February 2025 Month-End Market Update

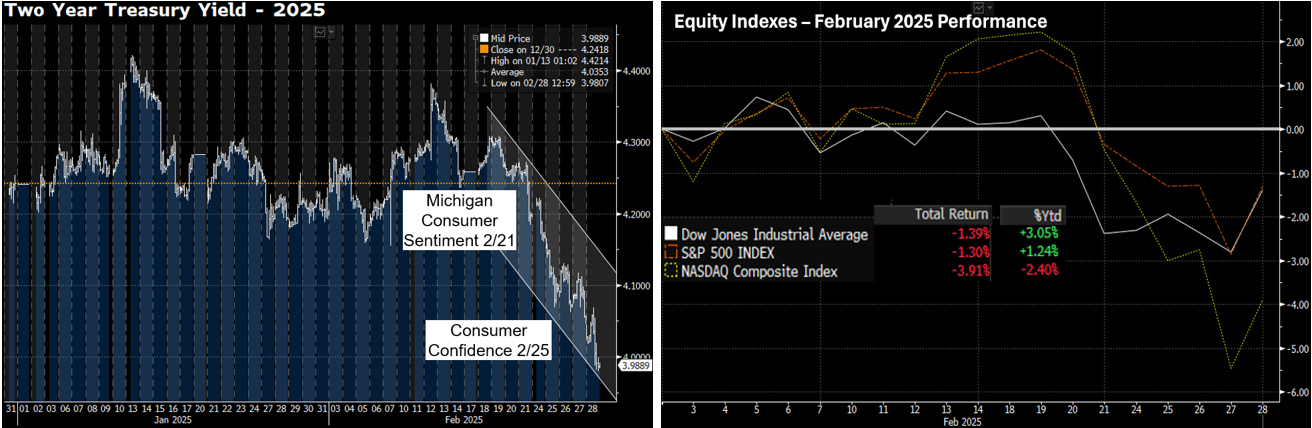

Yields Declined on Negative Consumer Outlook

Treasury yields declined significantly towards the end of February after two consumer survey reports came in much lower than expected. The drops were most significant in the long end, with the 10-year yield declining 33 basis points, while the 2-year yield fell below 4% for the first time since October 2024. The University of Michigan Consumer Sentiment Index (a survey on consumers’ thoughts on the economy, their finances, etc.) fell to a 15-month low. The Consumer Confidence Index (a survey that measures households’ view on current and future economic conditions ) declined by the largest amount in over 3-years to an 8-month low. Concerns regarding inflation and the overall economy were some of the primary reasons for the declines. The concern for economists and the Fed is that negative consumer outlooks could become a self-fulfilling prophecy: if consumers expect a slowdown in the economy, they could pull back on spending and if consumers expect higher inflation, a wage-price spiral could result.

Investment grade credit spreads held in well for the month, despite a risk-off tone in markets. Front-end spreads widened by 3 to 5 basis points while the main Bloomberg Investment Grade Corporate bond index widened 8 basis points. Auto ABS spreads tightened in February while credit card ABS spreads were unchanged. All three major equity indexes declined in February, led by the Nasdaq, which declined nearly 4% and fell into negative territory for the year.

Source: Bloomberg

February 2025 Treasury Yield Performance

Source: Bloomberg

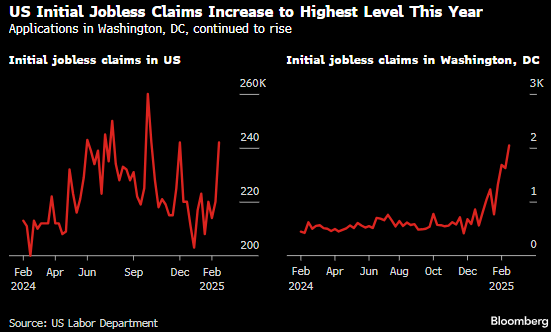

DOGE Impacts Labor Data

Weekly initial jobless claims jumped to the highest level of 2025 amid layoff announcements from corporations such as Starbucks and Southwest Airlines. The four-week moving average increased to 224,000, the highest level of the year. In addition, initial claims in the D.C. area recently rose to the highest level since March 2023. We note that federal government workers are not included in the initial claim reading, however, contract workers and other companies that do business with the government are impacted when funding gets cut. Some economists estimate that for every one government job lost, there are two private-sector jobs that are impacted. Looking ahead to March 7th, the February employment report is expected to show non-farm payrolls rising 160,000 and for the unemployment rate to remain at 4%.

Source: Bloomberg

Fed Members Still Need More Evidence on Inflation Progress

Patience on cutting rates continues to be the consensus view in recent Fed speeches. Many officials want to see further evidence of progress that inflation is moving towards the Fed’s 2% inflation target before the Fed resumes cutting rates. Here is a summary of comments from recent speeches:

- San Francisco Fed President Mary Daly: “At this point, policy needs to remain restrictive until, from my vantage point, I see that we are really continuing to make progress on inflation.”

- Philadelphia Fed President Patrick Harker: He suggests holding interest rates steady, as “the policy rate remains restrictive enough to continue putting downward pressure on inflation over the long term, as we need it to, while not negatively impacting the rest of the economy.”

- Cleveland Fed President Beth Hammack: Interest rates are not “meaningfully restrictive” and should be held steady for some time as officials wait for evidence inflation is returning to their 2% target.

- Kansas City Fed President Jeffrey Schmid: Easing policy “before inflation is beat” can make it more painful to vanquish.

- Richmond Fed President Tom Barkin: “The Federal Reserve may have to raise interest rates to counter economic trends that could push inflation higher.”

Despite communication from Fed members suggesting patience on further cuts, markets have increased bets on Fed rate cut activity in 2025 on the back of declining GDP forecasts and higher inflation expectations. Futures contracts are predicting three 0.25% cuts in 2025, which would bring the fed funds target range to 3.50%-3.75% by year end.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.