporate cash investors.

Over the past ten years, the dollar value of corporates with A ratings, as tracked in the Merrill 1-to-3 Year Index, has increased almost fourfold, and supplies of investment-grade BBB securities in the index have increased even more. So, as the short government securities continue to be haunted by supply constraints and stressed by demand, those considering alternatives in the corporate sector through individual securities or separate accounts have a bounty of options.

To explore these options in detail, download our new white paper, “Do BBB Corporate Bonds Belong in Treasury Management Portfolios?” It takes a close look at the subset of investment-grade corporates that have had the greatest increase in supply over the past ten years.

Of course, it would be a mistake to think that all BBB debt is alike. The creditworthiness of an issuer depends on many factors, including its business model, operating and financial conditions and susceptibility to external factors.

For credit instruments to be considered as potential investments, the most relevant question is whether the risk assumed is consistent with the principal preservation and liquidity objectives of treasury investments. Therefore, we recommend that corporate treasury managers considering purchase of A and BBB securities review and revise their investment policies, if necessary. We also recommend that corporate treasurers add more comprehensive counterparty credit and risk management practices.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.