Interest Rate Outlook: Volatile Bond Markets

Everchanging speculation on tariff war developments continues to drive bond market volatility as well as projections on potential interest rate cuts. Earlier this month, a mini-deal between the Trump administration and Chinese officials buoyed market sentiment when additional tariffs slated for implementation in December were delayed and China agreed to buy additional US agricultural products. Nevertheless, the Chinese commitment is vague and no progress has yet been reported on reducing any existing tariffs. Bond yields have bounced abruptly with each new development in the tariff wars; the 2-year Treasury note yield ended September at 1.63%, sank as low as 1.40% just days later, and has since rebounded to 1.60%. The 10-year note followed a similar trajectory, ending September at 1.68%, plunging to 1.52% and then surging back to 1.76%.

Domestic Economic Strength Becoming Less Apparent

While the ongoing trade dispute has been the foremost driver of recent market sentiment, signs of vulnerability in an otherwise solid domestic economy have recently appeared. September’s retail sales decreased by 0.3% from the prior month. With consumer spending supporting approximately two-thirds of U.S economic growth, further downward signals on spending could indicate that trade-related pullbacks in manufacturing and business investment are restraining consumer spending despite near-historic lows in unemployment. Yesterday’s industrial production number for September also showed further weakening as overall production contracted 0.4% with the manufacturing component down 0.5%.

Federal Reserve Rate Policy

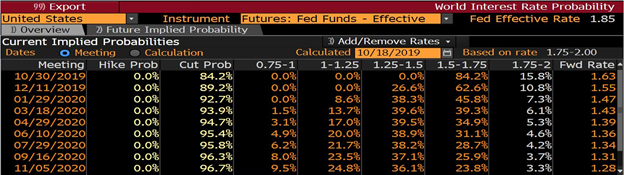

After rate cuts on July 31st and September 18th, a third FOMC rate reduction this year is mostly priced in for October 30th despite the improvement in the tone of trade negotiations. Futures contracts currently imply 84% odds of a cut later this month, while a contract rate down to the 1.30s by Q2 2020 assumes a second cut before the middle of next year. Just a week ago, futures markets assumed a third cut over the same timeframe and we expect similar volatility in interest rate forecasts going forward.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.