Interest Rate Outlook: Powell Calls for More Aid

April Unemployment Report Shows Record Job Losses

The April unemployment report released on May 1st reflected a loss of over 20 million jobs, and an unemployment rate over 14%. The number of newly unemployed in April wiped out the last decade of job gains, and the unemployment rate easily beat the previous 10.8% high recorded by the index beginning in 1948. Though leisure and hospitality businesses were the first and among the most significantly affected, employment fell across industries and all groups of workers. Of those who lost their jobs in April, however, 88% reported being temporarily laid off, implying that they may have work to return to when the time is appropriate. The long-term effects on employment will depend on the duration and severity of the COVID-19 pandemic and how effectively businesses are able to reopen.

House Passes Aid Package

The House passed a $3 trillion aid package in mid-May, with the proposal passing narrowly on a vote of 208 to 199. The bill includes $1 trillion in direct aid to states and localities, including grants and education assistance. Additionally, the bill sets aside funds to provide another one-time cash payment to Americans’ bank accounts, extends the duration of enhanced jobless benefits, assists in covering rent and mortgage, forgives student-loan debt and pays premium levels to essential workers.

Powell Calls for More Aid Amid Grim Outlook

Federal Reserve Chairman Jerome Powell spoke on May 13th, saying that further stimulus may be required to bolster the economy’s recovery. Powell described conditions of great uncertainty in the time ahead, with the outlook subject to high levels of downside risk. The Chairman urged the White House and Congress to do and spend more to support the economy’s revival. In his testimony before Congress yesterday, Powell said, “The scope and speed of this downturn are without modern precedent and are significantly worse than any recession since World War II.” In contrast to the Trump’s administration’s prediction of a sharp economic recovery, he noted that Fed members view a V-shaped recovery as unlikely.

Bond Market Liquidity

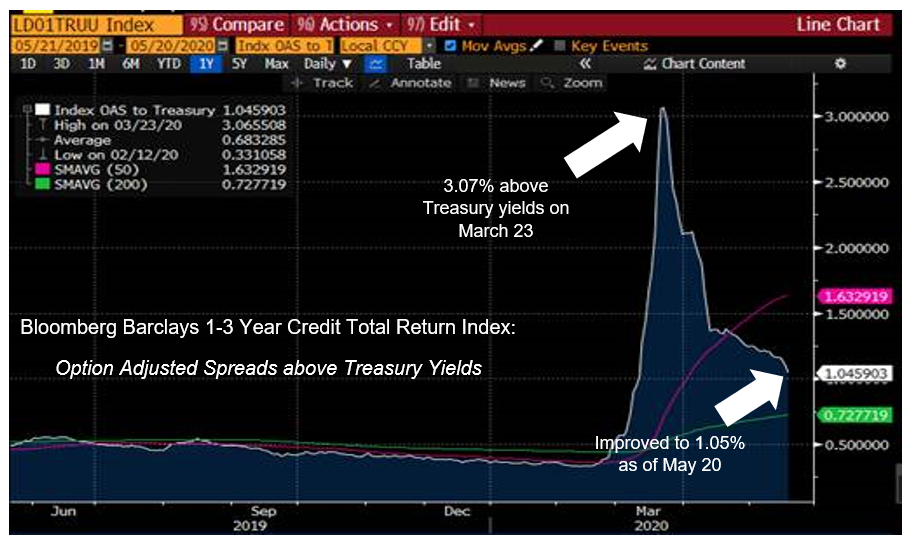

Conditions continue to normalize in the short end of the fixed income markets following the restoration of the balance between buyers and sellers. Corporate-to-government spreads have tightened in and yields for high-quality short-term credits continue the downward trend that we’ve observed since late March. One-month LIBOR fell by roughly 2 basis points last week and three-month LIBOR is down by more than 5 basis points over the same short period.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.