Early-Stage Companies and the Risk of Bank Deposits

As a registered investment advisor whose sole focus is on cash investments, Capital Advisors Group has a very clear mission: to make sure the strategies we develop for our clients comply with their investment policies, risk tolerance, and current business situation. Under the Investment Advisers Act of 1940 which governs SEC registered investment advisors, we have a fiduciary obligation to make decisions in the best interest of our clients. One of those many decisions concerns how to maximize yield on cash investments without sacrificing the prime objectives of liquidity and safety of principal.

When we first begin to work with prospective clients, we discuss how they are currently managing their balance-sheet cash and a typical answer is that some or all their cash is held at their bank. However, the mix of bank deposits and alternative cash investments typically varies widely between large, revenue-producing companies and early-stage venture backed companies.

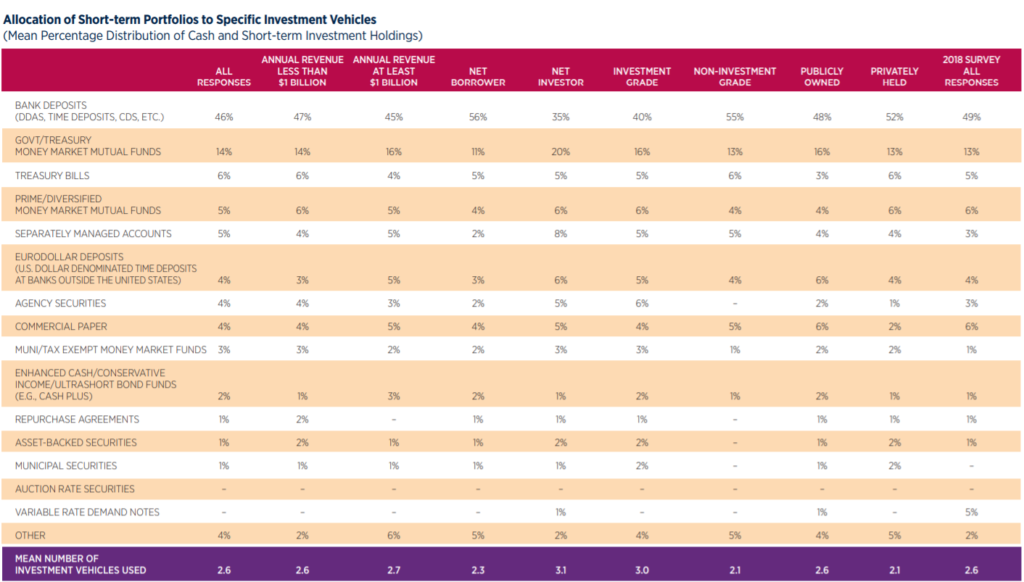

Larger revenue-producing companies usually allocate cash to bank deposits in concert with a portfolio of other cash investments. The 2019 AFP Liquidity Survey (Figure 1) shows allocations by larger companies that include bank deposits as well as more than a dozen other types of cash investments. Given the complexity of banking relationships and transactions for larger organizations, this range is not surprising. However, the percentage allocated to bank deposits is still quite large, given that some of the other investment options may have similar or better risk profiles and provide better yield.

Figure 1: 2019 AFP Liquidity Survey

Source: Association for Financial Professionals, 2019 AFP Liquidity Survey

Early-stage companies, on the other hand, might have much smaller amounts of balance-sheet cash compared to their late-stage counterparts. But cash is vitally important to their success and failure. They may have closed a recent funding or may have had a few small funding rounds amounting to between $5 million and $50 million in balance-sheet cash. When we engage with early-stage companies, they almost always have all their balance sheet cash invested with one, or possibly two, banks. This is understandable because transactional banking is critical to any growth company, so the first stop is often a bank that will handle their business needs.

