Interest Rate Malaise

The interest rate blues are well in effect. For those with enough foresight to see this coming (and thus to load up on long-duration Treasury bonds) it has been an absolute riot. For the rest of the fixed income investment community, it’s been a bit of a bloodbath.

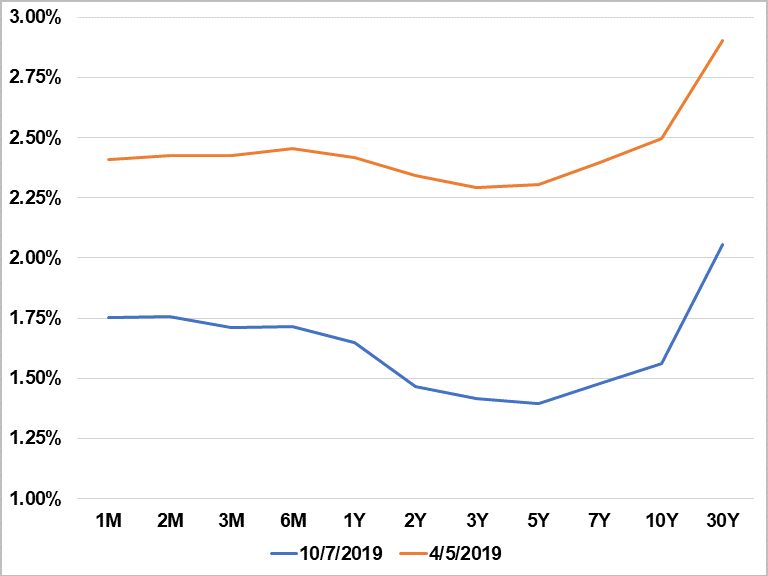

Figure 1: Yield Curve

Source: Bloomberg

Over the past six months, yields have fallen precipitously across the board (Figure 1). The 10-Year Treasury yield has fallen by nearly 100 basis points to 1.56% as of 10/7/19. Furthermore, the long-end of the curve has dropped off more than the front-end, leading to the much-discussed yield curve inversion. The implications of the inversion notwithstanding, the decline in the yield curve jibes with the general economic malaise that seems to have enveloped the global economy. More than 30 central banks across the globe have cut rates this year in efforts to fight weaker global growth, a burgeoning trade war, and lackluster inflation.

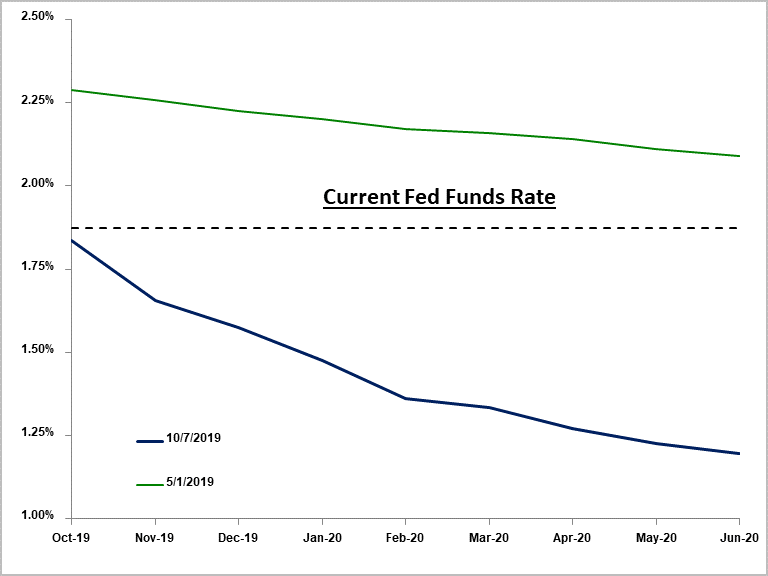

The Fed was one of the last to join the party but are now leading the way downward. Having cut rates twice already this year, they are expected to do so at least once more in 2019. Furthermore, the market is now expecting multiple cuts in the first half of 2020, bringing the expected fed funds rate in the range of 1% by the middle of the year. For reference, after its June meeting, the Fed expected that the Fed funds rate would be 2.4% at the end of 2019 and would remain north of 2% through 2020. Markets had slightly more realistic expectations but were still not keyed into just how dovish the Fed would turn (Figure 2).

Figure 2: Fed Funds Futures Projections

Source: Bloomberg

This stark turn in the path of interest rates provides some valuable insights for corporate cash investors in the post-crisis world.

1. The U.S. Economy Doesn’t Exist in a Vacuum

In spite of the current trade war, the U.S. economy’s interconnectedness with the rest of the world only continues to grow. Trade continues to rise as a percentage of U.S. output, and the trade deficit has hit new highs amidst higher government deficits. Furthermore, as Bank of England Governor Marc Carney noted, because of dollar dominance in global transactions, the U.S. maintains an outsized influence on international financial markets relative to the size of its economy (Figure 3). More and more countries are essentially dollarizing, and even those without an explicit dollar peg have large amounts of dollar debt and/or transact in dollars.

Figure 3: U.S. Dollar Share of Global Markets

Source: Mark Carney, Bank of England

All this means that what happens in China impacts what’s happening in the U.S., and vice versa. Because of dollar dominance, the U.S. attracts foreign capital, which in turn puts downward pressure on interest rates and upward pressure on the value of the dollar. The U.S. is essentially a banker to the world, and as such, cannot divorce itself from it. So as central banks across the world cut rates, and as negative yielding debt across the world continues to pile up ($15 trillion and counting), it becomes less likely that the U.S. can sustain higher interest rates.

2. The Traditional Phillips Curve Model Isn’t That Useful

This has been long discussed but is even more apparent now. Despite near-record low levels of unemployment (3.5% currently), the Fed continues to find itself with a low-inflation problem. The theory behind the Phillips Curve model is that low unemployment forces employers to compete for labor, which pushes up wages and then prices. For a variety of reasons, though, this hasn’t really played out as expected during the current expansion. Thus, the Fed finds itself cutting rates even when it has very clearly achieved the employment side of its mandate.

There is a distinct possibility that the unemployment rate is an insufficient measurement of labor slack. Perhaps the “underemployment rate,” or prime-age employment-to-population ratio, might work better. But the main point is that the state of the labor market cannot simply be extrapolated to other variables. Thus, even though unemployment is low, we cannot say with any degree of certainty that slack has dissipated or that price inflation will necessarily rise. These things are dependent on a variety of other factors, such as productivity growth, potential output, and monetary policy.

3. Don’t Try to Time the Fed

This is probably the most relevant point for cash-investors. Ten months ago, everyone was debating how high the Fed could take interest rates, and now we’re debating how low they could go. Over any significant period of time the path of interest rates is essentially a random walk. With the exception of the very short-term (within the next meeting or two) Fed guidance is not particularly accurate or useful. Nor would you expect it to be. Assuming they’re operating in an optimal manner they should be continually altering their forecasts to match incoming data.

When circumstances change, the market reacts and so does the Fed. Market forecasts are generally better than the Fed; however, they are subject to change as well. As a result, it makes sense for institutional cash investors to expand their view of the market beyond a narrow focus on the Fed. Watch the moves other central banks are making, stay on top of the day-to-day trade war news, and look more closely at all the employment metrics beyond the monthly jobs report. Then, develop a well-thought-out investment plan and be ready to stick with it through the highs and the lows.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.