Interest Rate Outlook: Trade Tensions Hammering Yields

Trade Dispute Escalation

The apparent lack of progress in U.S.-China trade negotiations stoked volatility in the financial markets in early May. On Friday, President Trump imposed 25% tariffs on $200 billion of Chinese goods with China responding in kind on $60 billion of U.S. goods. And just this morning, Trump targeted Chinese telecom giant Huawei in an executive order allowing the U.S. to ban certain telecom equipment from “foreign adversaries.” Treasury Secretary Mnuchin has said that the U.S. will soon resume trade talks with China, but Chinese representatives have denied knowledge of any such plans. With the U.S. reportedly considering levying tariffs on an additional $300 billion of Chinese goods, further intensification of the dispute may be likely before any denouement.

U.S. bond yields have declined this month in reaction to the trade battle. The benchmark 10-year note yield and the 2-year note yield have each fallen 15 basis points in May to 2.37% and 2.16%, respectively. The S&P 500 had been down as much as 5% in May but has since rebounded on strong earnings results but the index is now down about 2% on the month.

Domestic Economy

Manufacturing data in the U.S. showed headwinds in yesterday’s industrial production number which was down 0.5% for April with motor vehicle production plunging 2.6%. On a positive note, U.S. jobs data easily surpassed economists’ optimistic forecasts, with April payrolls surging 263,000 and the unemployment rate improving to 3.6% from 3.8%. Year-over-year wage gains maintained a 3.2% pace, while consumer and producer price indexes each showed tepid inflation pressures. Import tariffs may boost inflation, though negative impacts on growth are expected to more than offset those price pressures from a monetary policy perspective.

Fed Funds Futures

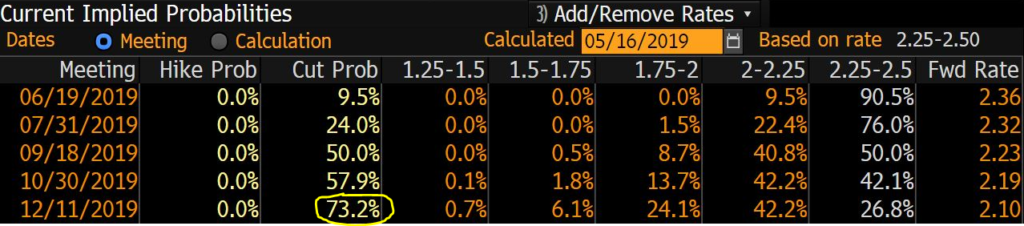

With heightened trade tensions threatening to restrain global economic growth, fed funds futures markets are now assuming about a three-in-four chance of a Fed rate cut by year end, up from 50/50 odds at the beginning of the month. Any signs of progress in trade talks would likely reduce the implied odds of cuts before year end, but the outcome is uncertain given the hardline negotiating tactics from both sides.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.