Investing with Economic Uncertainty in Mind

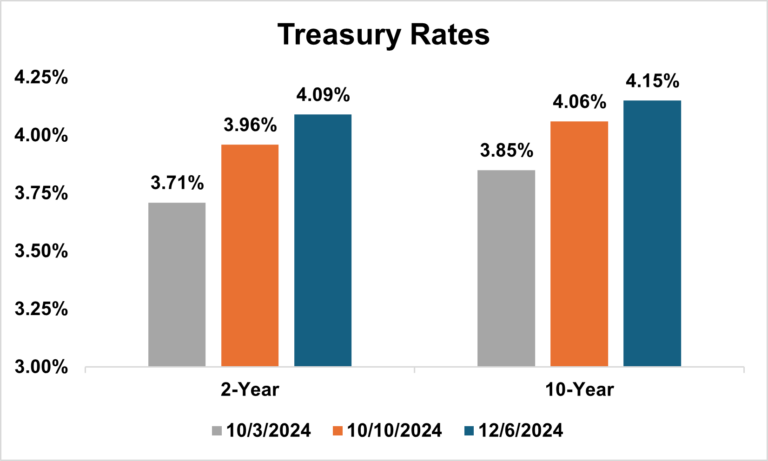

Economic forecasting is oftentimes an exercise in futility. Analysts with access to all the data and the best models can be no more accurate in their forecasts of unemployment and GDP than the average layperson with some conceptual knowledge. Take for instance September’s jobs report, which caught nearly everyone by surprise. Most analysts predicted non-farm payroll growth in the 150K range, in line with the recent trend. Instead, payrolls came in at 254K, an absolute blowout result that shifted the outlook for Fed policy and led to a massive repricing in fixed income markets. In the week following the report, the 2-Year Treasury yield rose ~ 25 basis points and the 10-Year yield increased by ~ 21 basis points. They’ve only continued their upwards march since.

Source: Bloomberg

How is it that economists were caught so offsides? There are several micro explanations for the miss, ranging from an outsized seasonal adjustment factor to more inconsistent survey response rates. However, to look solely at these factors is missing the forest for the trees.

The reality is that there is no foolproof way of forecasting macroeconomic data. This is particularly true at inflection points where the direction of travel changes. It’s easy to look at a time series of data and build a projection based on the current trend. However, it’s hard to identify when things will shift, and why. For an example look no further than Bloomberg, which infamously claimed that its models were showing a 100% chance of recession back in October 2022.

Bloomberg was undoubtedly more ardent in its forecast than most; however, the idea that the economy was about to enter recession was widespread at the time. The yield curve had inverted (a classic recessionary sign), the economy was experiencing a rapid increase in interest rates not seen in two decades, and typical Phillips Curve logic suggested that the only way to corral inflation was via higher unemployment and/or lower growth. The signs pointed towards recession; however, it failed to manifest. Score one for the adage, “economists have successfully predicted 9 out of the last 5 recessions”.

Relevance to Cash Investors

The main takeaway for cash investors is to not get tied up in trying to time the economic cycle. We believe, rather than micromanaging their portfolio towards timing a recession, for instance, investors should consider how their portfolio would react under various economic scenarios. Some examples would be:

- Reflation: A scenario where inflation rebounds to a level outside of the Fed’s band of tolerance. This would likely see a slowdown, if not outright reversal, in the Fed’s cutting cycle coinciding with an upwards repricing in rates markets. Something similar could happen in the event the economy is hit by a growth surge, though the implication on other macro variables would differ.

- Recession: A scenario where the economy experiences a typical demand-side recession, characterized by rising unemployment, lower growth and lower inflation. In this case, the Fed would likely accelerate cuts and rates would move lower.

- More of the Same: Call it a soft-landing, or no-landing, this is a scenario in which the status quo maintains itself. Interest rates come down gradually in line with how the Fed and the market are currently projecting. Under this type of scenario, things would remain relatively stable.

Secondly, we believe portfolios should be constructed with an eye on considering risk. In the current environment, investors who have the ability to extend their portfolio duration may benefit from the “lock-in” effect, particularly if they prize income stability. However, they should acknowledge that doing so risks missing out on potentially higher yields in a “reflationary” type scenario, and also results in greater market value risk. Conversely, those who choose to maintain a short duration should acknowledge the risk of a recessionary scenario where they are forced to reinvest at significantly lower rates.

With imperfect foresight no decision will ever be faultless, but thinking about the portfolio wholistically can reduce the probability of making an especially poor decision. In investing, sometimes being “less wrong” is as valuable as being right.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.