Implications of Coronavirus Vaccine Development

With 48 potential SARS-CoV-2 vaccines now undergoing clinical trials on humans, there’s mounting hope that one or more will be available in 2021. But many unknowns remain, especially regarding potential financial implications for the pharmaceutical companies that produce them. Timing of their arrival, manufacturing capacity, distribution, levels of potential government support, overall costs, and final pricing, for the most part, still pose more questions than answers. And potential ESG (Environmental, Social, and Governance) reputational impacts on suppliers create additional uncertainty. However, now is the time to start understanding the forces at work to anticipate possible changes that the arrival of one or more vaccines may bring to the credit and risk profiles of cash portfolios.

A Multi-Step Process

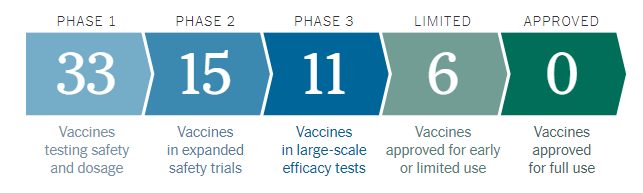

The vaccine development process is a multi-step and highly scrutinized endeavor. The process moves from exploratory, to pre-clinical, to clinical development, to regulatory review and approval, to manufacturing and quality control stages.

Clinical trials can only begin after identifying what substance induces an immune response in the human body, and then undergoing animal testing to assess the safety of the vaccine candidate and its ability to yield an immune response in the first two stages. In Phase 1, the candidate is administered to small groups of people to test safety and dosage and to confirm immune system stimulation. In Phase 2, the study is expanded and the vaccine is given to people matching characteristics of those for whom the vaccine is intended. Finally, in Phase 3, the vaccine is given to thousands of people to test for safety and efficacy.

This process is inherently challenging, especially in the context of a COVID-19 vaccine which is drawing worldwide attention and pressure. This is forcing an unprecedented acceleration of the development timeline, down from what is normally years to months. This acceleration increases the uncertainty around vaccine candidate approvals due to the reduction in time spent testing the vaccine. Additionally, some producers, including Moderna and Pfizer, are developing mRNA-based vaccines, which rely on new technology and impose additional requirements on governments and vaccine providers.

These sources of uncertainty through development and approval make it difficult to predict the potential implications for pharmaceutical companies involved in the race. According to the New York Times, as of October 20th, companies with vaccine candidates in Phase 3 trials include Moderna, BioNTech and Pfizer, CanSino Biologics, the Gamaleya Research Institute, JNJ, AstraZeneca and Oxford, Novavax, Sinovac, Wuhan Institute of Biological Products, Sinopharm, and the Murdoch Children’s Research Institute. (https://www.nytimes.com/interactive/2020/science/coronavirus-vaccine-tracker.html)

Figure 1

As evidenced in the decreasing number of companies who passed into each phase in Figure 1, the process is highly selective, with rigorous standards set for approval. Financial implications will depend largely on approvability and manufacturing capacity and agreements, as well as level of government support. Meanwhile, ESG implications are expected to be mostly related to the ‘S’, or social, component – with the effect centering on company reputation.

Financial Implications Largely Uncertain

Financial implications for vaccine candidate-producing pharmaceutical companies are very uncertain and dependent on a myriad of factors. To begin with, timing of widely available vaccines continues to be difficult to predict, and faces hurdles including approvability, manufacturing scale-up and distribution capacity. Approvability may prove to be difficult given new types of technology that have not been used in any approved vaccines previously, specifically mRNA-based vaccines. Additionally, while products might be approved for emergency use for front-line workers before commercial use, approvals for a broader population will face higher standards pertaining to safety and efficacy.

With respect to manufacturing, the capacity to produce billions of doses does not currently exist, though many companies are scaling up internally and through collaborations. For example, JNJ has partnered with Emergent BioSolutions with the aim to boost capacity by up to 300 million doses to support its target to produce 1-billion doses by the end of 2021. AstraZeneca also partnered with Emergent among other suppliers to meet its goal to supply 2-billion doses globally by the end of 2021. The more doses required to make the vaccine effective, the more production capacity and time will be required to bring it to market. Additionally, profit will be dependent on pricing as well as the degree of competition between manufacturers.

Finally, it is important to note that many vaccine developers have substantial businesses outside of vaccines, implying that coronavirus vaccine sales may not have a notable effect on their credit metrics. The impact will depend company by company. JNJ and Pfizer, for example, boasted annual 2019 revenue of $82 billion and $52 billion, respectively. Their infectious diseases and vaccine business segments accounted for $3.4 billion or 4% of total sales, and $6.5 billion or 12.5% of total sales, respectively. JNJ, rated Aaa/AAA, is unlikely to see as much financial gain reflected in credit ratings as Pfizer, who is rated A1/AA-.

An additional consideration in profitability will be government support. According to Moody’s, legislators have already introduced multiple bills in U.S. Congress aiming to limit profit opportunities from vaccines, with some citing taxpayer funding of vaccine development. The first form of the Heroes Act, for example, mandates that vaccines, therapies and diagnostics developed using Heroes Act funding be affordable in the commercial market. So far, prices of vaccine candidates have ranged across the spectrum. JNJ, for example, agreed to provide the U.S. government with 100 million doses of their vaccine in exchange for $1 billion, implying a price per dose of about $10. Meanwhile, Pfizer and BioNTech agreed to provide 100 million doses in exchange for $1.95 billion, implying a price of $19.5 per dose. On the extremes, AstraZeneca’s implied price per dose was $4, and Moderna’s was between $32 and $37.

ESG Considerations

Given the uncertainty of the process and outcome, Moody’s expects the main implications to be related to ESG, with emphasis on the ‘S’, or social. In its framework, Moody’s outlines the five social considerations most relevant to its credit analysis, with the most applicable to this scenario being customer relations. In this case, the agency sees the vaccine development opportunity having potential to improve relations with customers and stakeholders, including but not limited to patients, doctors, governments, and global health authorities. Societal benefits that could follow development include reduced mortality, lower burdens on hospitals and an easing of social distancing measures.

Going further, Moody’s sees social issues affecting credit quality mainly through reputational risk. For context, the pharmaceutical industry ranked the lowest out of 25 industries in a 2019 Gallup survey in the U.S., with the poor perception of the industry stemming from the cost of pharmaceuticals, as well as the perception of the industry’s role in the opioid crisis. A successful vaccine, however, could remind the public of the industry’s operational mission to improve human health. Another reputational risk stems from vaccine pricing and distribution decisions. Reputational harm could be done if prices are perceived to be too high. Pricing information so far has been limited and will depend on if products are approved for emergency use or for wider commercial use. Equitable distribution will also be key given demand will outweigh supply at first, with companies likely expected to make vaccines globally available in areas most affected by the pandemic.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.