Interest Rate Update

The Fed appears likely to increase its overnight rate target at the March 15th-16th FOMC meeting. In addition to many other Fed officials who have expressed a willingness to tighten monetary policy to contain inflation pressures, Fed Chair Powell reinforced the hawkish tone at his Senate nomination hearing earlier this month. Throughout most of 2021 the Fed had maintained that high inflation was likely to be “transitory,” but Powell acknowledged to the Senate that “supply side constraints have been very consistent and very durable.” Surges in COVID-19 infection rates and related social distancing measures weakened consumer demand in the previous waves, but the economic effects of Omicron are sharpest in supply constraints and in the potential for worsening inflation. While the current variant has had sometimes severe impact on attendance and output in certain industries, it hasn’t yet fueled increases in unemployment. CPI hit 7% in December, the highest in 40 years, and although the headline consumer inflation number may have peaked last month, core CPI (which excludes food and energy) is likely to increase further given rising wages and housing costs.

The minutes of the December FOMC meeting revealed a readiness among monetary policymakers to not only increase rates soon, but to begin shrinking the Fed’s balance sheet sooner and more aggressively than in the previous cycle. It took two years after the Fed raised rates from the zero percent floor in 2015 for the Fed to begin to shrink its portfolio of Treasuries and mortgage-backed securities in 2017. From 2017 to 2019 the Fed never increased the pace of balance sheet reductions to more than $50 billion a month. The December minutes made clear that the Fed would favor a substantially faster reduction in the balance sheet this time around, with Atlanta Fed President Raphael Bostic having suggested a pace as fast as $100 billion per month. With a first interest rate hike likely in March, quantitative tightening is likely to begin soon thereafter. The Fed’s balance sheet now about $9 trillion – double its size before the pandemic.

The 10-year Treasury yield rose above 1.85% this morning, its highest level in more than two years. The Fed-sensitive 2-year note yield surpassed 1.00% today for the first time since March 2020.

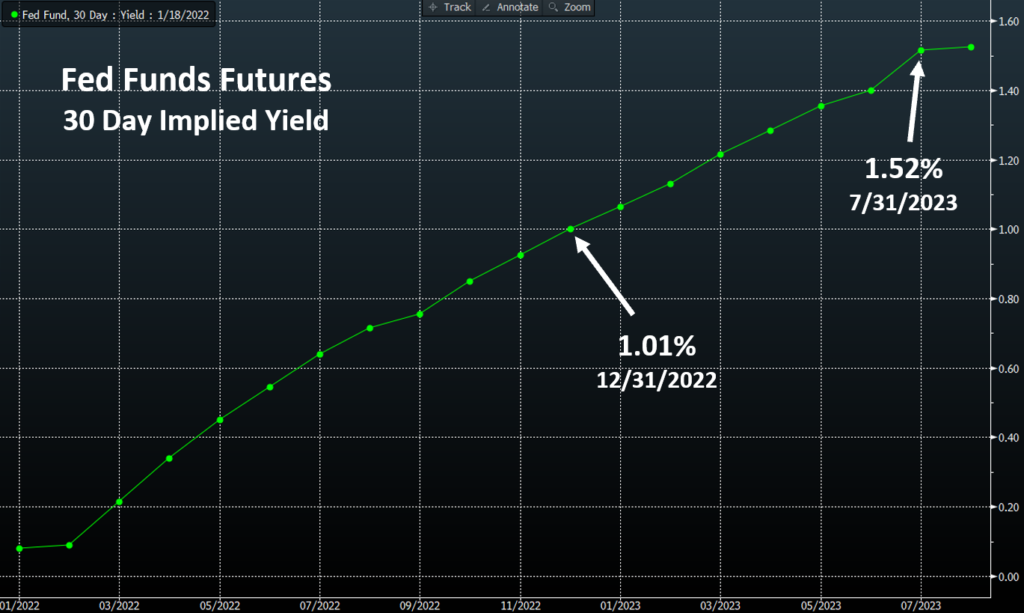

Fed Funds Futures Contracts

Futures markets are fully pricing in the first 25 basis point rate hike at the March FOMC meeting and point to quarterly hikes thereafter into late 2023. A rate-tightening pace of 1% per year would put the fed funds rate above 2.00% by the end of 2023.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.