February’s Soft Jobs Report: Outlier or Harbinger of a Slowdown?

When the Bureau of Labor Statistics reported early this month that non-farm employment rose by only 20,000 jobs in February—a huge miss from consensus estimates of about 175,000 new jobs—it threw many observers for a loop.

Was the low number an indicator of a slowdown in growth? Or could it be written off as a blip amongst a broader set of economic indicators pointing to continued strong demand for labor? After all, the unemployment rate actually decreased slightly to 3.8%. And monthly and yearly wage growth rates continued increasing by 0.4% and 3.4% respectively.

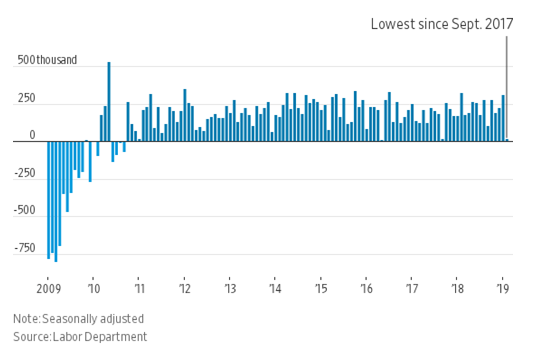

During a period characterized by extrinsic factors such as Brexit, trade negotiations with China, and the government shutdown, strong employment data had been a reliable and consistent indicator of a healthy labor market. So perhaps the February number truly was an outlier (Figure 1).

But hard on the heels of the February jobs report came the Fed’s reversal to a dovish stance, noting in its March statement that “recent indicators point to slower growth of household spending and business fixed investment.” The Fed signaled there would be no further interest rate hikes in 2019 after having initially forecast multiple increases.

Then, shortly after that, the yield curve inverted, with long-term interest rates dropping below short-term rates. As we remarked in our January white paper, The Curve, Trade and Brexit: Three Themes to Watch in 2019, the rare event of an inversion in the yield curve has in the past been a strong predictor of an upcoming recession.

So in this blog post, we are taking a closer look at the breakdown and implications of the February jobs report.

Figure 1: Nonfarm Payroll Plummets

Source: The Wall Street Journal

Nonfarm Payrolls

First, there’s nonfarm payroll data. According to employment survey data, payrolls increased by 20,000 in February. This is compared to a 311,000 increase in January and an average monthly increase of 186,000 over the prior 12 months.

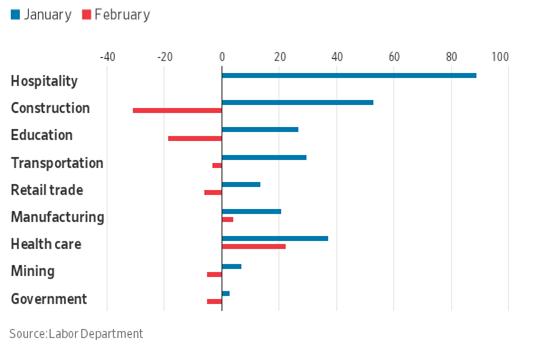

The reading was supported by a net increase of 42,000 jobs in professional and business services, 21,000 in health care, and 11,000 in wholesale trade. Pulling the reading down was construction, which was down by 31,000 following an increase of 53,000 in January, and manufacturing, which only increased by 4,000 compared to a previous average monthly increase of 22,000 over the prior 12 months. Leisure and hospitality were relatively unchanged after substantial increases of 89,000 and 65,000 in the previous two months.

As Figure 2 illustrates, it was largely seasonal industries (construction, and leisure and hospitality) which saw job losses. In addition, manufacturing was weaker compared to previous reports, possibly as a result of ongoing trade tensions.

Therefore, the drop could just be a blip among months of indications of strong demand for labor. Even if the February payroll data is a fluke, though, or if the number fell because of decreases in work in seasonal industries, many agree that it is an indicator of a trend towards moderation in the pace of growth in the economy.

Figure 2: Payroll by Industry Group

Source: The Wall Street Journal

Wages Increase and Unemployment Rate Decreases

Over the same time period in which nonfarm payrolls grew by only 20,000, wages grew by an annualized rate of 3.4% and the unemployment rate decreased by 0.2 percentage points to 3.8%. Both of these are indicators of strong demand for labor.

In fact, the annual growth rate in wages was the highest seen since April of 2009. Some have expressed concerns that increasing wages could incite the Fed to consider raising rates again. However, on CBS’s 60 minutes on March 5th, Federal Reserve Chairman Jerome Powell said that while the Fed has seen increasing evidence of a slowdown in the global economy, the bank is not in any hurry to change the current interest rate policy. Powell also went into further detail on the outlook for the economy citing risks linked to slower growth in China and Europe and from idiosyncratic events such as Brexit. Shortly after the interview, the Fed issued its March statement downgrading its characterization of the strength of the U.S. economy.

However, Powell also noted that negative factors are somewhat offset by strength in U.S. employment data as well as high consumer and business confidence levels. According to household survey data, the number of unemployed people fell by 300,000 in February to 6.2 million. The number of people who lost jobs or who completed temporary jobs fell by 225,000. This decline could be explained by federal workers who returned to work following being furloughed in January. Those involuntarily employed only part-time fell by 837,000 in February, which can also be explained by the reopening of the government.

Both the increase in wages and the drop in the unemployment rate are strong indicators of future consumer spending—providing a strong counter-narrative to expectations of an economic slowdown.

Mixed Signals Continue, for Now

Where do those mixed signals leave us? It is possible that February’s jobs report could be followed by a healthy level of additional payrolls as soon as the April report, a pattern that has repeated itself many times over in the past. For example, after only 20,000 jobs were added in January 2011, 213,000 were added in March 2011. May 2016 saw the economy add only 15,000 jobs, which jumped to 282,000 in June. Finally, September and October of 2017 saw a jump in payrolls from 18,000 to 260,000.

So one month’s worth of payroll data may not be enough to suggest that the economy is slowing. Economic fundamentals continue to be so strong that even an inverted yield curve has not convinced many investors that a slowdown is imminent. However, it’s prudent to pay heed to the fact that the Fed has backed off to a neutral stance from further rate increases in 2019. For cautious cash investors, that sends a somewhat frustrating but unequivocal message: “wait and see.”

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.