Do BBB Corporate Bonds Belong in Treasury Management Portfolios?

Abstract

BBB-rated debt continues to offer new possibilities for cash investors. Although it involves taking on incremental credit risk, allowing purchase of these securities can help alleviate supply shortages while also offering additional return opportunities. Should investors look into adding BBB names to their portfolios, we recommend that they follow these principles.

Guiding Principles:

- Expect lower market liquidity

- Steer clear of BBB financial issuers

- Credit research is essential

- Use BBB debt as part of a conservatively constructed core portfolio

Introduction

Back in 2015, in the light of money market reform and falling credit ratings across sectors, we took a look at the BBB debt market. Traditionally ignored by cash investors, we asked the question of whether portfolio managers could tap into this market to alleviate supply constraints and add incremental return. We concluded that the market did offer opportunities, but that it would only be suitable for a segment of Treasury portfolios.

Since our first publication in 2015, the BBB market has grown even further, both in size and prominence. As ratings continued their downward drift, BBB debt became a more attractive option for cash investors with strict concentration limits who are looking for high quality names and significant return over government securities. Even so, limits on the purchase of BBB rated debt are generally quite stringent.

In this piece, we analyze whether the case for adding BBB names has changed. What is the risk of adding BBBs to the portfolio, and is there requisite return to compensate for this risk? How does owning BBB debt compare to owning debt higher up the ratings ladder in terms of credit quality and potential ratings volatility? And finally, what are some guiding principles for cash investors thinking of entering the space?

BBB Ratings Explained

For starters, the BBB designation refers to a level of “investment grade” creditworthiness evaluation used by nationally recognized statistical rating organizations (NRSROs, or “rating agencies”). Moody’s, Standard & Poor’s, and Fitch designate investment grade debt in one of four categories – AAA, AA, A and BBB – representing “highest quality”, “high quality”, “upper medium grade” and “medium grade,” respectively. Ratings of BB, B, CCC, CC, C and D are considered “below investment grade” or “junk.”

Similarly, high quality short-term commercial paper obligations have “Tier 1” short-term ratings (P-1 by Moody’s, A-1 and A-1+ by S&P, F1 and F1+ by Fitch) that correspond to AAA, AA, and mid-level A ratings. “Tier 2” (P-2 by Moody’s, A-2 by S&P, F2 by Fitch) correlate to lower-level A’s through mid-level BBB’s. Lastly, “Tier 3” (P-3 by Moody’s, A-3 by S&P, F3 by Fitch) maps to lower-level BBB’s. Below investment grade issuers are designated as “Non-Prime” (NP).

In other words, when we speak of BBB-rated securities, we are referring to debt instruments still of investment grade quality, albeit at the lower rung of the credit ladder. For simplicity’s sake, we’ll use BBB long-term and Tier 2 short-term designations interchangeably.

Strong Presence in the Corporate Debt Market

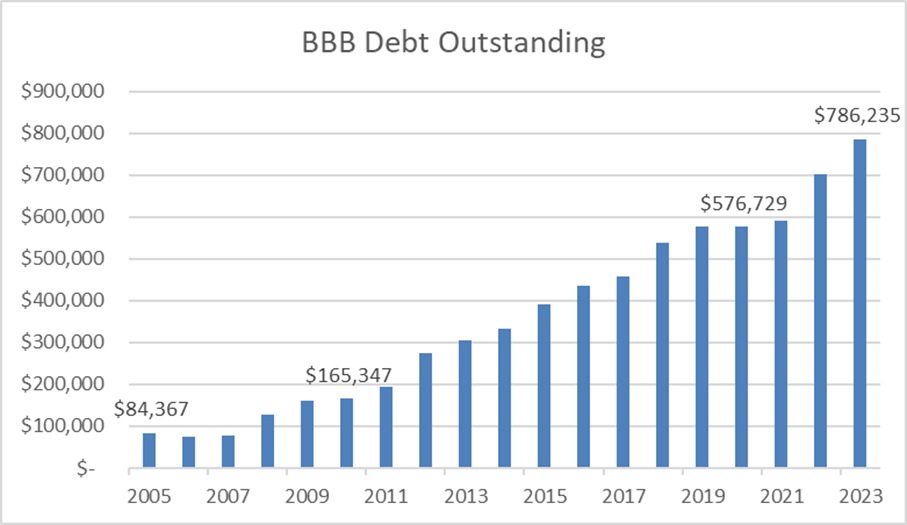

Since our last revision to this article in 2019, the BBB segment of the debt market has grown even further. Figure 1 illustrates this point, using the ICE (formerly Merrill Lynch) 1-3 Year Corporate Index as a proxy for the short-term investment grade market. Growth in BBB debt has been virtually unabated since 2005 and re-accelerated post-pandemic, rising more than 9-fold over the past eighteen years. In just the past year alone, BBB debt outstanding increased by $84 billion, more than the entirety of the BBB market in 2007.

