Integrated Oil & Gas Majors and the Transition to Renewables

While most major integrated oil and gas companies have expressed alignment with the Paris Agreement, efforts made by U.S. players have fallen short in comparison to their European counterparts. Despite some players still dragging their feet in their sustainability efforts, governments, world organizations and financial institutions continue to pressure companies to align with climate-focused goals. If companies do not take action to align themselves with the Paris Agreement, they will face social and regulatory pressure, and weakening business profiles resulting in ratings pressure.

Alignment with sustainability targets is crucial given the climate crisis and increasing pressure to act from all directions. Many energy-related organizations now expect peak oil demand to be reached sometime before 2040, with BP famously declaring in September 2020 that the market may never recover to pre-pandemic levels of demand of 100mn b/d. Even OPEC has identified 2040 as the year of peak oil demand, while acknowledging that this forecast might be overly optimistic. Specifically, they expect global demand will hit 109.3mn b/d in 2040 before declining to 109.1mn b/d in 2045 after which it will plateau in the long-run. Broken down, in OECD countries, OPEC predicts oil demand will plateau at 47mn b/d between 2022-2025, after which it will decline towards 35mn b/d by 2045. Meanwhile, in non-OECD countries, OPEC predicts demand will rise by 22.5mn b/d over the period from 52mn b/d in 2019 to 74mn b/d in 2045.

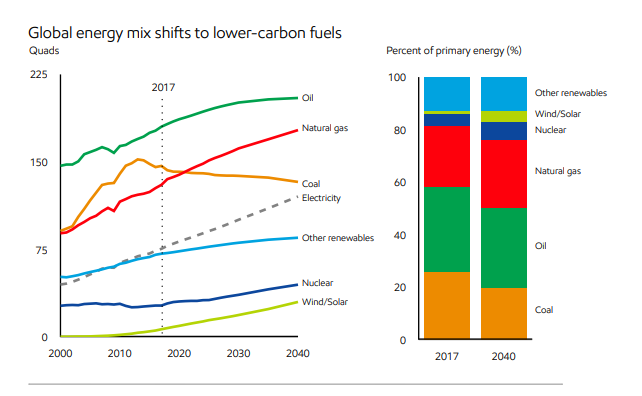

Similarly, the International Energy Agency (IEA) has forecasted that global oil demand growth will come to an end in the next decade. This will be followed by a long plateau, as the IEA states that in the absence of a large shift in government policies, there is no sign of a rapid decline. Even major oil and gas companies generally align with this assessment. Exxon, for example, forecasts a 20% increase in demand from 2017 to 2040 due to a growing global population and increasing prosperity, after which it expects to see a plateau and eventual decline. As can be seen in the figure below, while the increase in demand for oil will be supported by continued reliance on natural gas, demand for oil will taper.

Source: ExxonMobil

Shell expects peak oil demand will occur even earlier, in 10-15 years, and well before natural gas. Similar to Exxon, continued dependence on oil and gas assumes a growing world population and increasing prosperity. Despite the similarity in assumptions, the companies have taken contrasting levels of action related to the transition to a lower carbon footprint.

The European majors are further along than U.S. players, with bolder and more aggressive action towards sustainable business models. Like many European peers, Shell has committed to net-zero emissions by 2050 or sooner by setting short-term, incremental goals and tracking its net carbon footprint in the years before. Shell plans to transition its capital allocation toward low carbon energy sources, including hydrogen and biofuels, and less investments will be made in the traditional oil and gas businesses. Additionally, its net carbon footprint-related targets are linked to executive compensation, with sustainable development accounting for 20% of the 2020 Executive Scorecard which helps determine annual bonuses. Shell has also committed to increasing investment in its New Energies segment, which covers its renewables business, to 10% of its capital budget.

