Is a New Stimulus Package on the Way?

The Federal Reserve held its last meeting of the year this week and to no one’s surprise, it left the overnight lending rate unchanged at the 0.00% to 0.25% range. As it wraps up a tumultuous 2020 and looks forward to the new year, the Fed is focused on supporting “the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals”. To that end, bond purchases by the central bank will continue for an indefinite period with the Federal Reserve buying up at least $80 billion of Treasury securities and $40 billion of agency mortgage-backed securities monthly.

Summary of Economic Projections

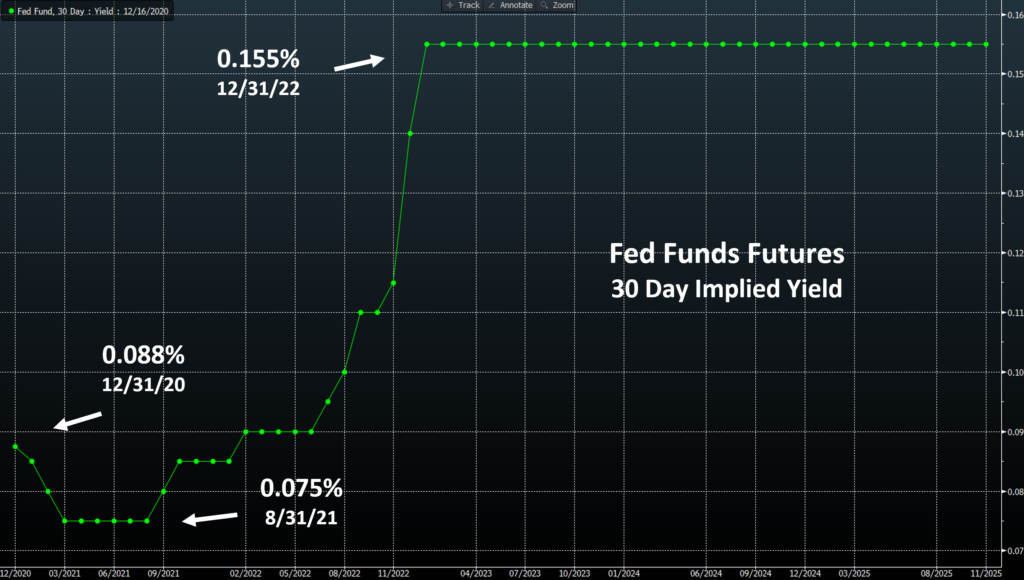

The FOMC also revealed its Q4 summary of economic projections this week, while acknowledging that the “path of the economy will depend significantly on the course of the virus” and “the ongoing public health crisis … poses considerable risks to the economic outlook over the medium term”. The Federal Reserve was generally more optimistic in tone since it last provided a forecast in September, but it did not amend its projection that the overnight lending rate will remain unchanged through 2023.

- Unemployment rate: projected to decline to 5.0% by the end of 2021, 4.2% by 2022 and 3.7% by 2023. September’s estimates stood at 5.5% by the end of 2021, 4.6% by 2022 and at 4.0% by 2023.

- Core PCE inflation: projected at 1.8% by the end of 2021, 1.9% by 2022 and at 2.0% by 2023. September’s estimates stood at 1.7% by the end of 2021, 1.8% by 2022 and at 2.0% by 2023.

- GDP: projected at 4.2% by the end of 2021, 3.2% by late 2022 and at 2.4% by 2023. September’s estimates stood at 4.0% by the end of 2021, 3.0% by 2022 and at 2.5% by 2023.

Is a New Stimulus Package on the Way?

Early in December, House Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell signaled their willingness to work towards an agreement on coronavirus relief through a bipartisan $908 billion proposal introduced by rank-and-file lawmakers. The bill represents a compromise between the Democrat-controlled House bill of $2.4 trillion and the Senate Republican proposal of $650 billion. Progress has been reported in recent days, but it is now make-or-break time for the negotiations. Lawmakers are aiming to merge the stimulus package into a year-end Congressional spending bill which has a Friday deadline, or the government shuts down.

Fed Funds Futures Contracts

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.