Figure 1: Growth of BBB Debt in ICE 1-3 Year Corporate Index

Source: ICE index as of December 31, 2023

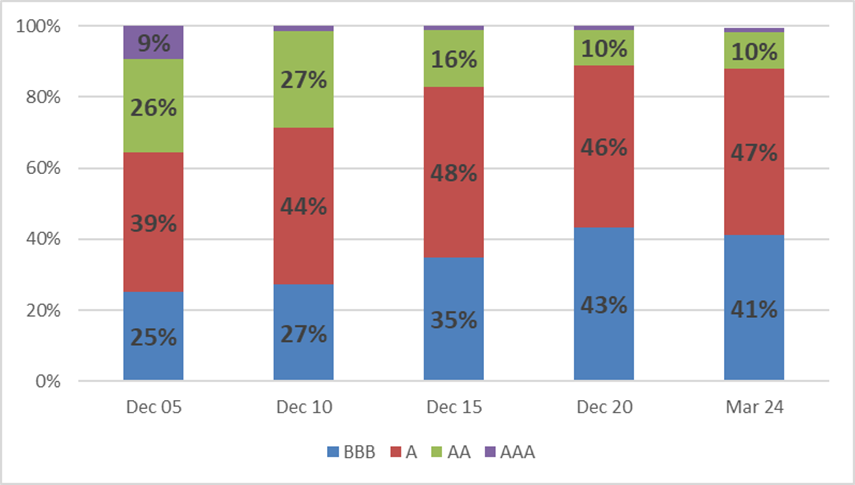

Figures 2 further highlights this point, comparing the composition of the ICE index at various points in time. It is now clear that the composition of the investment grade space has tilted significantly towards BBB issuers, as more issuers were content with a slightly lower credit status so long as they retain investment grade designation. Since 2015, several well-known non-financial corporate companies, including Boeing, Nissan, AT&T, General Electric, RTX Corp, and Bayer AG have been downgraded into the BBB space. More recently, we have seen break ups of conglomerates that have created new credits in the BBB market including names such as Haleon, Sandoz, and GE Healthcare. These trends are expected to continue going forward, as companies adopt more aggressive financial policies to deal with growth pressures and a changing interest rate environment.

