December 2024 Month-End Portfolio Update

2024 Recap

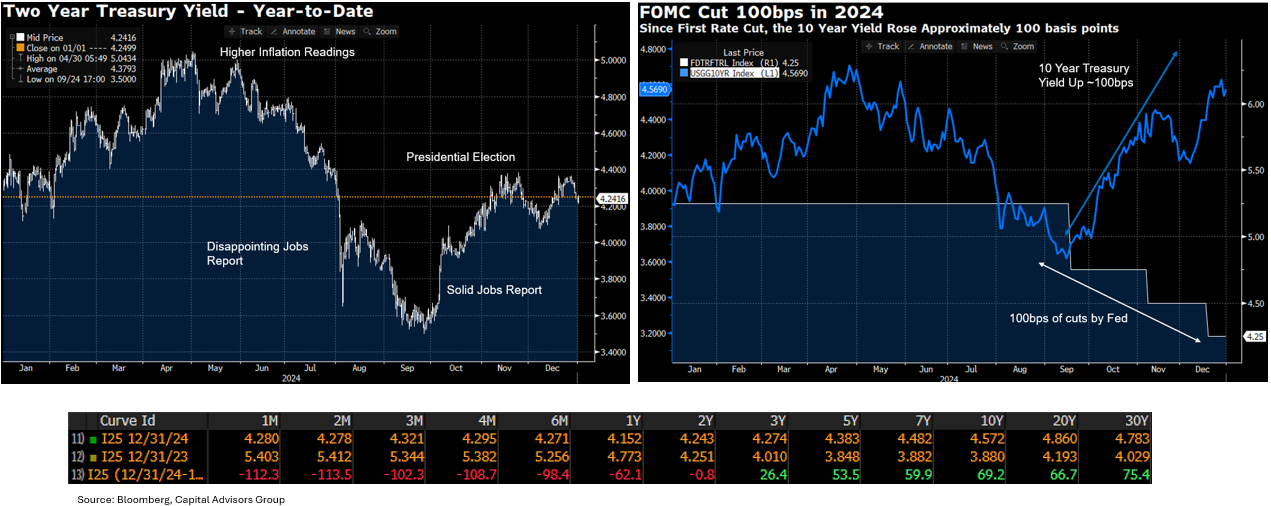

2024 saw major central banks begin to ease policy including both the Fed and ECB which each cut rates by 100 basis points. Risk assets had another strong year with the S&P 500 returning +25%, the first time since the 1990s that the index had back-to-back +20% returns. Gold rose over +27%, its strongest return since 2010, the dollar rose over +7%, and Bitcoin rose over +120%, surpassing $100,000 for the first time. It was a volatile year for the bond market, with Treasury yields both declining and rising while credit spreads tightened – below is a summary of the 2024 bond market:

- Front-end yields, from 1-month to 6-months, which are tied very closely to current monetary policy and the federal funds rate, rallied as a result of the FOMC cutting rates by 100 basis points in 2024.

- The 2-year yield, which is the most sensitive tenor to future monetary policy shifts, ended 2024 almost unchanged at 4.243%. However, significant changes to future monetary policy expectations led the 2-year Treasury yield on a roller coaster ride in 2024. For example, in September of 2024, the market was pricing in approximately 125 basis points of rate cuts in 2025, but that has now been reduced to as little as 25-to-50 basis points of cuts.

- Ironically, the 10-year Treasury had a memorable 2024 as it was the only time in history when the Fed cut rates by 100 basis points and the 10-year yield rose approximately 100 basis points (95bps to be exact). The 10-year yield is primarily influenced by future growth and inflation expectations. The incoming Trump administration is expected to focus immediately on items such as tariffs and tax cuts which are both likely to have an impact on growth and inflation.

- Credit spreads tightened on both investment grade and high yield debt, reaching levels not seen since the early 2000’s. Companies took advantage of these attractive spread levels by issuing over $1.496 trillion in new debt in 2024, the second highest year only to 2020’s $1.75 trillion of Covid-fueled issuance.

- The ABS market also had a record year, seeing over $300 billion in new issuance, with spreads at the tightest levels we’ve seen in multiple years.

