Interest Rate Update

Employment and Inflation

Markets inferred optimism on inflation earlier this month from Federal Reserve Chairperson Jerome Powell’s press conference accompanying the FOMC’s February 1st decision to raise rates. While the Fed’s statement and Powell himself indicated that more than one additional rate hike remained likely, markets contradicted the Fed’s guidance and bet that only one additional hike would be forthcoming before the Fed stopped tightening monetary policy.

On February 3rd, January’s Employment Report showed a substantially larger increase in payrolls than expected – the 10th consecutive monthly surprise to the upside for the key labor market reading. With Powell and the FOMC having highlighted a particular interest in wage-sensitive service-sector inflation net of housing, market opinion shifted on the stronger labor market news and fell in line with FOMC guidance for multiple rate hikes.

Last week the January CPI report was somewhat higher than expected, with a smaller deceleration than in the month prior. Shelter costs, which the Fed expects to reverse course and decline in the months ahead, increased again and were 7.9% higher than a year earlier. The University of Michigan’s Consumer Sentiment Survey ticked up again last week as well. The headline reading and the survey’s “Current Conditions” component both grew by more than expected and are substantially higher than the low points reached in mid-2022.

Fed Funds Futures & Bond Yields

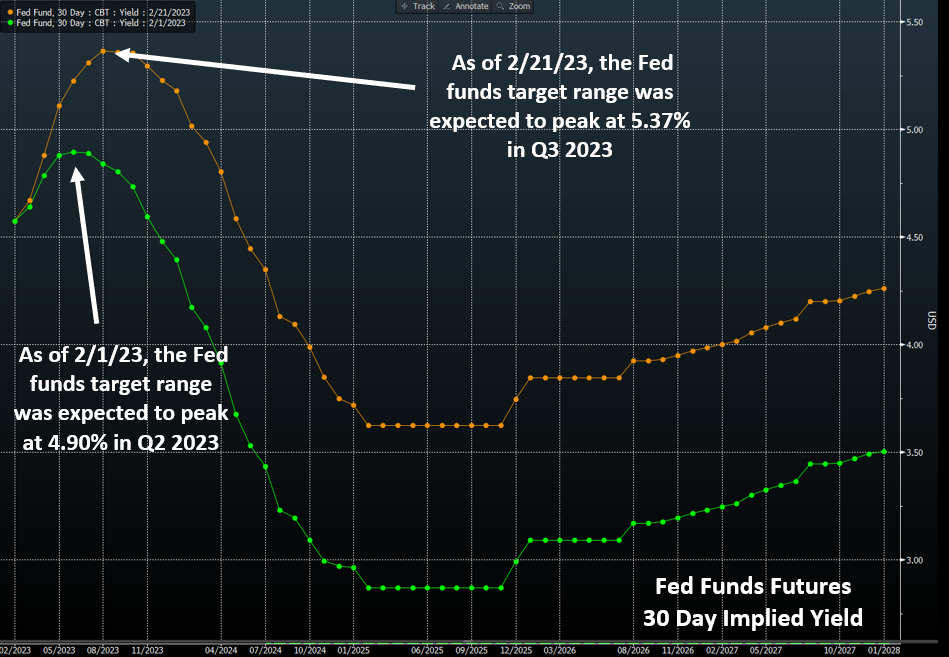

Given higher inflation readings, stronger consumer spending and increasing consumer confidence in January, the market assessment of the eventual peak Fed funds rate has risen this month. Futures contracts are now betting that the fed funds rate will climb to 5.37% — 0.47% higher than futures contracts immediately following the February 1st Fed decision. Bond yields have been volatile as a result, with the Fed-sensitive 2-year Treasury note yield dropping from 4.25% on January 30th to 4.09% on February 1st, and up to 4.70% as of this afternoon. The 10-year Treasury note yield has followed a similar trajectory and is up 54 basis points so far this month to 3.93% as of this afternoon.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.