December Month-End Portfolio Update

2023 Recap

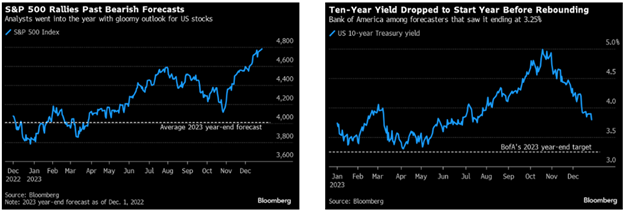

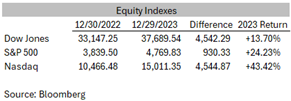

Despite the majority of market participants forecasting a recession in 2023, GDP rose over 2% in both the first and second quarters and jumped 4.9% in the third quarter, while both equity and fixed income markets had positive returns in 2023. The resilient consumer, cooling inflation, and the Fed’s pivot to deeper 2024 rate cuts, all contributed to the positive market performance heading into year-end. While it ended well, it was a volatile year for both risk assets and Treasury yields. Despite equity markets seeing three months of declines heading into November, the Dow reached seven new record highs and the S&P came within a few points of an all-time high during the year. The Bloomberg US Corporate Bond Index had a near-10% return for November-December 2023, which were the best two months since 2008. Treasury yields had positive returns across the curve.

2024 Fed Funds Outlook

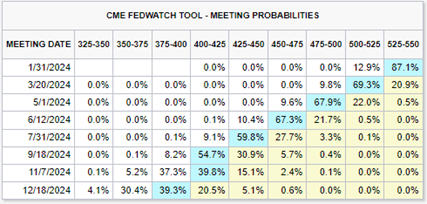

Looking ahead to 2024, markets will likely focus on when the first rate cut will occur and ultimately how much the Fed will cut this year. The FOMC is forecasting 75 basis point of rate cuts, which would bring the Fed Funds rate from 5.25%-5.50% to 4.50%-4.75%. Despite several Fed Presidents and Governors pushing back against the market’s recent aggressive rate cutting forecast in the wake of the December 2023 FOMC meeting, the Fed Funds Futures market is still signaling 150 basis points of cuts in 2024 and close to an 80% probability for the first cut to happen by the March 2024 meeting.

Source: CME Group

2024 Market Outlook

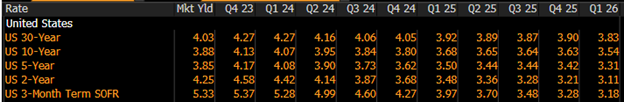

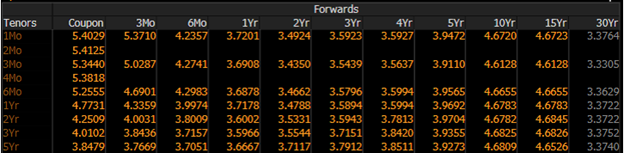

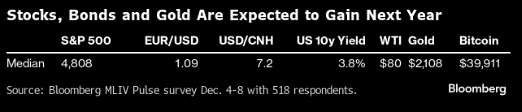

It should be no surprise that the market is forecasting lower yields by the end of the year. A survey of market strategists shows the 2-year Treasury yield declining from 4.25% to 3.68% by the end of 2024. Looking at the forward curve, the 6-month T-bill, currently well above 5%, is expected to decline to around 3.68% by the end of 2024. The consensus view for equity markets is that the S&P will likely be little changed from the current level as investors are factoring in slower growth in 2024.

Rate Forecasts (as of 12/22/23)

Source: Bloomberg

Forward US Treasuries Curve (12/29/23)

GDP Forecasted to slow in 2024

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.