Federal Reserve Sets the Stage for March Rate Hike

The Fed held its first meeting of 2022 last week and erased any lingering doubts, of which there were few, that it will raise the overnight lending rate when it next convenes in mid-March. In the press release following the meeting, the FOMC stated that “the Committee expects it will soon be appropriate to raise the target range for the fed funds rate” and cited “inflation well above 2 percent and a strong labor market” as primary elements supporting its stance. Chair Jerome Powell held a press conference after the meeting, saying “This is a very, very strong labor market” and “My strong sense is we can move rates up without having to severely undermine it.”

Given the Fed’s hawkish tone, the markets almost immediately began to speculate that the Fed could boost rates by as much as 50 basis points this quarter, with futures contracts pricing in 95% odds of 125 basis points in hikes in 2022. The 2-year Treasury note surged to a high of 1.19% on Thursday, up 22 basis points from 0.97% earlier in the week. However, several Fed officials spoke this past Monday and they walked back the notion that a 50 basis point hike is currently on the table for March. In an interview with Yahoo Finance, Raphael Bostic, Atlanta Fed President, remarked that such a move is “not my preferred setting [or] policy action for the next meeting”. Esther George, Kansas City Fed President, suggested that the FOMC may best achieve its monetary policy goals with a combination of balance sheet reduction and rate hikes when speaking to the Economic Club of Indiana. She commented: “What we do on the balance sheet is likely to affect the path of policy rates and vice versa,” and “For example, if we took more aggressive action on lowering, pulling down that balance sheet, it might allow for fewer interest rate increases.”

Q4 GDP

Last week’s release of preliminary GDP data for Q4 revealed that the U.S. economy grew at a 6.9% annualized pace during the quarter and by 5.7% for the 2021 calendar year, the fastest growth rate since 1984. The expansion in economic activity was mainly attributed to inventory investment (a 4.9% contribution to GDP growth) and consumer spending (a 2.2% contribution to GDP growth). On the inflation front, the core PCE index surged by 4.9% in the fourth quarter, suggesting that price pressures will remain a key concern for the Fed.

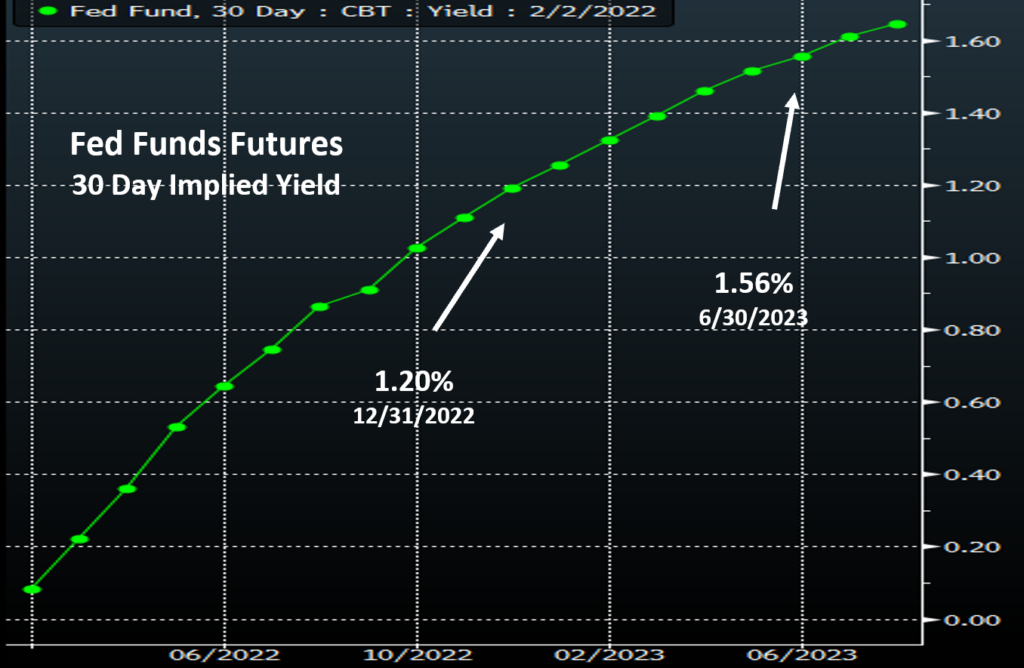

Fed Funds Futures Contracts

Futures markets are fully pricing in a 25 basis point rate hike at the March FOMC meeting and between four and five total hikes in 2022. December 2022 and January 2023 contracts currently hover in the 1.20% to 1.27% range, while the 2-year Treasury note is yielding 1.16%.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.