Federal Reserve’s Stance on Monetary Policy

The Federal Reserve met over the past two days to review its stance on monetary policy, and it has provided specific details on plans to taper its bond purchase program over the next few quarters. Since March of 2020, the central bank has been buying $120 billion of assets each month, and it revealed today that its market activity will slow by $15 billion per month to $105 billion in November and then $90 billion in December. If the reduction continues on pace into 2022, the Fed’s quantitative easing efforts would wind down by the end of the second quarter, setting the stage for possible interest rate hikes in the latter half of next year. Behind this decision, Chair Powell acknowledges that “inflation is elevated, largely reflecting factors that are expected to be transitory” and that “supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors”.

Economic Update

Despite the Federal Reserve’s actions to prepare for possible inflation risks in 2022, the advance reading of Q3 GDP revealed that US economic growth slowed to 2.0%, below projections of 2.6% and following a rate of 6.7% in Q2. The disappointing number marked the slowest pace of growth since the post-pandemic recovery began with two major factors contributing to the slowdown: a resurgence in Covid-19 cases from the highly contagious Delta variant and worsening supply bottlenecks which have negatively impacted major industries including the automobile and food sectors. Government stimulus, a major force behind the robust expansion in previous quarters, also slowed in the third quarter but consumer spending remained firm, jumping by 1.6%. Price pressures continued to track at the highest levels in three decades with September core PCE data, an inflation gauge tracked closely by the Fed, measuring at a 4.6% rate (year-over-year).

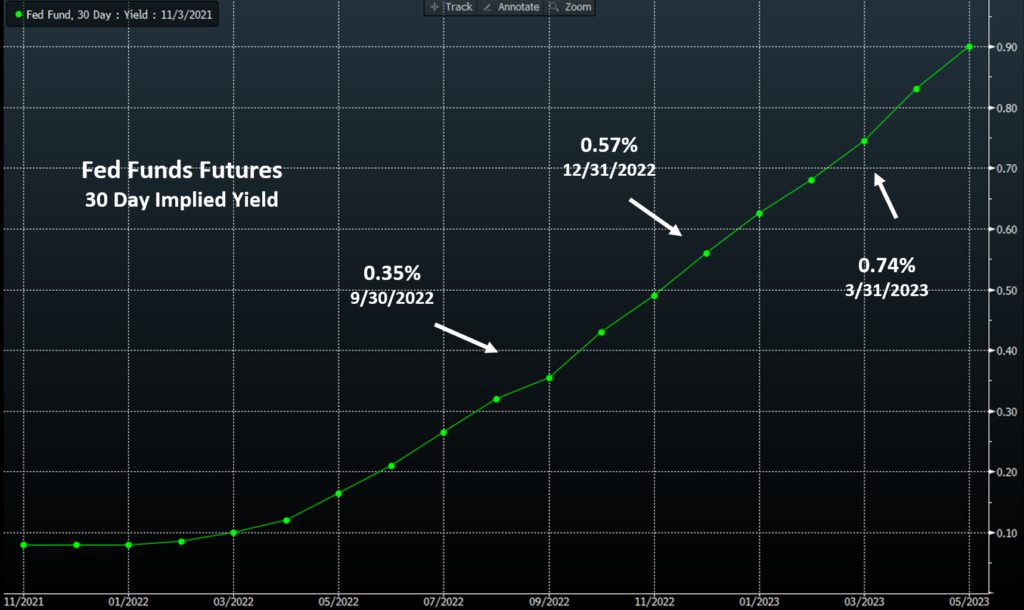

Fed Funds Futures and Bond Yields

Following the FOMC meeting, fed funds futures contracts have maintained their bets that the Federal Reserve will raise rates in the latter half of 2022. Current contracts are pricing in a first hike around September 2022 and a second hike by the end of the year, with expectations for the overnight lending rate to surpass 1.0% by the end of 2023. Bond yields went on a relative roller coaster ride in the days leading up to the Fed meeting. Over the last week, the 2-year Treasury yield fluctuated in the 0.45% to 0.50% range, finally closing at 0.47% post-meeting (up from 0.28% on September 30th and 0.20% on August 31st). The 10-year yield closed at 1.57% post-meeting (after moving between 1.61% and 1.70% over the past week) compared to 1.52% on September 30th and 1.30% on August 31st.

Disclaimer: Treasury yield indications as of 3:00pm Eastern time on 11/3/21.

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.