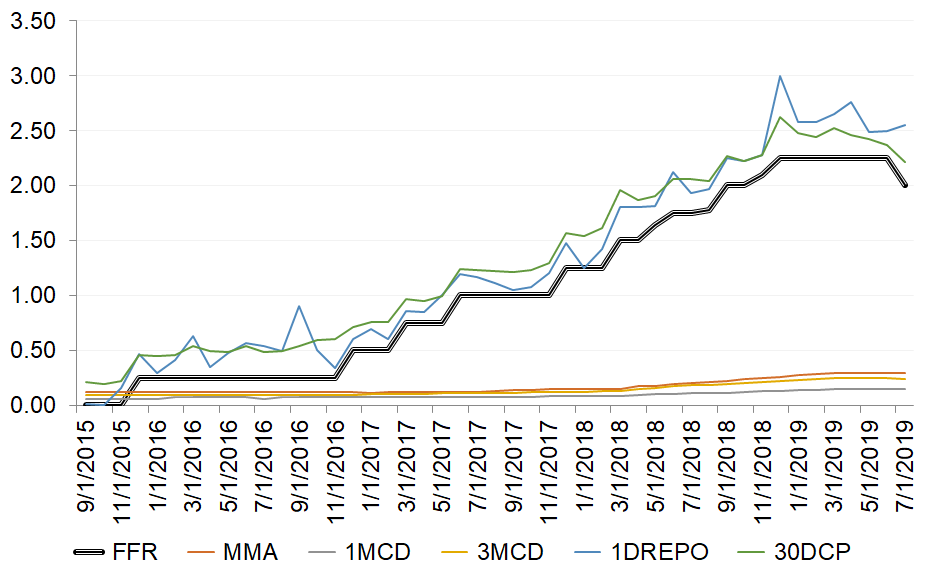

However, as cash investors, we believe that companies should try to optimize their investments while reducing risk. They should assess their liquidity needs for operating purposes and not hold more cash than necessary in unsecured bank deposits that provide yields below market rates. As Figure 2 shows, bank money market accounts, as well as 1- and 3-month CD’s, all trail 30-day commercial paper, 1-day Repo, and government money market funds yields by a wide margin. We explored this topic in depth in our June 2019 whitepaper, Deposit Betas Rising but Still Falling Short, which showed that as the Fed hiked rates six times through March 2018, bank rates barely moved. As we enter a period of lower market rates, one would hope to see cash investors benefit from a higher rate on deposits that lags the market rate as it descends. However, since rates on deposits never approached market levels on the way up, investors can’t expect to enjoy a differential from higher rates on the way back down.

Figure 2 – Rates Over Time

Source: FDIC and Bloomberg

Why should early-stage companies be concerned about where their balance sheet cash is invested and what it is earning? The answer: because their cash is, in many cases, the largest asset of the company. Many of their late-stage cousins are in a different situation when it comes to bank deposits. Late-stage companies holding more cash for longer periods typically utilize bank deposits as an investment and diversify deposits across several banking partners. They are also often able to negotiate market-level returns, given the size of the investments they make and they often have more complex transactional relationships with their banks, allowing them to pay for services by maintaining deposit balances. That said, in many cases we still see late-stage companies who could further optimize their cash investments. Depending on their liquidity needs, many may also have the opportunity to diversify away from bank deposits.

What do we tell clients when they have all their balance-sheet cash invested with one or two banks? We tell them that they need to understand the risk they are taking from two perspectives: credit quality (safety and liquidity), and opportunity cost (yield).

Credit Quality

The risk relating to credit quality is a simple one. If you have all your cash on deposit with one bank, you have no diversification beyond that institution. Cash, the lifeblood of all companies, is particularly important to early-stage companies. We advise our clients to diversify their cash holdings, because there is no reason to take on excess risk with cash. Credit-default risk comes to mind when talking about diversification. However, in today’s market, headline risk and organizational risk are also likely to create uncertainty—Capital One’s data breach this summer is only the latest high-profile example. Therefore, it is best to diversify.

