Institutional Cash Investments in the COVID-19 New Reality

Abstract

Extraordinary market volatility from COVID-19 led to a complete reset of portfolio strategies and expectations in cash investments. While liquidity has turned the corner, the path to recovery and a normal investment environment may be a long one. Fighting credit issues on one hand and the risk of negative interest rates on the other, treasury professionals should remain focused on liquidity management, take comfort in the Fed’s support programs, and proactively extend portfolio duration.

Introduction

Since last February, what started out as a regional outbreak of the new coronavirus quickly became a global pandemic, with more than three million confirmed cases and more than 260,000 deaths. In addition to incalculable human sufferings, global economies and financial markets faced one of the gravest challenges of the last century, with comparisons made to the Spanish Flu of 1918 and the Great Depression of 1929-1933.

Extraordinary actions were taken by the Federal Reserve and the Trump Administration to provide much-needed lifelines to the financial markets and direct cash payments and loans to keep businesses operating and to support furloughed employees. Today, the war on COVID-19 is fought on two fronts – to find a medical solution with drug treatments and vaccines and to restart the economy after mandatory stay-at-home orders and travel restrictions. Institutional cash portfolios must also contend with a different interest rate and credit landscape from two months ago. While we see plenty of signals to suggest that liquidity has turned the corner, the path to recovery and a normal investment environment may be a long and winding one.

While medical and economic solutions may be months away, financial markets adjusted swiftly to a lower-for-longer interest rate environment – which presents a big challenge to treasury professionals. As securities roll off and are replaced with new purchases, portfolio yields are expected to decline precipitously in money market funds and separate accounts. The story is similar in the deposit space, as the Federal Reserve again flushes the banking system with ample reserves that depress deposit rates. Meanwhile, credit conditions may deteriorate further as shutdowns linger, putting more stress on corporate balance sheets and bank loan books. What is a treasury investor to do in this environment?

The urge to wait out the yield drought may not work this time, as COVID-19 will likely cast a long shadow on the economy. The possibility of the Fed doing more to help the economy introduces concerns about negative interest rates. Protecting cash portfolios from COVID-related credit issues and principal erosion from negative rates creates tension in portfolio strategies that treasury professionals cannot avoid.

To decide where to go from here, it helps to understand where we were and how we came to the current state of the liquidity market.

