FOMC Meeting and Summary of Economic Projections

The Federal Reserve met this week to review its current stance on monetary policy and updated its Summary of Economic Projections for Q1 2021. While the Fed was encouraged by the addition of 379,000 jobs to non-farm payrolls in February and a decline in the unemployment rate to 6.2%, they also acknowledged that “the path of the economy will depend significantly on the course of the virus”, and while the Committee’s median expectation is still to keep the overnight lending rate near zero through 2023, 7 of 18 members expect rates to increase in 2022 or 2023, as opposed to just five in December.

- Unemployment rate: projected to decline to 4.5% by the end of 2021, 3.9% by 2022 and 3.5% by 2023. December’s estimates stood at 5.0% by the end of 2021, 4.2% by 2022 and 3.7% by 2023.

- Core PCE inflation: projected at 2.2% by the end of 2021, 2.0% by 2022 and at 2.1% by 2023. December’s estimates stood at 1.7% by the end of 2021, 1.8% by 2022 and at 2.0% by 2023.

- GDP: projected at 6.5% by the end of 2021, 3.3% by late 2022 and at 2.2% by 2023. December’s estimates stood at 4.0% by the end of 2021, 3.0% by 2022 and at 2.5% by 2023.

Fiscal Stimulus and Inflation Data

The US government has approved an additional $1.9 trillion coronavirus aid package with the goal of boosting an economic rebound, albeit risking inflationary pressures. Few price pains are evident at this stage, with February core CPI data revealing consumer costs up by just 0.1% in February and growing by 1.3% year-over-year, while wholesale price increases were also within market expectations around the same level. To note, core CPI data showed that service prices increased more than expected due to firmer rental costs, medical care services and motor vehicle insurance costs.

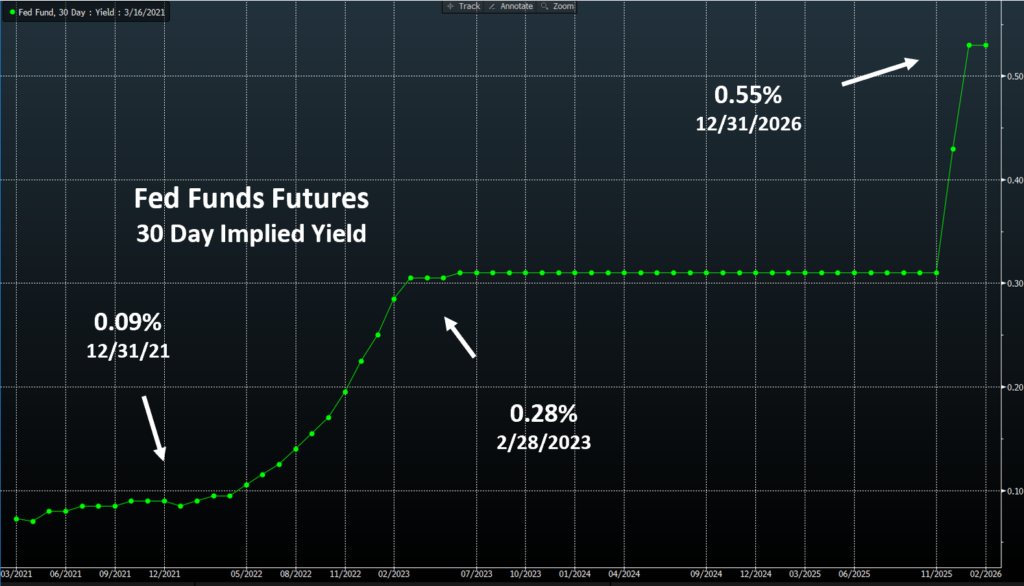

Fed Funds Futures Contracts

In advance of the FOMC’s March 17th meeting, Fed funds futures contracts were pricing in just one 25 basis point rate hike by the Federal Reserve by the end of 2023. While a 2021 hike is off the table, a second-half 2022 hike may be possible if we see stronger than expected GDP and labor market gains over the next few quarters.

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.