Interest Rate Update

Fresh Economic Data

This past week, the Bureau of Economic Analysis released October’s Personal Income and Outlays Report. Personal income and spending rose by 0.7% and 0.8%, respectively, on a month-over-month basis. The headline Personal Consumption Expenditures (PCE) index climbed by 6.0% year-over-year, while the core PCE index, stripping out food and energy costs and the Federal Reserve’s favorite measure of inflation, rose by 5.0% over the same period. Both marked slowdowns from the prior month. On the manufacturing front, the PMI Index dropped to 49.0 where data under 50.0 indicate a contraction in the sector. The reading was the lowest recorded since May of 2020. Finally, November’s Employment Report beat expectations with the creation of 263,000 new nonfarm payrolls compared to consensus estimates of 200,000 and following an upwardly revised October reading of 284,000 (initially reported at 261,000). The unemployment rate was unchanged at 3.7% and the labor force participation rate was anchored at 62.1%, down just slightly from the previous month’s reading of 62.2%. Average hourly earnings increased by 0.6% last month and by 5.1% year-over-year, up from 4.7% y-o-y in October. The Fed is certain to take note of the jump in wage inflation, but an otherwise stable labor market should give the central bank latitude to move ahead with additional rate hikes at upcoming meetings.

FOMC Minutes

The minutes from the FOMC’s recent meeting on November 1st and 2nd were published on November 23rd, and they revealed that Fed officials remain very concerned about price pressures in the economy. The minutes noted that “Inflation remained elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.” The Federal Reserve is highly likely to continue to raise the overnight lending rate as they move into the new year, but with a nod to the 3.75% in rate hikes that have already occurred over the past six FOMC meetings, “a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate.”

Fed Commentary and Market Reaction

Fed Chair Jerome Powell spoke on November 30th at the Brookings Institution in Washington D.C and acknowledged that “Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.” Echoing themes from the FOMC minutes, Powell believes that` “ongoing rate increases will be appropriate in order to attain a policy stance that is sufficiently restrictive to move inflation down to 2 percent over time.” However, he also commented that it “makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.” While Powell’s speech did not include any new revelations about the Fed’s state of mind, bond markets reacted almost immediately with the 2-year and 10-year Treasury notes each falling around 15 bps in yield to 4.31% and 3.60%, respectively.

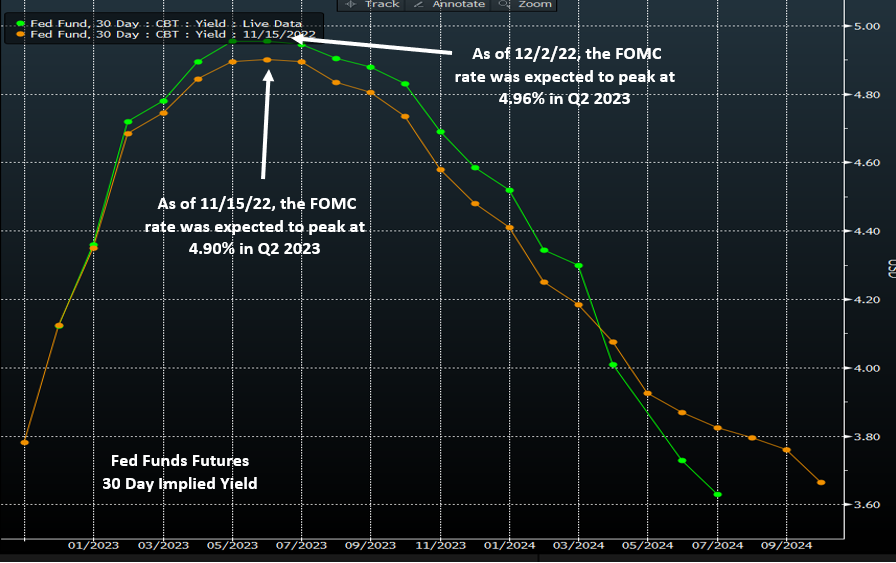

Fed Funds Futures

The target range for the overnight lending rate currently stands at 3.75% to 4.00%, with another 50 bps hike fully priced in at the next FOMC meeting on December 14th. Looking ahead to the new year, a 25 bps hike is priced in for the Fed’s early February meeting with approximately 60% odds of a larger 50 bps hike. A further 25 bps hike is priced in as of mid-March, implying that the fed funds range could reach at least 4.75% to 5.00% by the end of Q1. Futures contracts also continue to suggest that the Fed could begin cutting rates in the second half of next year despite no such indications from the Fed itself.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.