The Most Tumultuous Year on Record

After experiencing the most tumultuous year on record, the major stock indices finished 2020 in a strong manner. On the last day of December, the S&P 500 logged its 14th record close of 2020 while the Nasdaq just missed its 56th record close by approximately 10 points. For the year, the DJIA rose 7.2%, the S&P 500 increased 16% and the Nasdaq jumped 44%. Treasury yields closed the year lower with the Fed-sensitive 2-yr note posting its largest 12-month decline since December 2008 while the benchmark 10-yr note fell by the most since 2011. On the last day of 2020, the yield curve flattened as the 10-yr yield fell to 0.916% while the 2-yr yield declined to 0.122%.

President Trump changed his position on the coronavirus relief deal passed by Congress and signed it into law at the last minute. The legislation included $900 billion for pandemic relief and $1.4 trillion to fund the federal government through September. The bill was passed by Congress by wide margins, 92 to 6 in the Senate and 359 to 53 in the House, after months of negotiations and with concessions from both parties. The legislation had been expected to be signed by Trump until he unexpectedly demanded an increase in direct payments to Americans from $600 to $2,000 per person. He reverted his position over the weekend under heavy pressure from both parties with the impending run-off elections in twin Senatorial races in Georgia and the shutdown of the government over the holiday week hanging in the balance. The new law restarts two pandemic-related unemployment assistance programs that lapsed over the weekend – one provides unemployment benefits for gig and contract workers and another provides up to 13 weeks of additional payments. It also extends the maximum number of weeks a person can claim unemployment benefits to 50 weeks and provides a supplemental payment of $300 a week to unemployed workers. With the signing of the legislation, Trump said he would use the Impoundment Control Act of 1974 to temporarily limit funding to portions of the spending bill for a maximum of 45 days starting from January 3rd when the new Congress was sworn in, although the freeze will likely be removed once President-elect Joe Biden takes office on January 20th.

Britain left the European Union at midnight January 1st Central European Time, ending a 48-year relationship with the continent. Despite European and British Parliaments ratifying a trade deal, there are expected to be continued disruptions in trade routes in both the near and long-term as Britain’s departure from the block ends free trade between the parties.

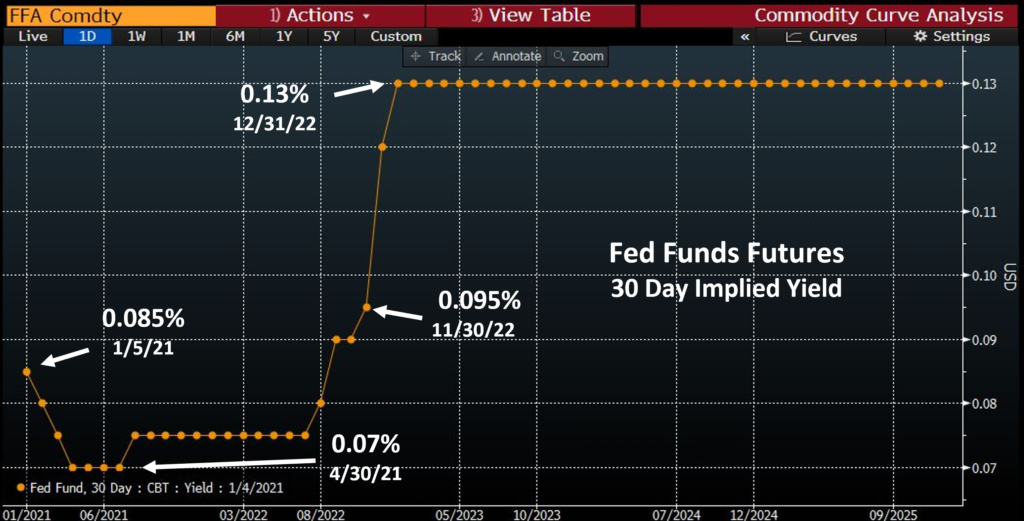

Fed Funds Futures Contracts

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.