Figure 2: ICE 1-3 Year Corporate Index Composition

Source: ICE index as of March 31, 2024

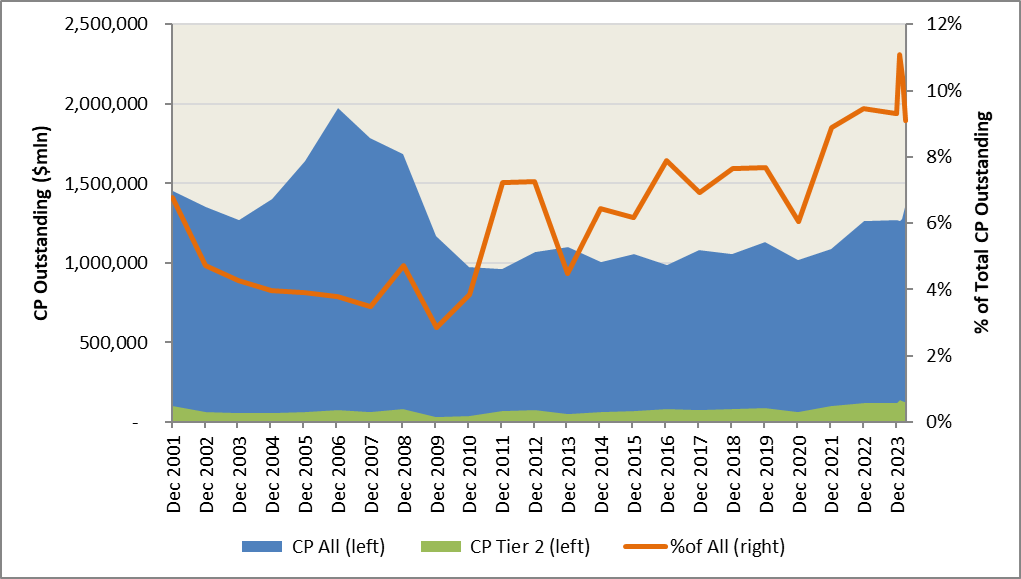

Similar trends can be found in the short-term debt market. While aggregate commercial paper issuance has remained relatively stable, the amount of Tier 2 paper outstanding continues to rise. As Figure 3 illustrates, Tier-2 commercial paper outstanding has doubled since 2015 and increased by more than three times since 2010, and makes up roughly 9% of the entire market.

Figure 3: Commercial Paper Outstanding

Source: Bloomberg as of March 31, 2024

The larger representation of lower rated investment grade debt, in and of itself, does not indicate its creditworthiness for treasury investment purposes. It does, however, speak to the breadth and availability of this type of debt issuance when compared to past decades and relative to debt in other rating groups. The shift in the overall ratings composition also validates the market concern for the lack of high-quality liquid investments in the short-term market.

This new reality speaks to the necessity of taking a closer look at BBB non-financial issuers, as they may provide necessary risk diversification and supply relief in a market traditionally exposed to the debt of confidence-sensitive financial institutions.

Marginally Higher Credit Risk

For credit instruments to be considered as potential investments, the most relevant question is whether the risk assumed is consistent with the principal preservation and liquidity objectives of treasury investments. To evaluate incremental credit risk, we review the annual default studies and ratings migration trends conducted by Moody’s1:

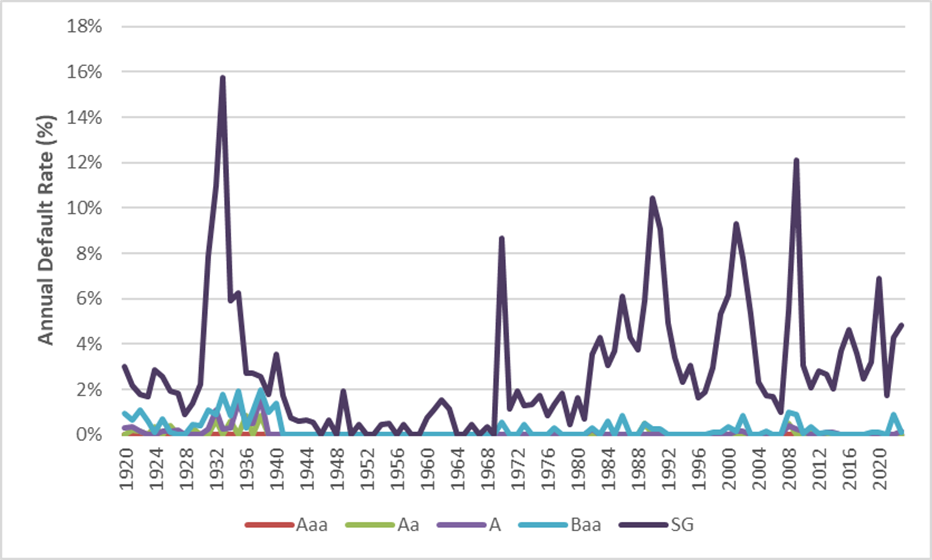

Figure 4: Moody’s Annual Corporate Default Rates by Ratings (1920-2023)

Source: Moody’s Default Study 2023

Figure 4 shows insignificant differences in default rates among various investment grade rating categories over the past 98 years. The average annual default rate among BBB (Baa) issuers over the period of1920-2023 was 0.26%, compared to 0.09% for A-rated issuers and 0.05% for AA corporates. Default rates for BBBs were slightly higher during the financial crisis, at 1.01% in 2008 and 0.92% in 2009 vs. 0.40% and 0.24%, respectively for A-rated issuers. BBB defaults spiked to 0.91% in 2022, reflecting Russian defaults related to the Ukraine-Russian war. However, excluding this specific cohort, the default rate was 0%. The average default rate of BBB issuers since 2009 is just 0.14%.

