Interest Rate Outlook: Inflation & Employment

Inflation & Employment

Readings on consumer inflation this week remained tame overall with wide variance around the average for certain components. CPI for September was up just 1.4% year-over-year and Core CPI was up 1.7% year-over-year. Weekly Initial Jobless Claims remain high at nearly 900,000 in the week ended October 10. Surging COVID-19 infection rates across much of the country are making near-term improvement in employment markets less likely.

Federal Reserve

Remarks from members of the Open Market Committee appear aimed at reinforcing the Fed’s updated policy framework regarding average inflation over time, and how that is likely to delay liftoff from the zero percent rate policy. Yesterday, in a speech to the Institute of International Finance, Vice Chair Richard Clarida addressed the new policy framework:

To this end, the new statement conveys the Committee’s judgment that, in order to anchor expectations at the 2 percent level consistent with price stability, it “seeks to achieve inflation that averages 2 percent over time,” and—in the same sentence—that therefore “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.” *

* https://www.federalreserve.gov/newsevents/speech/clarida20201014a.htm

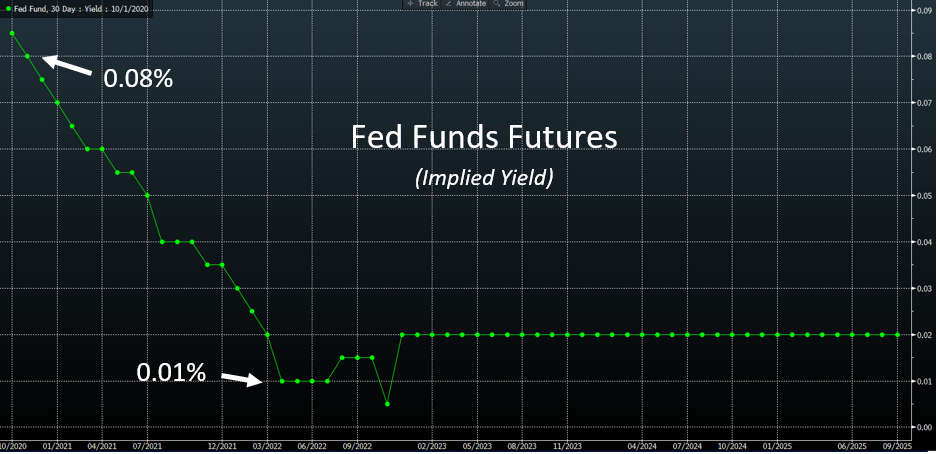

Clarida addressed potential timing with respect to monetary policy tightening through forecasts for employment and inflation gains. While it took 8 years following the global financial crisis in 2008 to return to full employment and to reach levels consistent with the Fed’s inflation mandate, Clarida noted that in September’s Summary of Economic Projections, Fed members predicted a decline in the unemployment rate to 4% and an increase in Personal Consumption Expenditures to 2% by the end of 2023. While the expectation is for quicker recovery than after 2008, given the Fed’s desire to see inflation “moderately above 2% for some time”, an increase in the Fed funds rate before then remains unlikely in our view.

Fed Funds Futures Contracts

Source: Bloomberg

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.