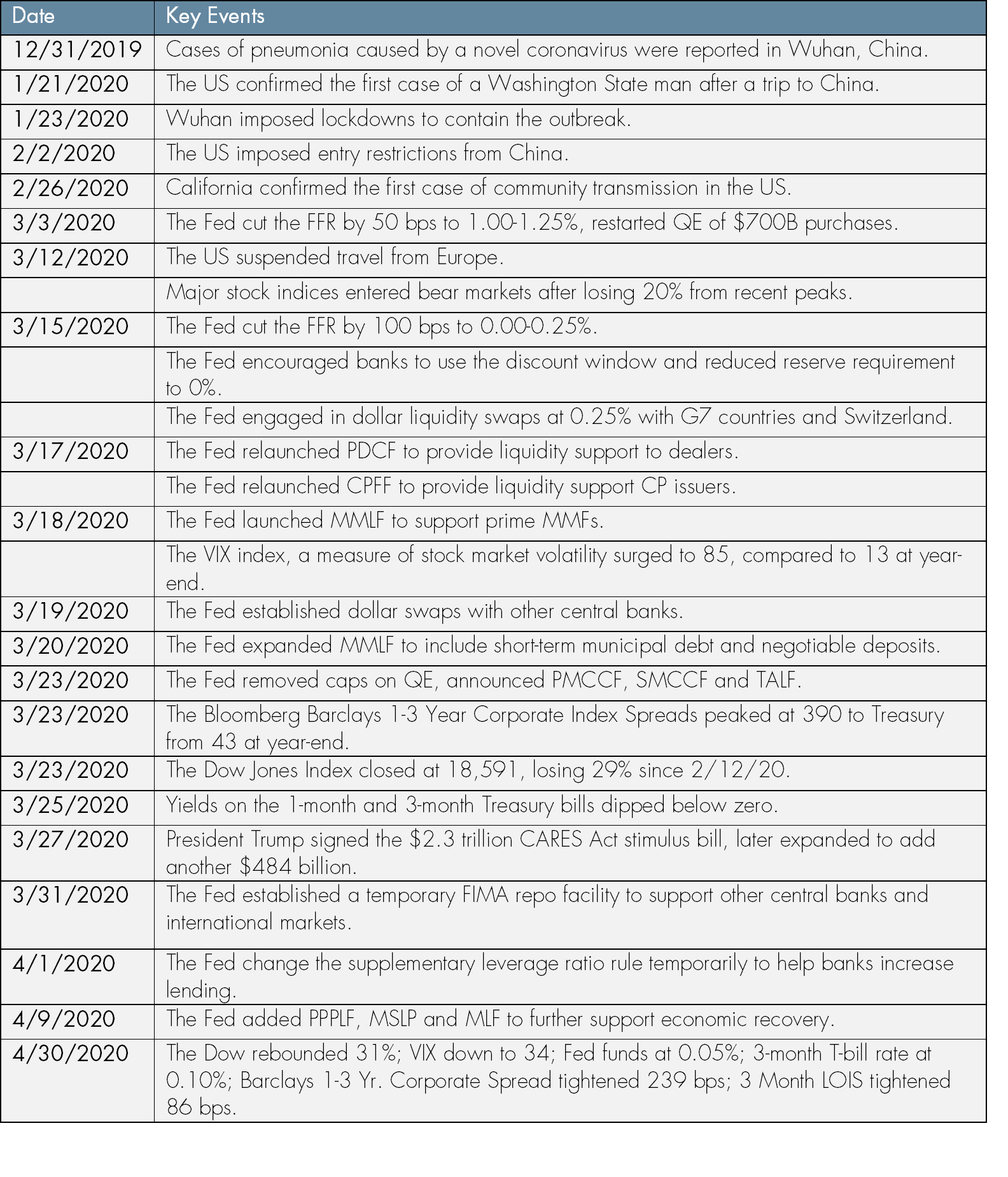

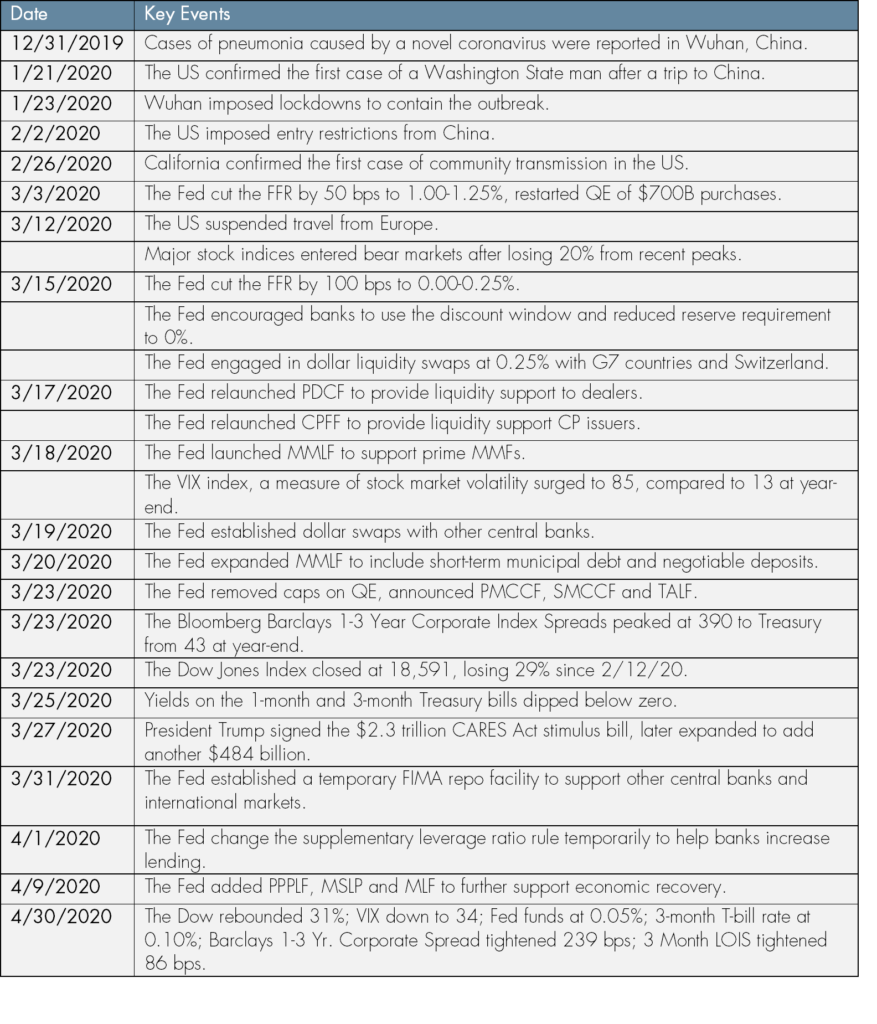

Table 1: Timeline of Key COVID-19 Market Events

A Recap of COVID-related Market Developments

A lot has been written about market events in the last two months. This recap will focus on key points salient to institutional cash investors. The initial concern to the US was about disrupted supply chains and travel-related revenue from China. Market volatility spiked after travel restrictions from Europe were imposed on March 12th. Equities sold off violently. Debt markets froze as dealers refused to take back inventory in the face of uncertainty. Prime money market funds, overwhelmed by rapid shareholder redemptions, saw net asset value erosion, and risked breaching the 30% weekly liquidity requirements.

Faced with the dual challenges of imminent mass layoffs and a dysfunctional financial market, the Federal Reserve lowered rates on March 3rd and made a second emergency inter-meeting rate cut on Sunday March 15th. It followed it up with a succession of emergency liquidity programs from the 2008 financial rescue playbook to support primary dealers, commercial paper issuers, money market funds and other liquidity market participants. On March 19th and again on April 24th, Congress passed combined $2.5 trillion fiscal relief packages to hand out direct payments and loans to support businesses and individuals. With the new allotted funds, the Fed launched a few more facilities to support primary and secondary debt markets, asset-backed and mortgage backed securities and municipal issuers.

By the end of April, despite the continued increase in COVID-19 cases and record unemployment claims, financial markets firmly established around a new equilibrium. The Dow Jones Industrial Average rallied 31% from the bottom. The VIX volatility index dropped to 34. Except for sectors directly impacted by the pandemic, credit spreads tightened significantly, reflecting better buyer appetite. The Bloomberg Barclays 1-3 Year Credit Index spread tightened 183 bps from the recent peak of 307. The 3-month LIBOR to Overnight Index Swap (LOIS) rate, a measure of short-term credit risk, also dropped to 0.52% from 1.39%.