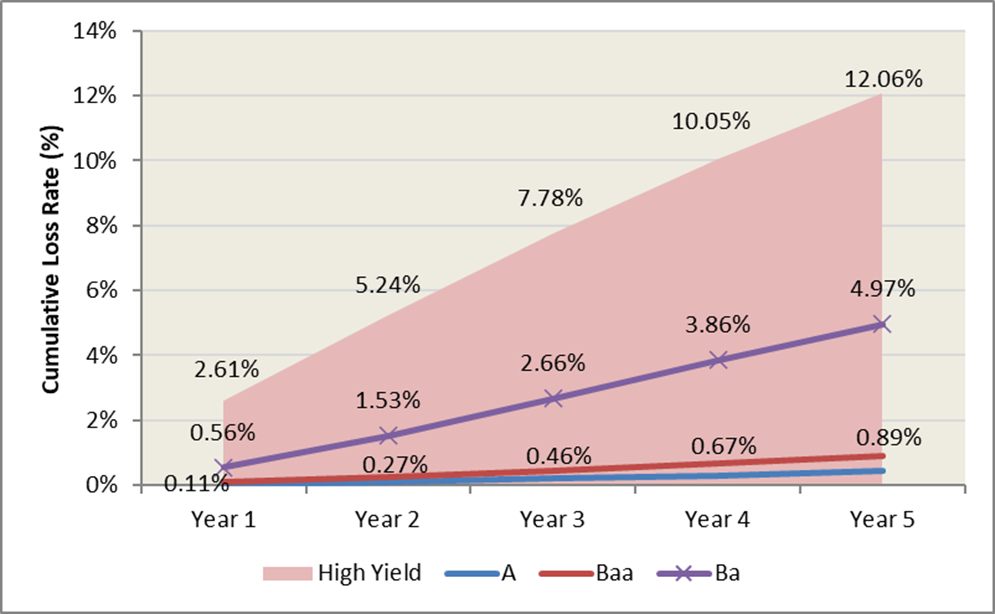

The limited credit risk of BBBs is further illustrated by expected loss rates. Expected loss is a more all-encompassing evaluation of credit risk, as it combines the probability of default with the expected loss of principal in the case of default. As Figure 5 illuminates, expected losses on BBB rated bonds are not materially different from those of higher credit quality. Over a one-year time horizon, the expected loss on BBB bonds is just 0.11%, and over a five-year period is 0.89%.

Compare this to loss rates on high yield bonds. Despite the close proximity in rating, expected credit losses at the BB (Ba) level are materially greater. Over a five-year horizon, expected losses rise to nearly 5%, more than 5 times greater than that of BBB names. This trend continues exponentially down the ratings scale, with issuers in the C range posting an expected loss rate north of 20% over the same horizon.

Figure 5: Average Cumulative Credit Loss (1983-2023)

Source: Moody’s Default Study 2023

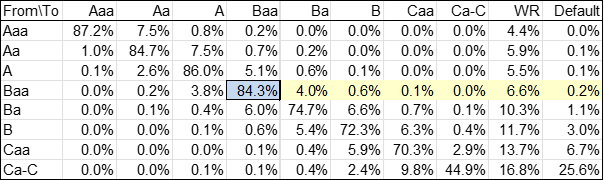

Given the short-time horizon of most cash investors, the real risk of investing in BBB lies in potential ratings volatility rather than outright loss of principal. Over the investment horizon, the chance of downgrade to the lower end of BBB, or to outright BB, is material. Moody’s historical data on ratings movements suggests that over the course of a year there is a 4.8%2 chance of a BBB name being downgraded out of investment grade, compared to a 4.1% chance of it being upgraded (Figure 6).

Figure 6: Average 1-Year Rating Migration (1920-2023)

Source: Moody’s Default Study 2023

For short-term debt, the most recent default and ratings migration study by Moody’s was as of 2017. It found that, over a period of 365 days, 4.6% of initial P-2 ratings were downgraded, 7.8% were withdrawn and 0.08% defaulted. This data series was based on an observation period of 1972-20173.

We should note that these Moody’s statistics include financial firms whose ratings tend to be more vulnerable under extreme market conditions. Excluding these firms would give a truer indication of both default and ratings risk for Treasurers looking to invest in BBB names.