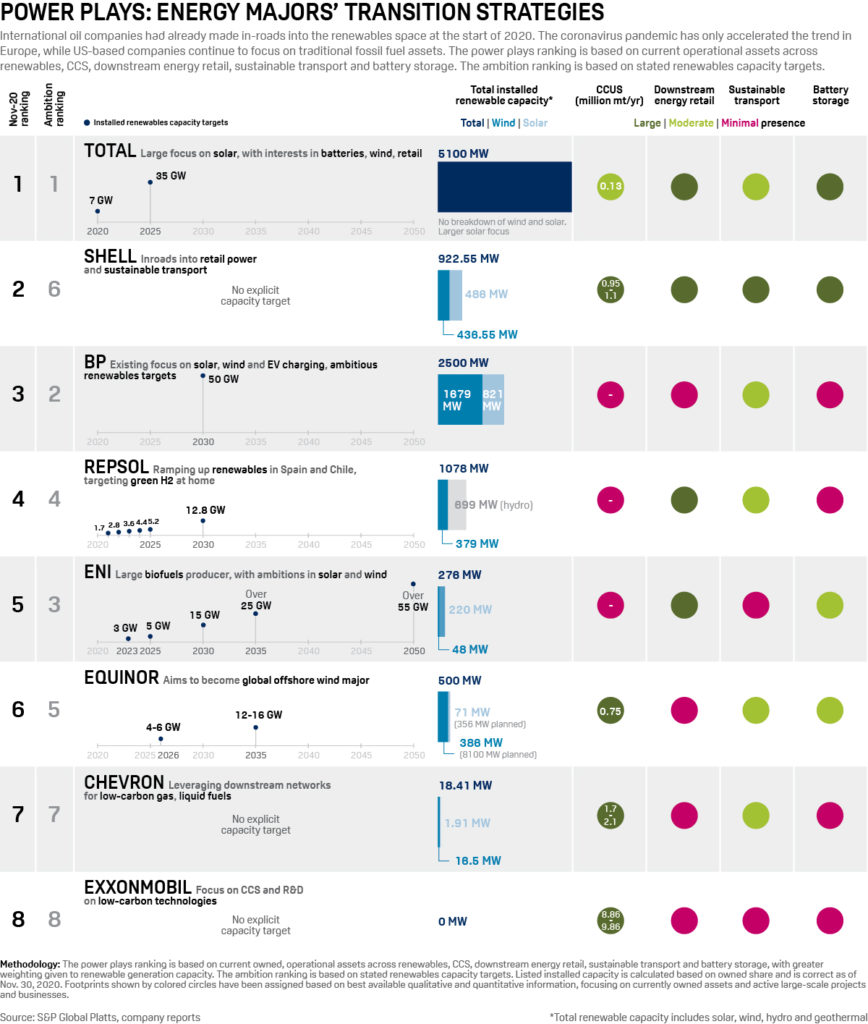

S&P compared the energy majors’ transition strategies in December 2020, documenting the rankings in the below infographic. As shown, European majors are consistently ranked higher compared to U.S. majors in terms of total installed renewable capacity and carbon capture utilization and storage (CCUS), as well as their efforts across downstream retail, sustainable transport and battery storage.

Source: S&P Global

As evidenced by the infographic above, up until very recently, Exxon’s sustainability-related initiatives had been next to nothing. In response to pressure from activist investors, Exxon announced with its fourth quarter 2020 earnings the creation of its new Low Carbon Solutions business segment. The segment will continue to develop and commercialize Exxon’s carbon capture storage opportunities. It is also rumored that Exxon continues to be in talks with activist investor D.E. Shaw, with a settlement potentially including adding additional renewables-focused individuals to the Board of Directors.

Industry Majors Face Increasing Pressure to Act

As mentioned in Capital Advisors Group’s most recent newsletter, in 2020 alone there has been significant action taken on the ESG front. This includes BlackRock’s Larry Fink calling on all companies in his annual newsletter to “disclose a plan for how their business model will be compatible with a net zero economy”. Additionally, Bank of America joined firms including JP Morgan, Citi, Goldman Sachs, Morgan Stanley, and Wells Fargo in committing not to finance oil and gas exploration in the Artic in response to activist pressure. In a year ravaged by a pandemic, European policymakers have demonstrated their intention to prioritize green initiatives within their stimulus packages. Meanwhile, the U.S. players face social and regulatory pressure, reaffirmed and heightened by President Biden’s election on a platform to reach a net zero economy by 2050. Additionally, while lack of reliable and consistent ESG data previously served to discourage relying on such metrics to make investment decisions, governments, NGOs, accounting standards boards and industries are progressing towards standardization in reporting requirements that will likely serve as more impactful and consequential investment tools.

If companies do not align or take significant action in support of a net zero economy, consequences could include decreased investment confidence, weakened business profiles and rating downgrades. One such example was S&P’s recent downwardly revised oil & gas industry risk assessment, from intermediate risk to moderately high risk, putting negative pressure on most integrated oil and gas names. Among the considerations resulting in the downgrade were significant challenges and uncertainty associated with the energy transition. Given the recognized risk associated with the transition, or lack thereof, towards a more renewable future, oil and gas companies would be smart to take action.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.