Interest Rate Outlook: Election Day

A Momentous Week

All eyes are on the United States as Election Day finally arrives and a bitterly contentious campaign cycle draws to a close. An estimated 100 million early votes were cast in advance of Election Day and the country appears to be heading for a record presidential election turnout. The focus now shifts to post-election anxiety: Will we see delays in ballot counts? Civil unrest? Disputed claims to leadership? While we hope for a smooth and swift resolution, any election-related uncertainties are likely to lead to short-term volatility in equity markets. Programs instituted by the Federal Reserve in March to support credit market liquidity remain in place, and we expect market liquidity to remain robust despite the potential for election-related turmoil.

In what would otherwise be major events, the Federal Reserve is set to reveal its latest views on monetary policy on Thursday and the October Employment Report will be released on Friday.

Economic Data

In the advance estimate, Q3 GDP rebounded by a record 33.1% (annualized) as lockdown measures were relaxed in many parts of the country over the summer. Consumer spending jumped 40.7%, with households splurging on durable and non-durable goods while outlays for services rose by a lesser extent. GDP growth was also driven by increases in non-residential fixed investments (up 20.3%), international trade (up 59.7%) and residential investment (up 59.3%). But Q3’s booming number was not enough to offset Q2’s record decline of 31.4%, and many economists worry that the toxic combination of high unemployment, expiring stimulus programs and a resurgence in coronavirus infection levels could present headwinds in Q4 and diminish the year-end outlook.

On the manufacturing front, the Institute for Supply Management’s October report beat expectations at 59.3, the sixth straight monthly gain. Of note, the new orders, prices paid and employment sub-indices also outperformed market forecasts.

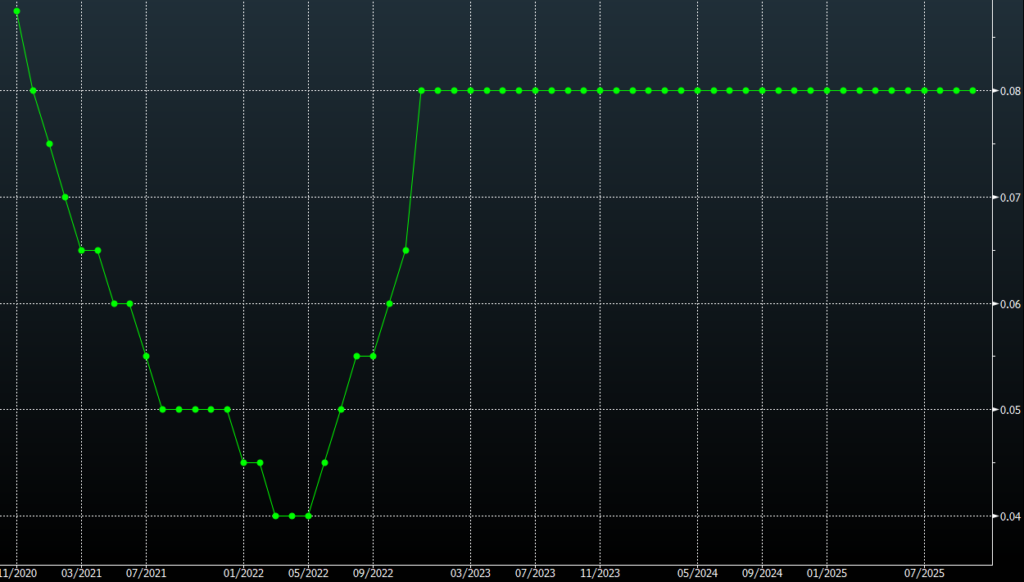

Fed Funds Futures Contracts

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.