Cyclical Considerations

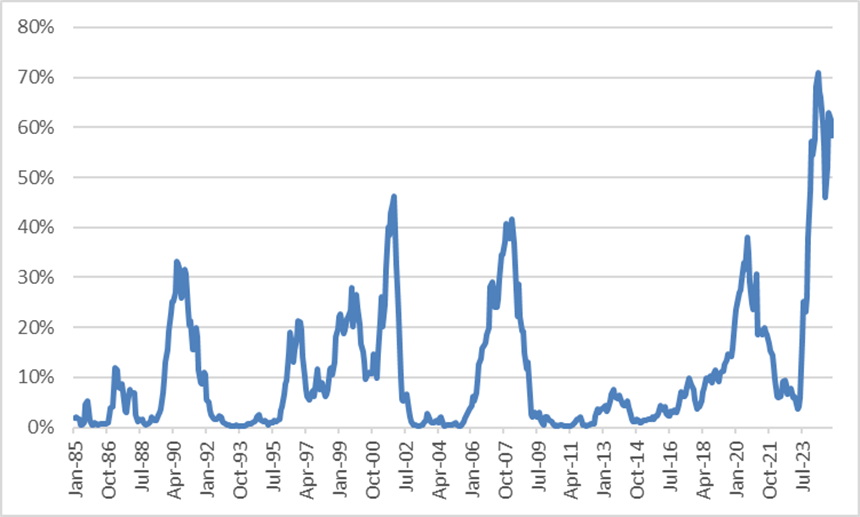

As noted in our December 2023 whitepaper Tightening Financial Conditions May Cause Us to Lose Circulation, factors that affect the economy may come into play when evaluating the BBB space. While the Federal Reserve has acted accordingly to bring inflation down by significantly hiking rates in 2022 and 2023, a higher-for-longer interest rate cycle is increasingly putting pressure on weaker corporate issuers. Many companies took advantage of low rates during the pandemic by issuing sizeable amounts of debt, but as those mature, a refinancing wave is expected to occur through 2026. Although weak balance sheets do not guarantee an end to a cyclical expansion, there is some evidence that it will end in due time. The yield curve, as measured by the spread between the 3-month Treasury Bill and the 10-year Treasury note, has been inverted since November 2022. The New York Fed’s yield curve recession model puts the chance of recession in the next twelve months, as of March 2024, at 58%.

Figure 7: Probability of US Recession 12-Months Ahead Predicted by Treasury Spread

Source: NY Fed

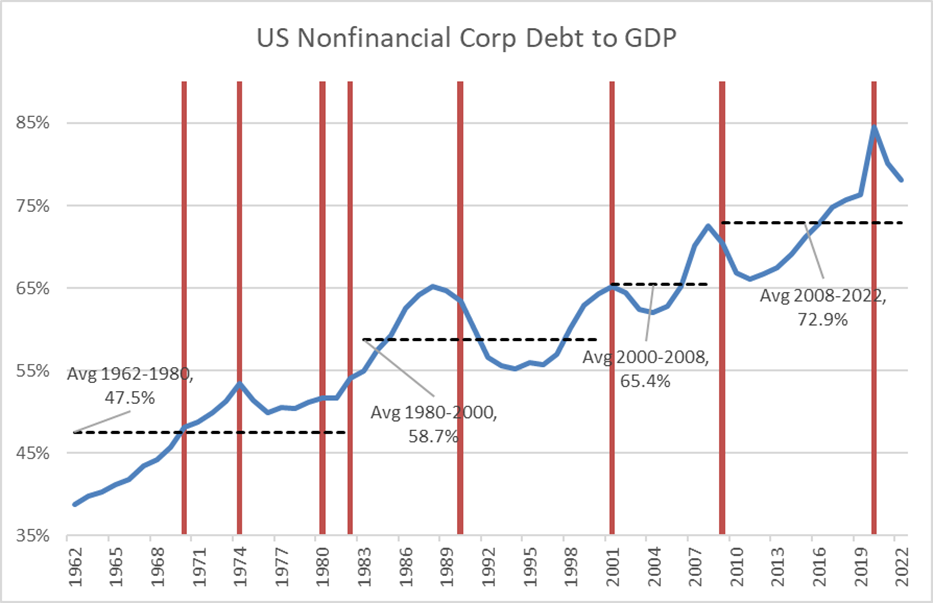

A turn in the cycle presents some downside risk for investors in BBBs. Default risk, credit losses and ratings volatility would likely pick up, as evidenced in the Great Financial Crisis of 2008-2009. In the current interest environment, this is especially true as corporate leverage hits new highs and weaker companies are forced to refinance debt at higher interest rates.