Exhibit 1: VIX Volatility Index

Source: Bloomberg

Exhibit 2: Bloomberg Barclays 1-3 Year Credit OAS

Source: Bloomberg

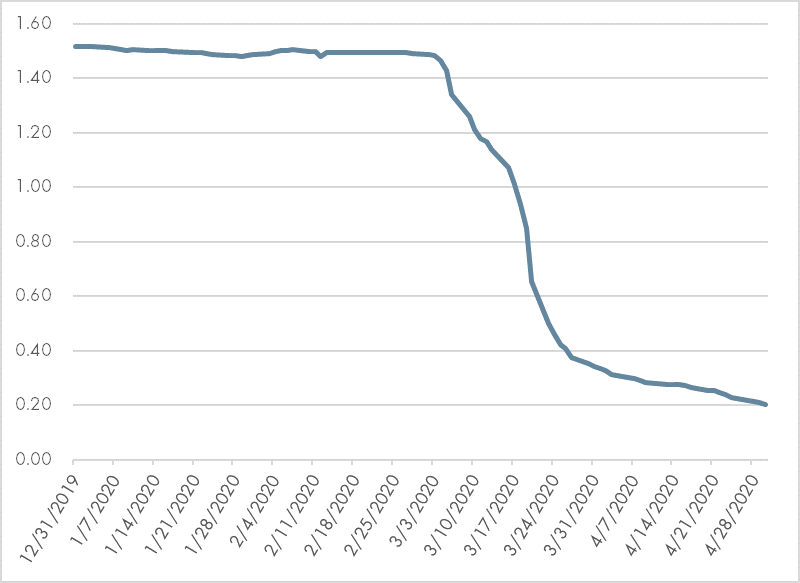

Exhibit 3: Libor to Overnight Index Swap Rate History

Source: Bloomberg

While credit markets returned to a new “normal” environment, effective fed funds, government repos, Treasury bills and other high-quality short-term rates also dropped precipitously. Technical factors caused yields on the 1- and 3-month T-bills to dip below zero before the Treasury Department increased borrowing to reflate these rates. Since April 1st, Treasury securities within 1 year of maturity traded consistently below 0.15% and are trending lower. Government MMF yields are expected to drop further as existing higher-yielding securities roll off.

Exhibit 4: 3-month Treasury Bill Yield

Source: Bloomberg

Exhibit 5: Treasury Yield Curve

Source: Bloomberg

Exhibit 6: Average Institutional Government MMF Yield

Source: Average yield of 14 largest Institutional Government MMFs compiled by CAG from Bloomberg data

Tighter Bid-Ask Spreads Indicate Improved Market Liquidity

Effective cash investment portfolio strategies rely on efficient market liquidity, and recent signs indicate that conditions have improved. As expected, most cash portfolios ceased trading between March and early April, particularly in credit instruments such as commercial paper (CP). Extraordinary Fed liquidity and credit facilities provided much needed relief to short-term debt markets. Observable measures of market liquidity, namely the bid-ask spread of credit instruments, have indicated considerable recovery in market conditions.

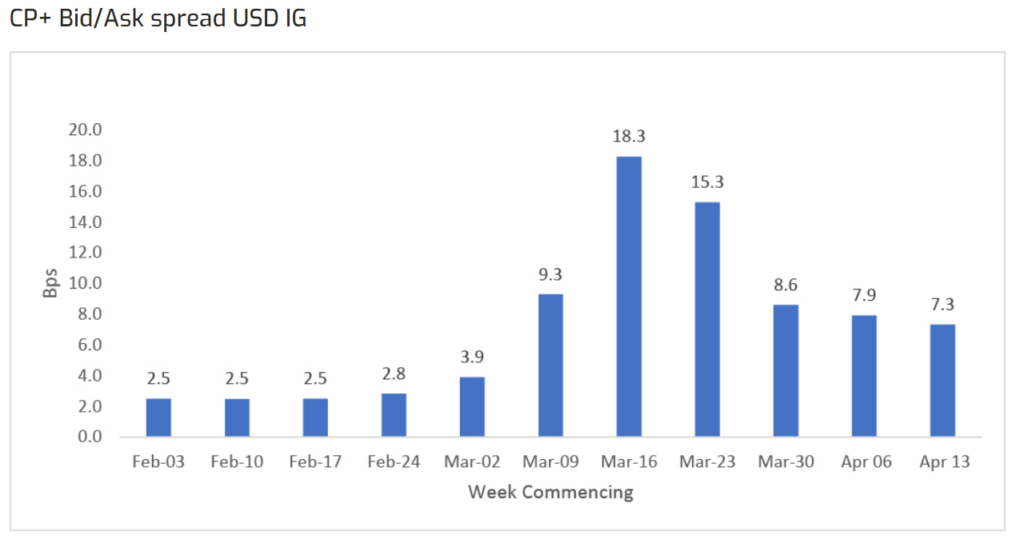

Exhibit 7: MarketAxess Composite+ (CP+) Bid-Ask Indications

Source: MarketAxess

Composite+ is an AI-powered pricing engine of more than 25,000 corporate bonds globally traded on the MarketAxess bond trading platform, covering 90-95% of trading activity in its markets1. Exhibit 7 shows that the average weekly bid-ask spreads were less than 3 basis points in February. The spread shot up to 18 bps in the week of March 16. The composite has since recovered significantly to 7 bps. Spread compression suggests that dealers and investors are more confident of the market’s ability to provide liquidity should they need to raise cash through selling credits in the open market.

