Economic Impact of the Coronavirus

The coronavirus has been the major event in the global economy so far this year. With more than 40,000 confirmed cases globally as of 2/10/2020, it has already surpassed prior flu pandemics. It has resulted in the effective quarantining of the city of Hubei, along with severe travel restrictions in and around mainland China. There are reports of businesses across China closing for the near-term, as the entire country seems to be in a holding pattern while the government and global health organizations work to contain the spread of the virus.

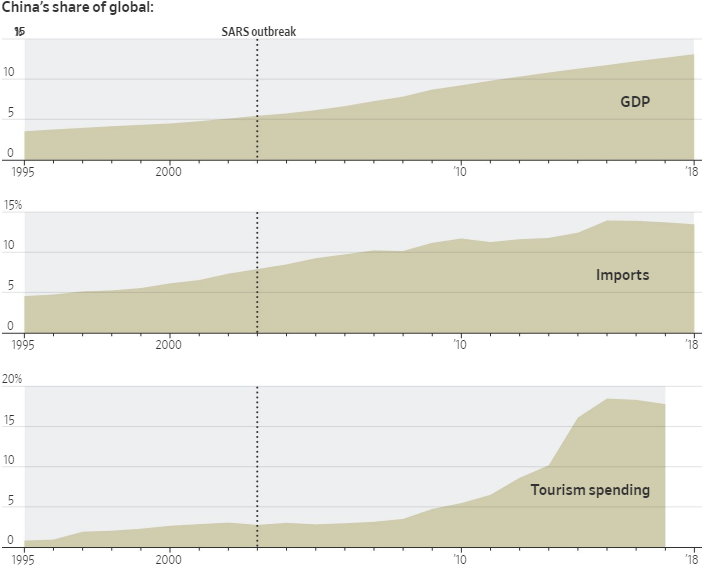

In this context, attempting to estimate the impact the coronavirus will have on the Chinese (much less the global) economy is extremely difficult. There are some obvious parallels between this outbreak and the SARS pandemic at the turn of the century. However, China’s stature in the global economy has changed significantly since then. Once a bit player, it is now a $14 trillion economy accounting for more than 10% of global economic output and global trade.

Figure 1: Ripple Effects of SARS

Source: WSJ, IMF, World Bank

As a result, a “sudden stop” in Chinese economic activity is likely to have severe ripple effects across the globe. This could be seen in the reaction by financial markets, which saw sentiment turn from exuberance to fear almost instantaneously when news of the virus surfaced. The S&P 500 gave away most of its gains from the start of the year, falling by 3% over the course of two weeks. More significantly, bond markets moved in a bearish direction on fears of a reduction in global demand. Rates on the short end were mostly unchanged, but the middle and end of the curve saw significant downwards pressure. This resulted in a brief inversion of the yield curve at the 3M-10Y portions, a much talked about recession barometer that was flashing red last year.

The action in markets was mirrored by developments inside and outside of China. Travel restrictions currently limit the movement of 48 million people, and the government extended the Lunar New Year holiday for at least another week (impacting provinces that account for upwards of 2/3 of China’s GDP). Multi-national companies including Apple, Starbucks, McDonalds and Ikea have temporarily closed their stores, likely having a material impact on sales. Auto manufacturers such as GM and Toyota have been forced to delay production, potentially leading to production shortages. The tourism and hospitality industries have ground to a standstill, threatening airlines, hotels, and restaurants. Large tech companies are looking at pressure on both their top and bottom lines.

Lower Demand Stokes Global Recession Fears

From a macro perspective, it is the demand side of the equation that is most immediate and worrisome. Back-of-the-envelope math suggests that halving Chinese economic growth over the course of the first quarter could shave more than 1% off of global GDP in the near term. This is more aggressive than most estimates, but not entirely unreasonable if the virus is not contained.

Open economies susceptible to changes in trade flows (i.e. Hong Kong, Singapore, Australia) would be most severely impacted. But, even more closed economies such as the U.S. would almost certainly see a reduction in growth as well.

Perhaps more importantly, the odds of a global recession would rise significantly. The combination of uncertainty about the containment of the virus, along with the potential for subsequent shocks, increase the potential likelihood of a downturn.

This is where the response from policymakers comes into play. Upon markets re-opening, the Chinese central bank cut interest rates by 10 bps and injected $22 billion into money markets via liquidity operations. Additionally, analysts expect that the government is likely to ramp up fiscal spending to fight the outbreak and potentially issue subsidies for affected industries. Depending on how long it takes to contain the outbreak, other central banks and governments may be forced into similar actions.

How Will the Fed Respond?

The Fed has been on the sidelines since it last cut rates in November but is now likely to consider further accommodation to offset the move in the yield curve and to re-stabilize inflation expectations. Perhaps more likely is action by the European Central Bank, which may be required given exposure of some of Europe’s largest industries (notably autos) to Chinese demand.

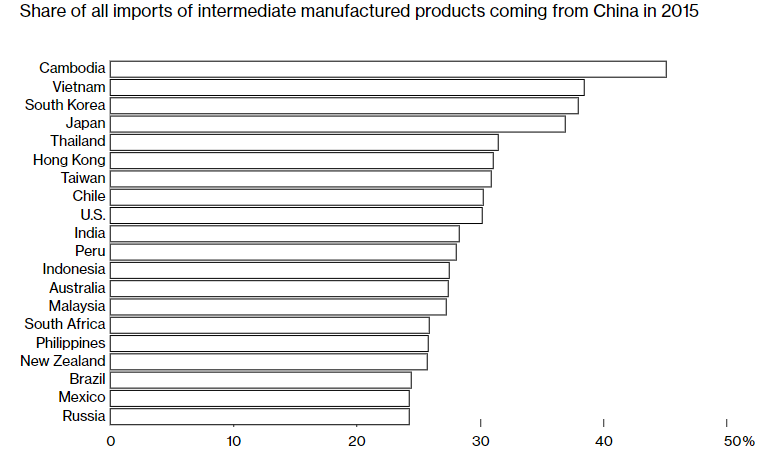

There will also be real effects over the longer term. China is now far and away the most important manufacturing hub in the world, with its 27% share of global manufacturing value added almost twice that of the U.S. In particular, it’s a key producer of intermediate goods, which are subsequently used in finished products all over the world.

Figure 2: Asian Factories Risk Supply Disruption

Source: Bloomberg

As a result, any disruption or re-alignment of global supply chains away from China will necessarily impact productivity and potential output. A shift in manufacturing base to other countries may be positive for isolated industries but also may lead to higher prices and less output overall. This is especially true for specialized and high value-add goods such as tech and autos. This would be further exacerbated by any de-coupling that resulted from the transitions, potentially leading to greater trade barriers, less immigration, and more tension between China and Western nations. All of these would be barriers to future growth, at a time when productivity and interest rates are already at rock bottom levels.

Of course, all of this is subject to a great deal of unknowns. The ultimate impact of the coronavirus is largely dependent on its containment, and how long it takes for the panic surrounding it to subside. Furthermore, outside of anecdotal reports from businesses and the government, there is very little data as to just how much economic activity in China has slowed. Until we have greater clarity on these fronts, the outlook for the global economy remains precariously balanced.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.