How Are Your Peers Managing Their Cash?

Following the collapse of Lehman Brothers in 2008, the rapidly deteriorating economic environment in the U.S. and abroad caused most treasurers to reevaluate their cash investment strategies, with a specific focus on restricting investment in certain asset types. Some companies implemented these restrictions by changing their investment policies, while others simply gave instructions to their investment advisors to limit investment activity to the most conservative corner of their existing guidelines. Across the board, we witnessed our clients “hunkering down” in government-issued and government-backed debt during the height of the credit crisis. However, with a substantial improvement in the credit markets over the past ten years, we have observed a considerable shift in clients’ desire to pursue more yield by allowing for investments in non-government securities.

When considering changes to their investment strategies, many treasurers are interested in understanding the decisions being made by their peers. This context not only helps to validate the recommendation that a treasurer may receive from an investment manager, but it also provides a reality check before a new cash management strategy is presented to an Audit Committee or Board of Directors. In 2012 we published a white paper using Capital Advisors Group’s client data to compare how investment strategies changed over the three years from March 31, 2009 to March 31, 2012. With another 6 years having elapsed, we hope that some fresh data will assist treasurers in evaluating their current investment strategies and whether to pursue additional yield in their cash portfolios.

The Sample

The sample of Capital Advisors Group’s clients used in the analysis met the following two criteria: i) they were clients throughout the entire nine-year period of March 31, 2009 to August 31, 2018, and ii) they permitted investments outside of money market funds. For each client, we determined whether or not they permitted investment in U.S. Government debt, industrial and financial corporate securities on each of March 31, 2009, March 31, 2012 and August 31, 2018. In determining if a client permitted investment in a particular asset class or industry, we considered the client’s investment guidelines in combination with the client’s instructions, if any, with respect to such asset class or industry. Our analysis did not consider the maturity limits or the ratings of securities.

Government Debt

As of March 31, 2009, 100% of the clients in our sample were comfortable with the purchase of securities issued by or guaranteed by the U.S. Government. These securities include U.S. Treasuries, government-sponsored enterprises (GSEs), and FDIC-insured securities issued under the Temporary Liquidity Guarantee Program (TLGP). Not surprisingly, as of 2018, all clients remained comfortable with debt issued by or guaranteed by the U.S. Government.

Industrial and Financial Corporate Debt

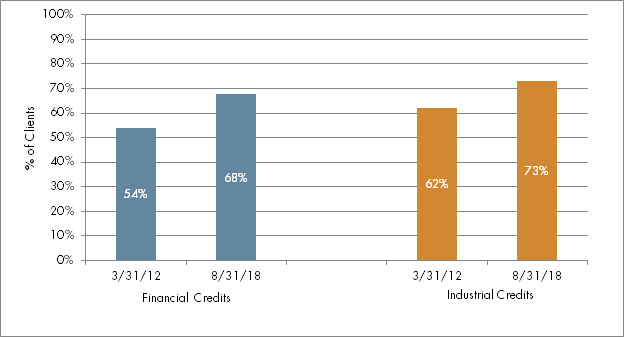

As the credit markets deteriorated in 2007 and 2008, we sharply reduced our clients’ exposure to potentially unstable issuers of industrial and financial corporate debt. Following the collapse of Lehman Brothers in September of 2008, we advised that clients invest solely in government-guaranteed securities. As a result, on March 31, 2009 none of our clients in the sample permitted investments in securities not guaranteed by the U.S. Government. However, as credit conditions improved, Capital Advisors Group gradually resumed investment in corporates, first purchasing select industrial credits in July 2009 and select financial credits in October 2009. By March 31, 2012, Capital Advisors Group was comfortable with the credit profiles of many industrial and financial issuers, and approximately half of the sample permitted investment in both industrials and financials, as indicated in Figure 1 below. By August 31, 2018, an additional 14% had grown comfortable with financial credits and an additional 11% with industrial exposures.

Figure 1: Clients Permitting Investment in Industrial and Financial Credits

Source: Capital Advisors Group, Inc.

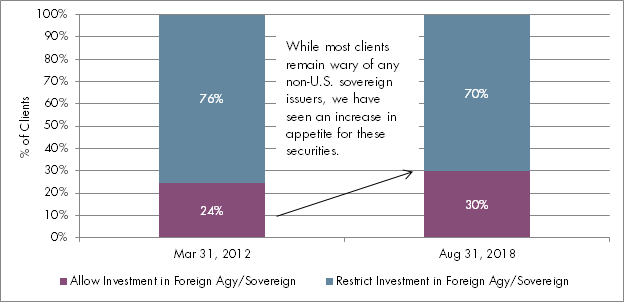

Foreign Sovereign and Agency Debt

Securities issued by sovereign governments other than the U.S. and by agencies guaranteed by these governments may be appropriate investments for cash portfolios. Some of the largest and most stable countries in the world issue debt denominated in U.S. dollars, and some of their risk profiles rival those of the most stable corporate issuers. As of August 31, 2018, 30% of our client sample allowed for investment in foreign sovereign and foreign sovereign agency debt, up from 24% on March 31, 2012 and 0% on March 31, 2009.

Figure 2: Clients Permitting Investment in Securities Issued by Foreign Sovereigns and Agencies

Source: Capital Advisors Group, Inc.

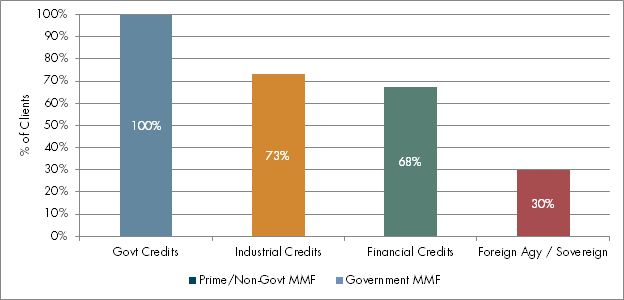

Conclusion

Worries about new crises and fears of resulting contagion obscure the fact that the U.S. economy and world economy have recovered from the depths of the credit crisis. On March 31, 2009, none of the clients in the sample permitted investment in corporates, or foreign sovereign and foreign sovereign agency debt. On March 31, 2012, 62% of the clients permitted investment in industrials, 54% permitted investment in financials, and 24% permitted investment in foreign sovereign and foreign sovereign agency debt. By August 31, 2018, those figures had grown to 73%, 68% and 30%, respectively.

Figure 3: Summary of Permitted Investments as of August 31, 2018

Source: Capital Advisors Group, Inc.

Memories of the near collapse of the financial markets in 2008, and continued risk aversion are reflected in approximately half of the sample that did not permit investment in either industrial or financial corporates as of March 31, 2012, and the 27% as of August 31, 2018.

We have continued to see increased demand for yield via non-U.S. Government securities and we expect that this trend will continue as investors seek the potential incremental yield associated with non-U.S. Government assets. Some clients have even requested that we aggressively pursue yield; however, the circumstances and preferences of each client are different. While this paper provides a backdrop of institutional cash investment trends, asset classes must be considered within the context of each treasurer’s individual organization.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.