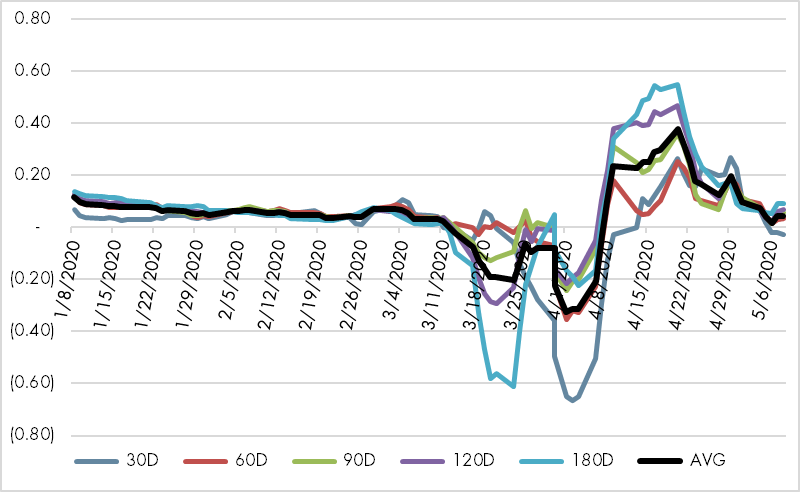

Exhibit 8: Average 5-Day CP Bid-Ask Spreads

Source: Bloomberg

Turning our attention to the CP market, we observe a similar pattern with an interesting twist. Anecdotally, bid-ask spreads on previously well received names such as integrated oil & gas and automotive names were as wide as 200 bps or higher. Many dealers refused to bid on names regardless of levels for fear of inability to finance the flood of sell orders from prime money market funds and other short-term credit investors.

Exhibit 8 provides the bid-ask yield spreads of dealer-placed A-1/P-1 rated CP yields by 30, 60, 90, 120, and 180-day maturities according to Bloomberg. The series are presented in 5-day moving averages since the beginning of the year. They indicate an efficient trading market of less than 10 bps for most maturities through early March, when the spreads mysteriously went negative for more than a month before spiking out in the latter half of April. Spreads have since return to 2-10 bps, levels resembling conditions before the pandemic.

Negative bid-ask spreads are odd, as dealers would not want to bid (offer to buy) a security at a lower yield (higher price) than to ask (offer to sell) at a higher yield (lower price). While we do not know for sure if errors in data collection played a part, a likely explanation is that securities the dealers offered to buy during this period were not the same as those they offered to sell. In other words, our guess is that dealers were more willing to bid on higher-quality, more liquid names at higher prices and offered to sell less-desirable names at lower prices. This would evidence a two-tiered market among A-1/P-1 issuers in bid-ask spreads. The inverse relationship confirms with anecdotal dealer quotes we observed during that time.

Bid-ask spreads reversed directions in late March to reflect more active two-way activity. Average bid-ask spreads of all maturities were as wide as 38 bps on April 20th before trending down steadily to just 4 bps on May 8th, a tight level even in a normal trading environment. A significant factor for the rapid tightening of spreads was the Fed’s Commercial Paper Funding Facility (CPFF) which went live on April 14, 2020. The Fed established the CPFF to be the buyer of last resort for all A-1/P-1 rated CP.

In summary, both the MarketAxess CP+ and the Bloomberg average bid-ask spreads for A-1/P-1 CP indicate that liquidity has returned to the credit market since the height of the pandemic to provide a level of support for cash investors.

A Network of Fed Programs Provide Additional Safeguards

The war on the COVID-19 pandemic is by no means over. Until effective vaccines and treatment drugs are found and become widely available, relaxation of social distance rules risks new waves of outbreaks. Cash investors are right to question if the worst is behind us before resuming normal investment strategies. We think the emergency support measures in place drastically reduces the probability and magnitude of the volatility we observed in late March. Below are some of the programs we think will directly benefit the short-term debt market.

