Here We Go Again – Fourth Consecutive 75bp Rate Hike by the Federal Reserve

In a widely expected move, the Federal Reserve raised the overnight lending rate today by 75 basis points for the 4th time in 4 meetings. Following the FOMC’s action, the rate now rests at the 3.75% to 4.00% range. The Fed’s 2022 tightening activity has been extraordinary for a central bank with a history of moving slowly and steadily when it comes to interest rate hikes. Despite its aggressive efforts over the past several quarters, the Fed has been unable to quell price pressures. September’s Consumer Price Index shows headline inflation running at 8.2% (y-o-y) and core data excluding food and energy at 6.6% (y-o-y), well above their stated 2.0% target.

Will the Fed Scale Back?

In the statement following their release today, the FOMC said: “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”. This language hints at the possibility that that the Fed might scale back in 2023, but it’s very early to make a call.

We still see divergent scenarios for the next year or two – one in which the Fed continues to raise interest rates beyond current expectations to tame inflation and others in which the US economy falls into a mild, moderate or severe recession. Amid these uncertainties, we’re positioning our clients’ portfolios to take advantage of upside opportunities and to protect against potential interest rate risks.

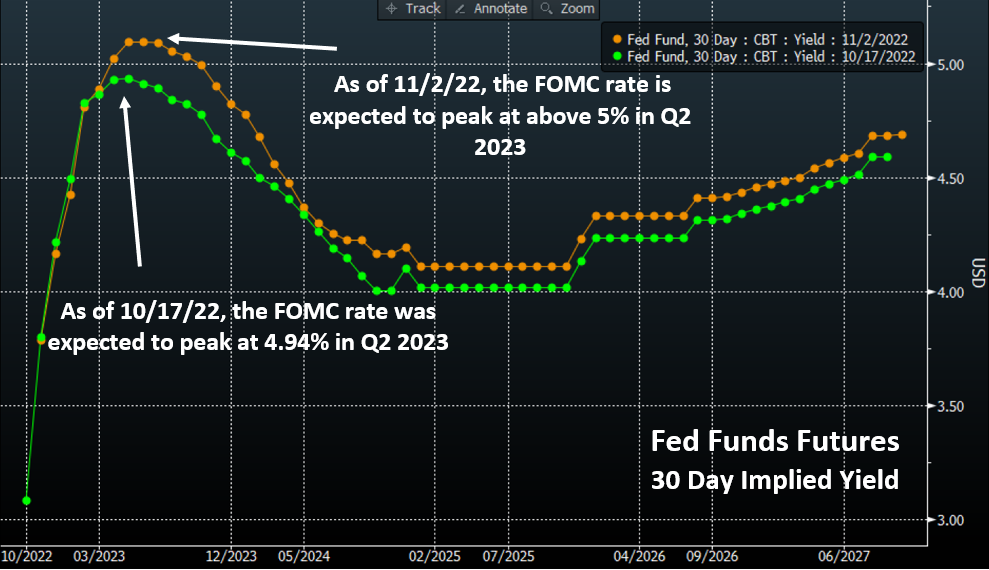

Fed Funds Futures

Markets haven’t yet settled down following this afternoon’s news from the Fed, but initial readings from Fed funds futures contracts are fully pricing in a 0.50% hike at the December 14th meeting. Looking ahead to 2023, markets are currently anticipating that the ‘terminal rate’ may approach 5.25% – 5.50% by the end of May. They also suggest that the Fed could begin cutting rates in the fourth quarter of next year despite no such indications from the Committee itself.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.