February Mid-Month Portfolio Update

Economic Data Supports Feds Delayed Rate Cuts

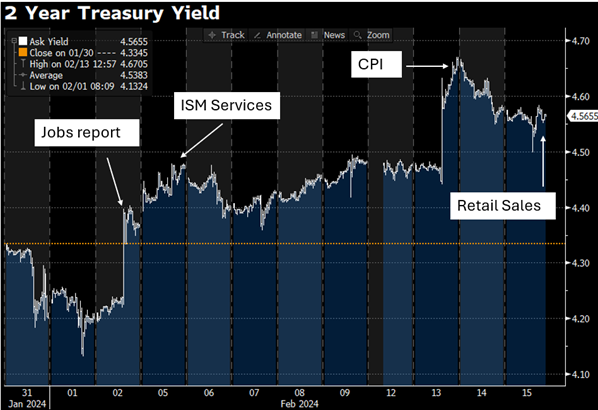

Data released this month supports the patient tone regarding rate cuts that both Fed Chair Powell and other Fed members have been conveying so far this quarter. Stronger inflation and labor market data has led to a recent surge in rates, with the 2-year yield rising 18 basis points after the CPI release on February 13th – the largest gain since March 2023. Is the “higher-for-longer” narrative coming back?

- – Nonfarm payrolls came in at 353,000 vs. expectations of 185,000 and there were 126,000 in upward revisions to November and December. Average hourly earnings increased +0.6% in January — up from +0.4% in December and the largest monthly gain since early 2022. The unemployment rate held at 3.7%, marking 2 straight years at or below 4%, which is the longest stretch since the 1960s.

- – Both ISM Manufacturing and ISM Services came in higher than expectations. ISM Manufacturing rose to a 15-month high of 49.1. ISM Services came in at a 4-month high of 53.4 with the prices paid component rising unexpectedly to 64, providing more fuel for inflation concerns.

- – The January Consumer Price Index (CPI) came in higher than expectations for both headline and Core-CPI, rising +0.3% and +0.4% respectively. Although the year-over-year headline CPI reading continued to decline from 3.4% to 3.1%, the year-over-year reading for Core-CPI held steady at 3.9%. The “Super Core” reading, which is closely watched by the Fed, jumped +0.8% in January, the largest increase since April 2022. One caveat: January inflation readings tend to be among the highest of the year historically, reflecting residual seasonality.

- – The Import Price Index reported its first increase since September and the largest monthly gain in almost two years.

- Retail Sales growth, on the other hand, was a disappointment. Although expectations were for Retail Sales to decline in January, readings were even lower than expectations. – Headline retail sales fell -0.8% vs. -0.2% expected while the Control Group – which feeds into GDP – declined -0.4% vs +0.2% expected. This is not expected to change the Fed’s narrative, as the consumer and the economy were each expected to normalize in 2024 after last year’s above trend growth.

Source: Bloomberg

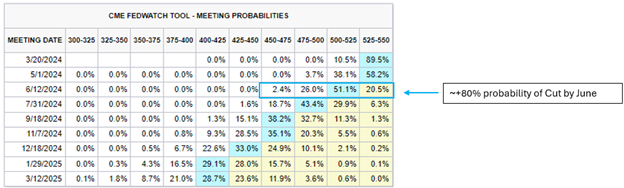

First Rate Cut Delayed

After the CPI release, the Fed Funds Futures market effectively priced out the probability of the first rate cut occurring in May and delayed it to June 2024, which is currently showing about an 80% probability that the first cut by the FOMC will occur by the June 12th meeting. The futures market continues to price in fewer rate cuts this year than it did a month ago; futures imply four 25 basis points cuts this year, much closer to the Fed’s forecast of 75 basis points of cuts in 2024. At one point last month, futures were pricing in over 150 basis points of cuts this year.

Source: CME Group as of 2/15/24

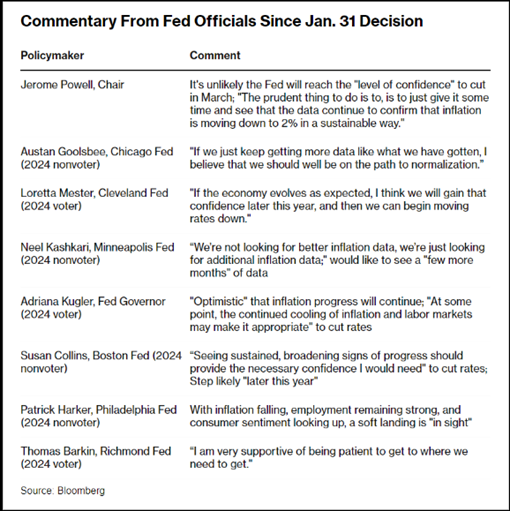

Fed Commentary – Rate Cuts are Coming at Some Point

Even the more hawkish members of the FOMC have talked about rate cuts this month, but they don’t believe the cuts will be coming soon. They are laying a path towards cutting rates at some point, only once the data supports such a move. After the recent CPI release, Chicago Fed President Austan Goolsbee said, “Inflation can be a bit higher and still on track to 2%” and added that he does not “support waiting until inflation on a 12-month basis has already achieved 2% to begin to cut rates”, echoing the consensus view of the Committee. Below are some of the notable quotes from Fed members since the end of January.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.