Interest Rate Update

Co-authored by: Pate Campbell

Economic News

The December Employment Report revealed a decline in the unemployment rate to 3.5% from 3.7% while 233K jobs were added to non-farm payrolls. Despite ongoing tightness in the labor market, average hourly earnings grew at 0.3%, slower than the rate in previous months. Lower hourly earnings growth not only has pass-through effects on inflation but could also signal that employers are less confident that excess demand, which the Fed is attempting to dampen, will last throughout the year. Simultaneously, December’s CPI data flashed signs of softening inflation, as falling energy and goods prices pulled the headline level down to 6.5% from 7.1% (year-over-year). While still well above the Fed’s desired 2% target, the 0.1% month-over-month deceleration was a welcome sign that rising rates may be finally sinking their teeth into the economy.

Together, these reports suggest that excess demand may be beginning to be constrained by higher interest rates. At the same time, a robust labor market continues to support consumer spending, which accounts for over two-thirds of GDP. While certainly not a pattern at this point, markets have taken these combined releases as a sign that the path to a ‘soft landing’ could still be viable. Additionally, readings of cooling inflation and slower wage growth have strengthened the argument for the Fed to increase rates in smaller 25 basis point (bp) increments at their upcoming meetings. The Fed has already lowered the size of their last interest rate increase to 50 bps from 75 bps to prevent an over tightening of financial conditions, mindful of past policy actions’ impact on economic data.

Market Developments

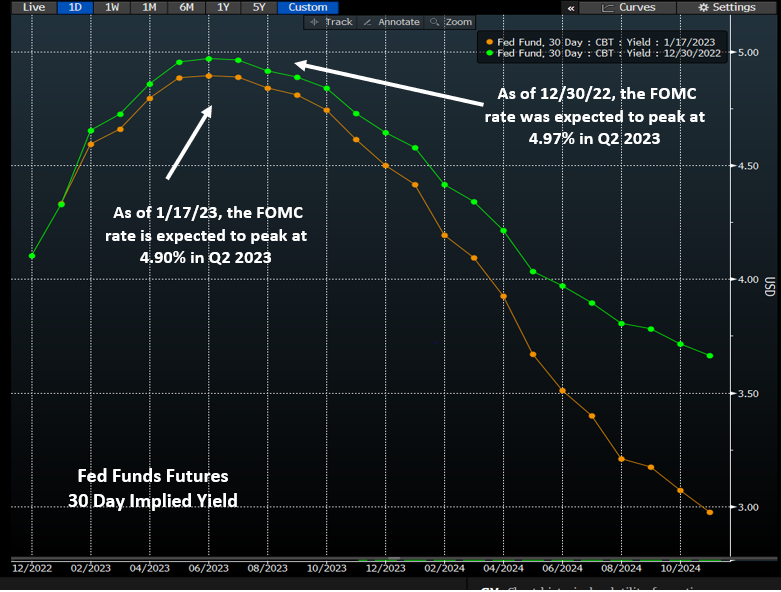

The economic developments mentioned above have resulted in the market forecasting a more dovish Fed to start the year. Futures contracts currently expect a 25 bp hike at the Fed’s next meeting on February 1st, having previously estimated a one third chance that the Fed would increase rates 50 bps. Additionally, projections for the terminal rate have declined from 4.97% at the end of December to 4.90% as of January 17th.

The impact has been even greater on longer rates. The 2-Year Treasury yield has declined about 60 bps from its November high point to 4.10% as of January 18th. It’s become increasingly clear that the market sees rates declining in the last half of 2023, in direct conflict with the Fed’s current guidance that it plans to hold short rates at a restrictive level through the end of the year and into 2024.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.