Figure 8: U.S. Nonfinancial Corporate Debt as Percentage of GDP

Source: IMF (red bars indicate recessions)

Higher leverage could induce excess ratings sensitivity in the event of a downturn, as a drop in revenues could squeeze margins and worsen debt service capabilities. This risk is particularly acute for BBB- names, as a one-notch downgrade out of investment grade could subsequently result in materially higher borrowing costs, thereby inhibiting their ability to refinance outstanding debt at a reasonable cost.

Incremental Return Potential

If investors are willing to take on this incremental credit risk, they can expect to receive a higher return to compensate for it. Empirical evidence since 1989 of the ICE 1-3 Year Corporate Index component supports this notion of greater return potential.

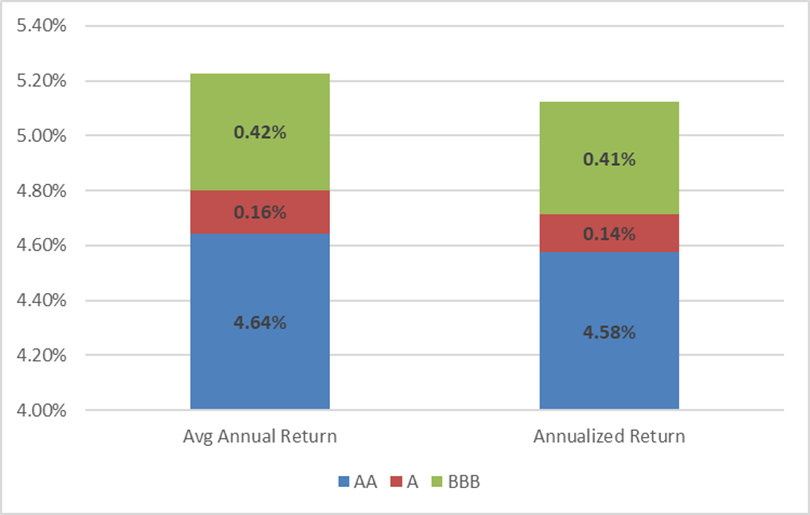

Figure 9: Total Return by Ratings (ICE 1-3 Year Corporate Index components, 1989-2023)

Source: ICE index data as of December 31, 2023

Figure 9 shows that, since 1989, the AA-rated cluster in the ICE 1-3 Year Corporate Index had an annualized return of 4.58%. The A-rated cluster performed similarly, as the annualized return of 4.71% offered just 14 bps of excess return.

On the other hand, BBBs showed significant outperformance, with an annualized return of 5.12% offering 41 bps of excess return over the A-rated component and 55 bps over the AA-rated component. As an example, on a portfolio of $100 million, the 41 bp spread translates to more than $2 million in additional return over a five-year time horizon.

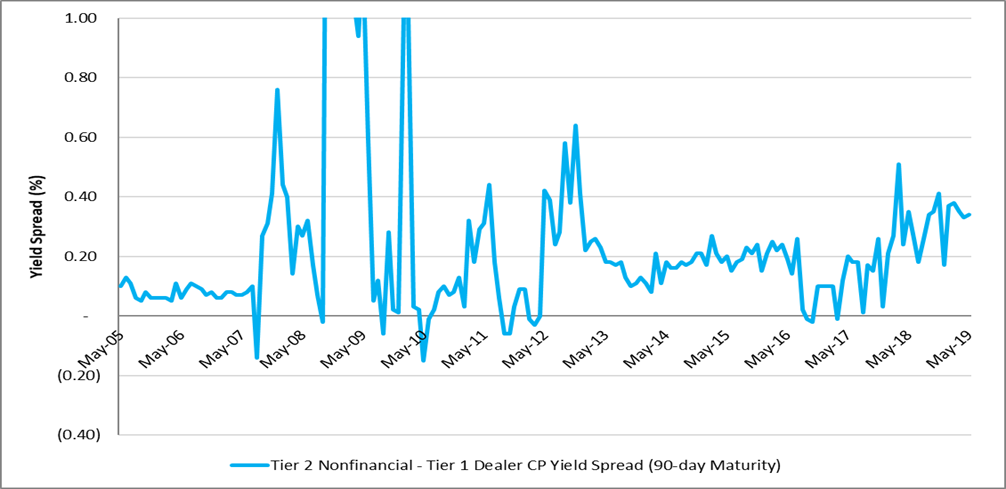

Figure 10: Yield Spread of 90-Day Tier 2 Non-financial to Tier 1 Dealer Placed CP

Source: Bloomberg Money Market Rate Curve as of May 31, 2019.

