Does Brexit Affect Your Institutional Cash Portfolio?

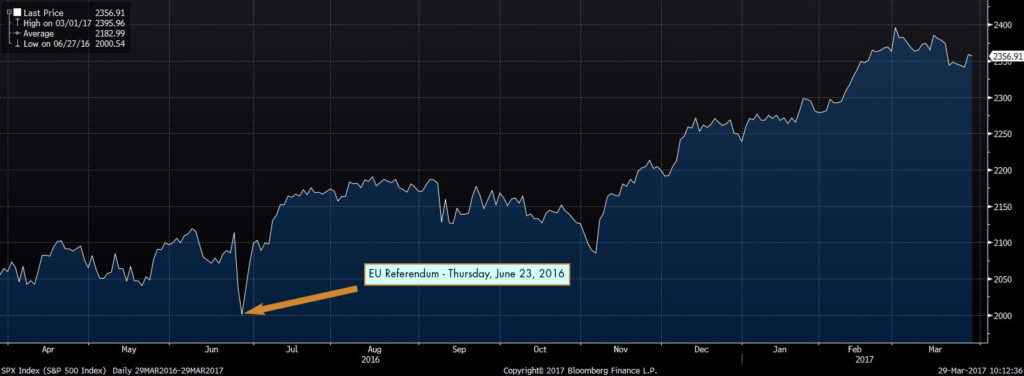

When British citizens voted to leave the European Union last June, markets reacted strongly: the pound dropped 11%, the FTSE 100 (an index of British stocks) fell 9%, and equity markets from the United States to Japan sold off as well. Although much of the value lost in these markets was recovered quickly, the Brexit vote was undoubtedly a market-shaking event. This week, Brexit was in the news again. What exactly is happening and what effect should you expect it to have on your cash portfolio?

GBP Currency (British Pound Spot)

Source: Bloomberg, as of 3/29/2017

Source: Bloomberg, as of 3/29/2017

PX Index (S&P 500 Index)

Source: Bloomberg, as of 3/29/2017

Source: Bloomberg, as of 3/29/2017

In the nine months since “Leave” won the referendum, the United Kingdom has engaged in contentious debate, has changed Prime Ministers, and Brexit has constantly been among the world’s biggest headlines. But despite all this commotion, it wasn’t until Prime Minister Theresa May finally triggered what is called Article 50 on March 29th that the process of leaving the EU was set irreversibly into motion. We want to clarify what this means.

The process of withdrawing from the European Union is outlined in Article 50 of the Treaty of Lisbon, which sets forth the legal structure and functions of the EU. Article 50 states that a country which intends to withdraw from the EU must provide notification to the European Council (as the UK has just done). From the time this notification is given, there is a two-year period during which all of the provisions of currently signed treaties will still apply. This means that the UK will be treated as though it is still a member of the EU for two years, during which time the country will have to renegotiate the nature of its relationship with the EU. This renegotiation will include defining how trade policies, immigration policies, and regulatory policies will be structured. Theresa May has stated that while she wants the greatest possible access to the EU, she does not want the UK to be “half-in, half-out,” and so we expect the UK to negotiate a clean break with all currently standing EU agreements. The UK will also have to negotiate new deals with its trade partners outside of the EU, with which it currently trades under terms negotiated by the EU as a bloc.

Given that the triggering of Article 50 on this date was announced well in advance, markets had time to price in the ramifications and therefore there were no major market dislocations like those seen after the unexpected referendum result.

We want to emphasize that the impact on domestic cash portfolios specifically should be muted and liquidity should not be greatly impacted. The credit strength of companies located in the UK should not immediately deteriorate as a result of the Brexit vote. The two-year window outlined in Article 50 will allow business conducted between the UK and the EU to continue as usual during this time. Our most important takeaway is that during this period, the credit quality of current investments maturing within this window should remain excellent.

In the longer run, we think the outlook is less clear. Whether the economy of the UK will thrive once it is freed from the European Union or suffer in isolation remains to be seen. If the new terms of the UK’s relationship with the EU are not favorable to international companies operating out of the UK, we expect these companies would shift many of their employees out of the UK and over to mainland Europe, which could be damaging to the UK’s economy. This risk is especially high in the financial services sector, as many large companies use London as their base for doing business with the European continent.

The triggering of Article 50 seems unlikely to have an effect on the decision-making of the Fed here in the U.S. In Europe, an increase in market uncertainty, if combined with a prolonged period of market volatility, could lead the European Central Bank to consider cutting rates or extending accommodative policies such as its bond-buying program. Purchases of UK-denominated credits maturing beyond this two-year window should be made with the understanding that the business environment could be drastically altered during the security’s holding period and as such uncertainty is much greater.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.