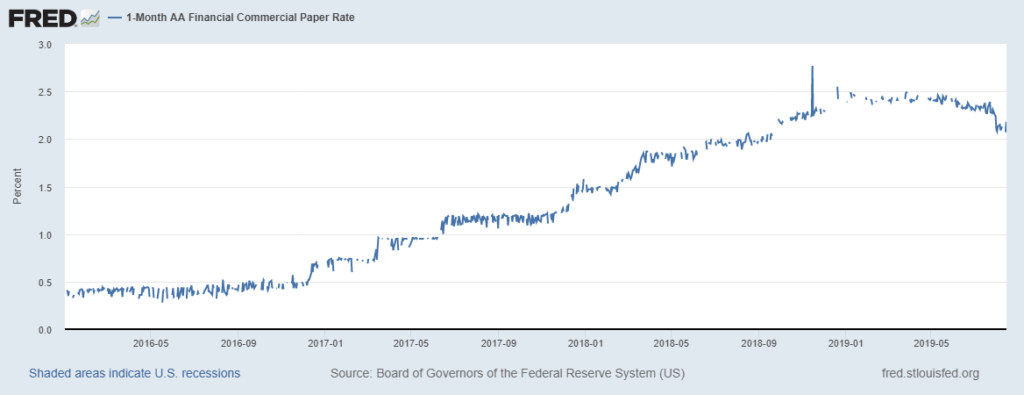

It is also important to remember that only up to $250,000 in bank deposits are FDIC-insured. Most early-stage companies hold cash balances well in excess of this amount and are afforded no FDIC protection on the additional deposits. That raises the question of the credit quality of the bank itself and of its cost of funds on the open market. For example, Figure 3 shows 1-month commercial paper rates for AA financial issuers. As of August 13, 2019, the average yield on these investments was 2.08% for commercial paper with a 1-month maturity. However, the yield on any individual investment is in part determined by the credit quality of the institution issuing the commercial paper. The higher the credit quality, the lower the cost of issuance, and vice versa. You could easily compare the interest rate you are receiving on your deposits with the rate your bank would have to pay in the open market to borrow, in this case through issuance of commercial paper based on their credit quality. This comparison provides an estimate of what the market requires to be paid to take on the credit risk of a bank—which leads us to a discussion on opportunity cost.

Figure 3 – 1-Month AA Financial Commercial Paper Rate

Source: FRED, Federal Reserve Economic Data (Federal Reserve of St. Louis)

Opportunity Cost

For cash investors, opportunity cost can be defined as the difference between the yield earned and the yield that could have been earned given a similar credit risk and maturity profile. In short, is there a better investment option available than the one currently being used? In Figure 2 above, 1-day Repo (1DREPO) is earning 2.55%, where a money market account (MMA) is earning 0.29%, a difference of 2.26%. Both have daily liquidity, and the repo investment has potentially better credit quality characteristics than a single bank deposit.

The same comparison can be made with a government money market fund which is AAA rated and comprised of a diversified portfolio of US government securities. A government money market fund also has daily liquidity and, as published in Crane’s Money Fund Intelligence report as of 7/31/2019, the average 7-day yield for all government money market funds in their index was 2.19%. These are simple examples of overnight investments. The opportunity cost may widen when taking other securities into account and when discussing other strategies for a falling rate environment.

Lastly, when calculating opportunity cost against a total cash balance, the loss of income because of a below-market rate can be sizable. Using our previous example in very rough numbers, a 2.26% opportunity cost on a $20-million balance could amount to approximately $452,000 in lost income annually. For an early-stage company, this can be important earned incremental capital.

Conclusion

It is important to understand the risk-reward tradeoffs of cash investments for an early-stage company. Safety of principal and liquidity are of primary concern, with yield being attained in the context of those objectives. Regardless of the size of your balance-sheet cash position, we suggest that you take a proactive approach to its management, starting with a well-authored investment policy. From there we advise that you turn your attention to understanding your cash-flow forecast and your risk tolerance. Only then is it possible to develop an optimal cash investment strategy. Even if you need all your cash available overnight, it is likely there are better alternatives than exclusive reliance on traditional bank deposits.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.