Interest Rate Outlook: FOMC Holds Rates Steady

FOMC Holds Rates Steady

The Federal Reserve met last week to review monetary policy for the first time this year and to no one’s surprise, the FOMC left the overnight lending rate unchanged at the 1.50% to 1.75% range. The Fed remains in a wait-and-see mode where interest rates are concerned, saying it “judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2 percent objective”. During the subsequent press conference, Fed Chair Jerome Powell echoed the generally positive tone of the meeting, but he also cautioned that global issues including ongoing trade tensions and the emerging Coronavirus could create headwinds for the US economy in coming months.

GDP Updates

The US economy grew at a 2.1% pace in the fourth quarter, and full-year 2019 GDP finished at 2.3%, the slowest annual growth in three years. Subdued by the US/China trade war and a slowing global economy, growth was simultaneously bolstered by the resilient labor market and strong consumer confidence and spending. China’s GDP grew at a 6.0% annual rate in Q4, resulting in a full-year growth rate of 6.1%, the lowest level in three decades. The country is burdened by high debt, rising private sector defaults, and an aging population.

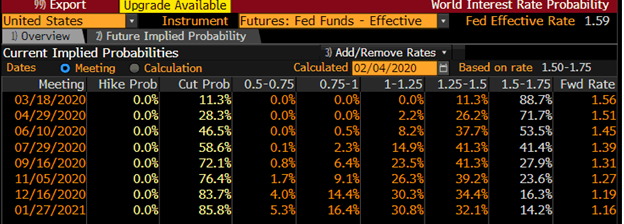

Fed Funds Futures

The current consensus within the Federal Reserve is that the overnight lending rate will remain unchanged throughout 2020. The markets hold a somewhat different view, however, with fed funds futures contracts pricing in a 25 basis point reduction in the rate by September and greater than 50% odds of a second cut by the December timeframe.

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.