Source: Bloomberg

2025 Outlook

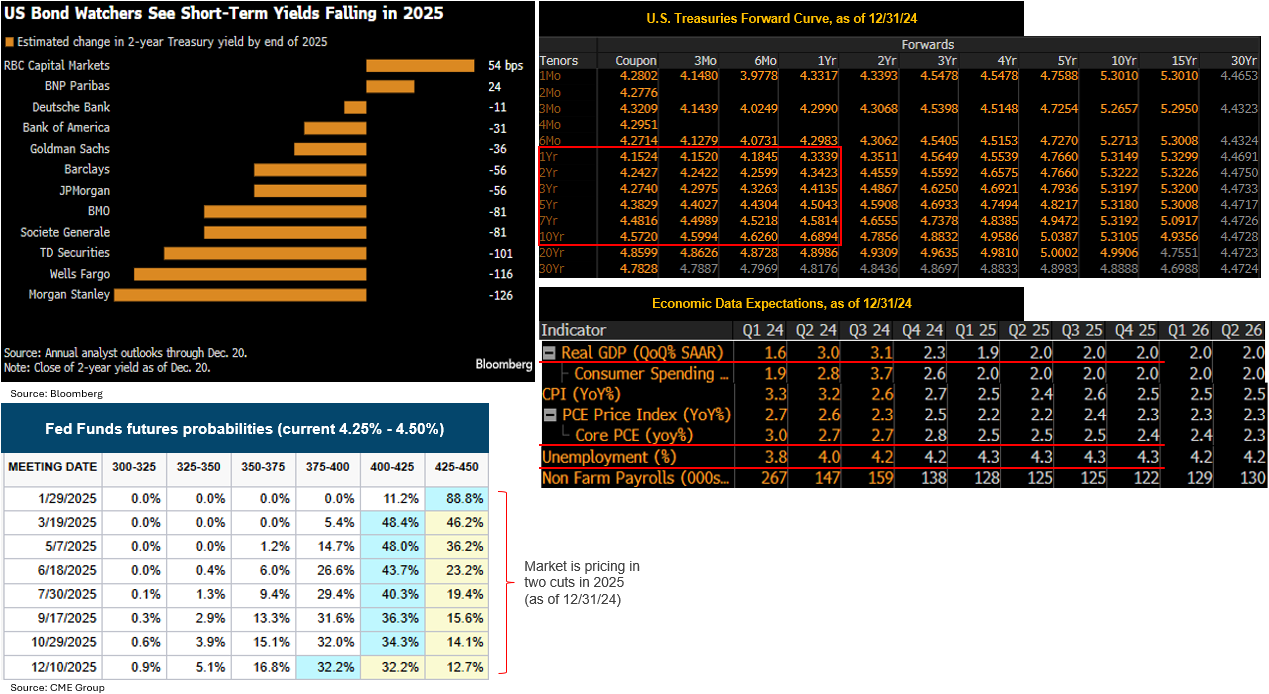

Looking ahead to 2025, the focus will be on what impact the incoming Trump administration will have on the economy and how the Fed will respond. Although it is likely the Fed will continue easing policy despite political uncertainties and a “bumpy” path of inflation as characterized by Fed Chair Powell, expectations are for the Fed to remain on hold for a good portion of 2025.

- The Fed Funds futures market is pricing in two 25-basis point rate cuts, with the first occurring in March and the second not occurring until the December meeting, with the Fed on hold in the months between. This is in line with the Fed’s expectations for 50 basis points of cuts in 2025 from their latest Summary of Economic Projections.

- Although expectations are for fewer cuts in 2025 than were anticipated a few months ago, the Fed is still going to be in a rate-cutting mode for the year and forecasts for the 2-year Treasury yield reflect this. A survey from 12 rate strategists has 10 participants seeing the 2-year yield declining while only two see the 2-year yield rising. Looking at the forward curve, yields are expected to be higher a year from now, but rangebound within the first half of the year until there is more clarity on the impact to inflation or growth from Trump’s policies.

- On the growth outlook, market expectations are for GDP and consumer spending to grow at 2% in 2025, which is also in line with the Fed’s latest forecast.

- The Fed’s preferred inflation gauge, Core PCE, is expected to remain above the Fed’s 2% target through 2026, which is likely to cause the Fed to be patient on additional rate cuts.

- The unemployment rate is expected to rise to 4.3% in 2025 which is also where the Fed is forecasting the unemployment rate to end 2025.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.