Government Yield Curves are Flat and Low

FOMC Minutes Released

The minutes from the FOMC’s July 28-29 meeting were released today. In the committee’s discussion about how to continue to support the flow of credit to consumers, they deemed “it would be appropriate over coming months for the Federal Reserve to increase its holdings of Treasury securities and agency residential mortgage-backed securities (RMBS) and CMBS at least at the current pace. These actions would be helpful in sustaining smooth market functioning, thereby fostering the effective transmission of monetary policy to broader financial conditions. In addition, participants noted that it was appropriate that the Desk would continue to offer large-scale overnight and term repo operations.”

In terms of future forward guidance on monetary policy, members “commented on outcome-based forward guidance—under which the Committee would undertake to maintain the current target range for the federal funds rate at least until one or more specified economic outcomes was achieved—and also touched on calendar-based forward guidance—under which the current target range would be maintained at least until a particular calendar date. In the context of outcome-based forward guidance, various participants mentioned using thresholds calibrated to inflation outcomes, unemployment rate outcomes, or combinations of the two, as well as combinations with calendar-based guidance.”

Lastly, the possibility of using yield caps and targets as potential monetary policy tools was debated, while most members “judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee’s forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low. Many of these participants also pointed to potential costs associated with yield caps and targets. Among these costs, participants noted the possibility of an excessively rapid expansion of the balance sheet and difficulties in the design and communication of the conditions under which such a policy would be terminated, especially in conjunction with forward guidance regarding the policy rate. In light of these concerns, many participants judged that yield caps and targets were not warranted in the current environment but should remain an option that the Committee could reassess in the future if circumstances changed markedly.”

Government Yield Curves are Flat and Low

Given the current economic environment, yields for US government issuance are extremely low and the curves are flat:

- 1-month Treasuries – 7 to 8 basis points

- 6- to 12-month Treasuries – 12 to 13 basis points

- 18-month Government Sponsored Enterprises – 15 to 16 basis points

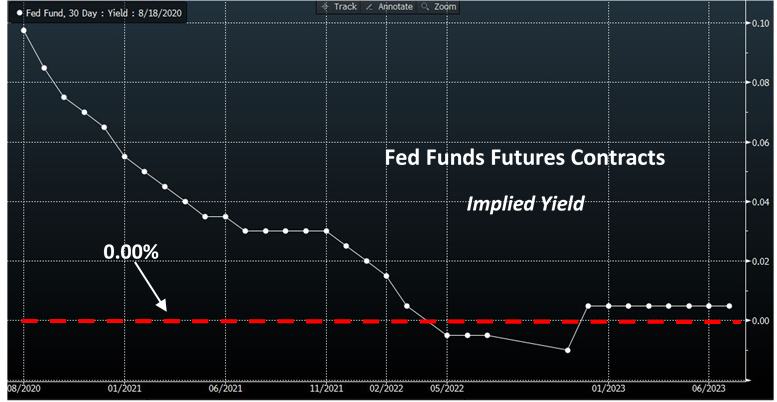

Fed funds futures contracts suggest the likelihood of further compression in overnight rates:

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.