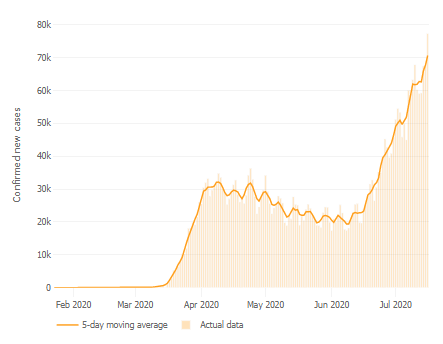

COVID-19 infection Rates Surge

COVID-19 infection rates have fallen dramatically in most industrialized nations, but new cases in the U.S. and in developing countries have surged to record levels in the last few weeks. Despite the serious setbacks, lawmakers in the U.S. continue to grapple with how to most appropriately implement mask requirements to slow the spread of the virus. While U.S. manufacturing production and retail sales began to improve in May and June after a deep retrenchment in April, the rapid increase in daily infection rates has many states pulling back on economic reopening efforts.

Source: Johns Hopkins, https://coronavirus.jhu.edu/

Treasury Yields Continue to Fall

With the spike in new infections and deaths, uncertainty clouds most forecasts on the pace and timing of the economic recovery and Treasury yields have continued to fall as we move into the summer. The 1-year T-Bill yield is down to 0.14% as of today compared to 0.16% at the end of June and to 0.17% at the end of May. The 10-year Treasury yield shrank to 0.62% as of today compared to 0.66% at the end of June and 0.65% at the end of May.

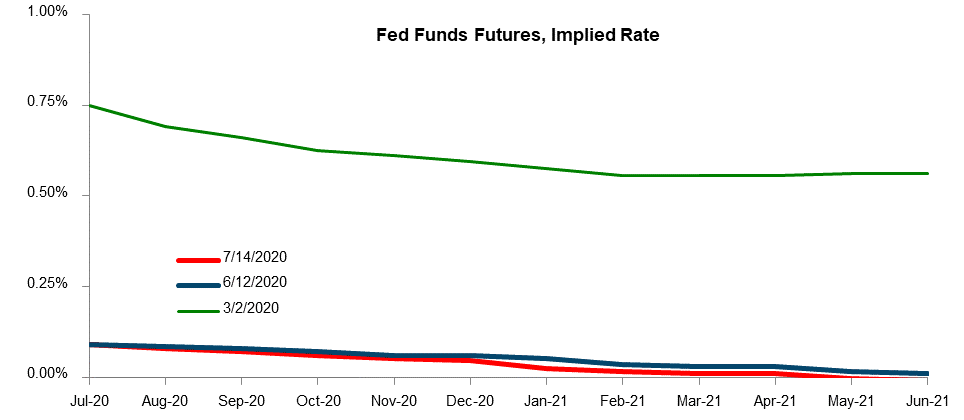

Fed Funds Futures

Futures contracts maintain a meaningful probability that overnight rates could further compress in the year ahead. Capital Advisors Group recommends that its clients move cash from overnight vehicles into direct purchases of term debt as liquidity requirements and cash use forecasts allow.

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.