Interest Rate Update

Federal Reserve – A Hawkish Pause

As expected, the FOMC held the Federal Funds rate at the 5.00%-5.25% range at their June FOMC meeting, marking the first pause after 10 consecutive increases. The Fed has raised rates by a cumulative 5 percentage points since March of 2022, the most since the 1980s. Powell commented that the Fed paused to allow the Committee to assess additional information and the implications for monetary policy. The Committee unexpectedly revealed two additional quarter-point rate hikes for 2023 in their updated economic projections. Powell tried to downplay the additional forecasted hikes by saying the dot plot targets are not a decision or plan and cautioned against reading too much into the updated dots; however, he said nearly all members expect it will be appropriate to raise rates somewhat further by year-end. The next FOMC meeting will be held on July 26th and the market is currently pricing in more than a 70% probability that the Fed will raise rates by 25 basis points to 5.25%-5.50%.

Mixed Economic Data

ISM Services remained in expansion territory (above 50) for the 5th consecutive month but the index has dropped from 55.0 earlier in the year to 50.3 for May. The two most forward-looking components (new orders and business activity) both declined with business activity falling to the lowest level of the year. The prices paid reading remains the highest component but it also declined 3.4 points to 56.2, a 3-year low.

Weekly initial jobless claims for the week ending June 3rd came in at the highest level since October 2021 at 261,000, much higher than expectations. Last week, initial claims remained over 260,000 and the 4-week moving average, which removes week-to-week volatility, rose by 9,250 to 246,750. The market suspected the jump in claims earlier in the month reflected seasonality around the Memorial Day holiday but back-to-back elevated readings may signal a softening labor market even though claims remain at historically low levels.

On the inflation front, the May CPI report was mostly in line with expectations. The headline reading for May rose 0.1% while the year-over-year headline reading declined to 4%, the slowest pace since May 2021. A 3.6% decline in energy prices supported the deceleration. However, Core CPI rose 0.4% for May with the year-over-year reading declining to 5.3%. Although the 0.4% monthly gain is down from the 0.7% and 0.8% readings seen in 2021, the still-elevated monthly readings will be concerning for the Fed. Yields rose in the bond market after the release, signaling that the markets expect there is still more monetary policy tightening to come.

The consumer remains resilient with the retail sales report coming in better than expectations, rising 0.3% in May versus expectations for a decline of 0.2%. 9 of the 13 categories gained, led by building materials and autos. Although the headline reading beat expectations, the Control Group – which feeds into GDP – was in line with expectations at +0.2%, a slower pace from the previous reading of +0.6%. The only service sector category included in the report – eating/drinking establishments – gained 0.4% and is up a solid 8% year-over-year, highlighting consumers shift from goods to services spending.

Bulls on Parade

The S&P 500 has now rallied more than 20% from its recent low, signaling a bull market. With the debt ceiling fight resolved for now, the recent banking turmoil seemingly contained, and overall solid economic data, it is not surprising the equity market rallied despite continued forecasts for a mild recession. The corporate bond market has also rallied, with both Investment Grade and High Yield index spreads tightening in June.

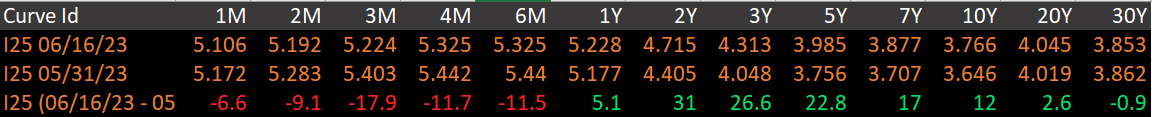

Sticking with the mixed data theme, Treasury yields so far in June have been mixed. Front-end yields from 1-month to 6-months have fallen, primarily due to the debt ceiling being resolved, while yields from 1 year to 30 years have risen, led by the 2-year yield rising 31 basis points through June 16th. The 2-year and 3-year Treasury yields are sensitive to future monetary policy moves and this part of the curve was already over 20 basis points higher in June prior to the FOMC meeting due to the “higher for longer/no 2023 rate cut” narrative. Since the Fed surprised the market with 50 basis points of additional rate hikes in the dot plot last week, yields have moved higher still.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.