In the commercial paper (CP) market, the average yield spread of Tier-2 90-day non-financial CP to Tier-1 dealer placed CP has been 0.28% since the mid-2000s through 2023. In 2023, the widest month-end spread was 0.35% on April 28th and the narrowest was 0.23% on October 31st. During the financial crisis in 2008, this spread understandably spiked to 4.88% shortly after the Lehman Brothers bankruptcy. More recently, the spread peaked at 2.09% on April 30, 2020, at the beginning of the pandemic.

An Opportunity Set Unavailable in the Money Market Fund World

With the implementation of the Securities and Exchange Commission’s (SEC’s) money market fund reform in 2016 and continued revisions post-pandemic, the money market fund space has drifted towards higher quality investments. Short-term T-Bill issuance remains strong due to higher budget deficits, and agency debt remains relatively unchanged from the levels seen in the past few years. However, as ratings on the corporate end continue to drift lower, the available supply of non-government related Tier-1 debt is dwindling.

In this backdrop, BBB-rated securities introduce an additional source of supply unavailable to most money market funds. For prime money market funds, to the extent that institutional investors are willing to accept floating net asset values, SEC rules limit Tier 2 concentration to 3% of a portfolio with a maximum maturity of 45 days. Single issuer concentration is limited to 0.5%. Note that rating agencies often have more stringent criteria for funds to retain their AAA ratings than the rules prescribed by the SEC.

Accounts unconstrained by these restrictions will have the flexibility to add credit or duration exposures to BBB securities through direct purchases or separately managed accounts.

Treasury Portfolio Considerations

BBB-rated corporate bonds have the positive attributes of broader supply, improved risk diversification, moderate default and ratings migration risk and attractive yield potential. These attributes need to be viewed in the context of treasury management organizations, which tend to emphasize principal preservation and liquidity more than income objectives in cash portfolios. Institutional cash investors may do well observing the following guiding principles.

- Expect lower market liquidity: Although BBB-rated corporate securities are of investment grade quality, market acceptance tends to be more limited. Lower acceptance often leads to lower secondary market liquidity as fewer potential buyers are available. Liquidity risk can be at least partially mitigated by staying shorter, allowing purchases to mature on a regular basis to produce organic liquidity rather than relying on secondary market bids.

- Steer clear of BBB financial issuers: Both corporate and financial debt issues can be found in the corporate debt market, but it would be a mistake to think that all BBB rated debt is alike. The creditworthiness of an issuer depends on many factors, including its business model, operating and financial conditions and susceptibility to external factors. Decades of empirical evidence has shown that ratings on financial firms tend to be more volatile due to the confidence-sensitive nature of their business models and reliance on market funding. Staying with non-financial issuers may help limit ratings risk and reduce market value swings.

- Credit research is essential: Investors should not be solely reliant on ratings in determining credit quality. BBB issuers are more varied in scope and quality than their higher rated peers, requiring a more granular level of analysis. At the lowest rung on the investment grade ladder, slippage in credit performance may land a BBB investment in “junk” status. A focus on monitoring company fundamentals, sectoral trends, and macroeconomic environments can mitigate the risks of buying lower quality names.

- Use BBB debt as part of a conservatively constructed core portfolio: For investors who deem BBB debt suitable for a treasury portfolio, portfolio construction should start with a core base of high quality liquid investments, while BBB debt is layered in as attractive risk diversifiers and yield enhancers. When this portion is managed as part of an integral portfolio or as a separate sleeve within a larger portfolio, investors should be aware of the liquidity and market value implications.

Conclusion – BBB Debt is Not For Every Treasury Portfolio

Since our first publication of this whitepaper in 2015, we continue to believe that BBB debt may offer benefits in supply, risk diversification, and yield enhancement for cash portfolios. Adding BBB debt is not ideal for all treasury organizations, as risk cultures, liquidity constraints, and return expectations vary. However, as yield and supply challenges intensify in the short-duration debt market, organizations that are able to take advantage of this debt class may be well compensated for the moderately higher credit and liquidity risk they represent.

1Moody’s Annual Default Study: https://www.moodys.com/research/Default-Trends-Global-Annual-default-study-Corporate-default-rate-to-Sector-In-Depth–PBC_1395606

2 This excludes the event of a ratings withdrawal or default.

3Moody’s Commercial Paper Default Rates https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1103652

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.