CPFF: With the Commercial Paper Funding Facility, the Fed offers to buy 3-month CP for Tier-1 rated CP issuers at OIS + 110 bps up to the maximum of its outstanding between March 2019 and March 2020. Issuers downgraded to Tier-2 since March 2020 can still sell to the Fed at OIS + 200 bps as a one-time purchase. The program is good through March 21, 2021. The US Treasury provides $10 billion to the Fed for loss protection.

PDCF: The Primary Dealer Credit Facility allows the primary dealers to borrow from the Fed at 0.25%. Eligible asset collateral includes investment grade corporate debt, CP (incl. Tier-2), municipal debt, ABS, MBS, and equities. It will be active for at least six months, longer if conditions warrant an extension.

MMLF: For the Money Market Fund Liquidity Facility, the Fed offers to purchase secondary market investments from MMF portfolios such as Tier-1 CP, ABCP, muni and bank deposits through sponsor banks at prime credit rate (0.25%) + 100 bps. The program ends on September 30, 2020.

PMCCF and SMCCF: The Fed offers to purchase new issues and secondary market debt from investment grade corporate issuers through the Primary Market Corporate Credit Facility ($500 billion up to four years) and Secondary Market Corporate Credit Facility ($250 billion up to five years). Treasury provides $75 billion in equity investment for credit protection. The facilities provide long-term financing to corporate borrowers.

TALF: Through the Term Asset-backed Lending Facility, the Fed offers to purchase up to $100 billion of new three-year loans from issuers backed by consumer loans such as credit card receivables, auto and student loans, and commercial mortgages and collateral loan obligations. The facility indirectly supports outstanding asset-backed securities and asset-backed CP.

MLF: Fed offers to buy up to $500 billion of debt up to 36 months from state and certain local municipal issuers through the Municipal Liquidity Facility. The facility indirectly supports other municipal debt.

As of May 6th, these are the program balances on the Federal Reserve’s balance sheet: CPFF $3.9 billion; PDCF $17 billion; MMLF $44.6 billion; and PMCCF $29.9 billion. Regardless of access levels, these facilities serve as backup support mechanism to corporate debt and CP, municipal, asset-backed, and mortgage-backed securities. With these programs as well as government bond purchases, open market repo operations, the discount window, central bank swap lines, the Main Strain Loan Facility, the Paycheck Protection Program Liquidity Facility (PPPLF) and the CARES Act fiscal stimulus programs, credit markets are better protected than they were two months ago should market conditions turn unfavorable again.

Portfolio Considerations for the COVID-19 New Reality

As states follow a set of guidelines to partially reopen their economies, we think treasury professionals should consider a few factors as they contemplate resuming active cash investments.

Liquidity Remains Job One: As in previous episodes of disruptive markets, liquidity scars take time to heal. To fend off bouts of liquidity flareups, consider building extra cash buffers in government money market funds or short-term Treasury obligations. For credit instruments, consider reducing exposure to names directly impacted by the pandemic such as energy, transportation, travel & entertainment, dining, and certain retail credits. Focus on industry leaders with ample cash cushion and staying power.

Look to issuers eligible in Fed facilities for backup support: As discussed earlier, the various liquidity facilities from the Fed provide the necessary backup support should issuers find it difficult to raise funding in the open market. While utilization rate remains low today, the programs are vitally important in building confidence. Investors should be aware of ratings, classifications, country domiciles and deadlines to ensure the credits they use remain eligible to access those programs.

Extend duration to protect against negative yield: While the Fed publicly disavows negative interest rates for the US, speculation about such extreme measures intensified in recent weeks. Overnight repo rates and short treasury bill rates went below zero on isolated occasions but were supported by very large Treasury bills issuance. As the Treasury shifts its issuance to longer term maturities, pressure may return to the front end. Should the Fed lower the fed funds rate to negative, deposit and market rates likely will follow there. Despite a flat yield curve, extending purchases further up on the yield curve may be a defensive plan against reinvesting at negative rates.

1Learn more of the Composite+ pricing engine here, https://www.marketaxess.com/price/composite-plus

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.