Counterparty Risk Management for Corporate Treasury Functions

Abstract

Experience has taught us that counterparties can fail with little warning. Counterparty risk management has become more challenging in recent decades due to concentrated exposures, complex financial instruments and evolving bank credit. Corporate and treasury organizations should manage this risk proactively, have an integrated risk policy across business lines, diversify risk by setting exposure limits according to risk criteria and seek out professional resources where available.

Introduction

One of the great lessons we learned from the financial crisis a decade ago was that the financial world we lived in was not as safe as we thought. This statement remains true today, despite recent industry and regulatory efforts aimed at bolstering the strength of the financial system.

In conversations with corporate cash investors, we found an increased awareness of counterparty risk management. As the topic remains a top priority among risk managers at financial institutions, it is an even bigger challenge to treasury practitioners who may have limited knowledge of the complex, interconnected and concentrated world of finance.

In this whitepaper, we attempt to explain counterparty risk from the corporate treasurer’s perspective, why it has become more difficult to track and manage and the key principles of managing this risk. We should note that since this is an all-encompassing topic, our focus is on the credit aspect of counterparty risk, as opposed to collateral management, settlement risk or other operational and legal issues.

Counterparty Risk – The Corporate Treasurer’s Perspective

What is Counterparty Risk?: Counterparty risk refers to the risk that a party in a contract may not fulfill its contractual obligations. It is essentially a form of indirect credit risk, different from direct risk from unsecured borrowings, such as bonds and deposits.

For example, in an interest rate swap transaction with an investment bank, the investor may fail to profit from a winning contract if the bank becomes insolvent prior to the contractual date, rendering the agreement worthless. For some transactions, asset collateral, margin balances and third-party guarantees may protect against counterparty risk, although such support mechanisms also may introduce new dimensions of counterparty risk.

The Corporate Treasurer’s Perspective

Although much focus on counterparty risk has been centered on transactions between financial institutions, corporate treasury organizations also face significant challenges. In the last two decades, businesses increasingly have become more global, resource- dependent and multifaceted. These new dynamics necessitate various trade finance, support agreements and hedging activities with multiple financial intermediaries.

As financial instruments become more sophisticated and financial institutions become more complex, corporations feel particularly challenged to identify, track, manage and mitigate counterparty risk due to a lack of expertise and resources as compared to their financial counterparts.

For most small- to medium-sized corporations, avoiding default by a financial intermediary is the focus of their risk management strategies, as more complex and expensive risk mitigation techniques are not financially feasible. We, thus, focus on risk prevention and diversification, which are more applicable to the resource-constrained treasury staff.

Types of Transactions Involving Counterparty Risk

Listed below are some of the common transactions that may involve counterparty risk:

- Business and trade, including receivables and payables through financial intermediaries

- Trade guarantees and short-term lending, including letters of credit, banker’s acceptances, unfunded commitments and revolving credit lines

- Repurchase agreements and reverse repurchase agreements, as well as securities lending arrangements

- Derivatives, including currency forwards, interest rate swaps, asset swaps, credit default swaps, total return swaps and options on swaps

Insurance policies, including surety bonds, property and casualty, maritime, directors’ and officers’ liability, and errors and omissions insurance

Consequences of Counterparty Failure

Whenever a corporation fails to receive financial benefits as agreed, counterparty failure has occurred. Sometimes, pledged asset collateral or government intervention may lead to full or partial recovery of losses, but only after a delay. At other times, there may be no recovery due to the highly leveraged and high-risk nature of financial intermediaries.

It should be noted, that it does not always require a counterparty default for the investor to sustain a loss. Sometimes, the counterparty may fail to deliver on its promises for reasons not of a financial nature, which may result in a time-consuming and costly legal process to recover the funds. Thus, corporations must assess both the counterparty’s willingness and its ability to pay.

New Challenges in Counterparty Risk Management

Corporate risk managers may feel that their tasks have become more challenging in recent years, and those feelings are valid for several reasons: 1) financial institutions have grown larger, more complex and have become more interconnected; 2) the financial crisis resulted in significant deterioration of credit, liquidity and capital conditions at many financial intermediaries despite efforts to rebuild loss-absorbing capital in recent quarters; and 3) government support assumptions for large banks have been scaled back significantly in most developed countries.

What May Cause Financial Intermediaries to Fail?

Understanding counterparty risk requires a sensible appreciation for the financial intermediaries’ business models, operating conditions and financial health, as well as the prevailing economic cycle, current market conditions and the regulatory environment. Confidence-sensitive funding models, high financial leverage, lack of visibility of underlying risk exposures and engagement in capital market activities all contribute to the highly unpredictable nature of financial institutions’ risk, but the problems do not stop there.

The Increasingly Concentrated World of Banking

Since the repeal of the restrictions on interstate banking by the Riegle-Neal Act in 1994, bank mergers in the U.S. have grown substantially, eventually resulting in an industry dominated by a few very large players. Ironically, failing institutions during the financial crisis and financial regulators’ efforts in tackling the “too-big-to-fail” risk resulted in even higher concentration in the financial industry. Consolidation brings new challenges to counterparty risk management because corporations are frequently forced to maintain multiple banking relationships with a shrinking pool of intermediaries.

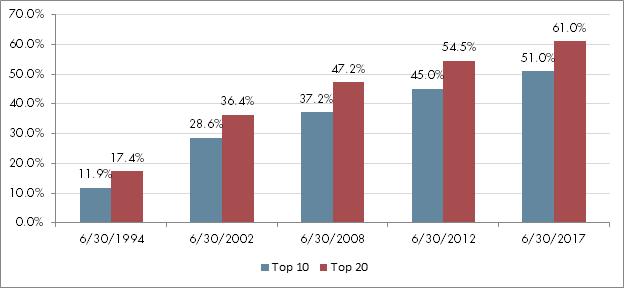

Figure 1 shows that, since 1994, the share of U.S. national deposits at the 10 largest banks more than quadrupled from 11.9% to 51.0% in 2017. Similarly, the share of the 20 largest banks grew from 17.4% to 61.0% over the same period.

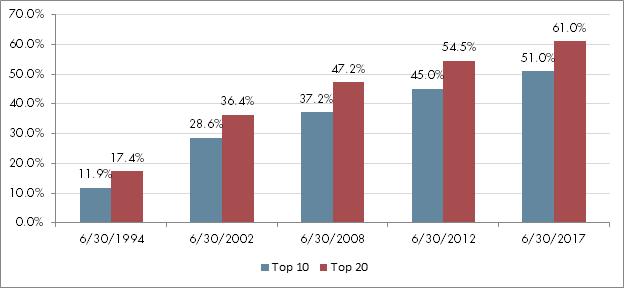

To further illustrate the effect of mergers on counterparty concentration, Figure 2 traces the lineage of surviving entities from the Top 20 banks in 1994. It shows that as many as six of those banks are now part of JPMorgan Chase, five became Wells Fargo and four became Bank of America.

Figure 1: National Deposit Concentration

Source: FDIC Top 50 Commercial Banking Institutions by Deposits as of June 2017

To make matters worse, many corporations now have counterparty exposures to the same few large banks, which could become a systemic concern if one of the banks run into problems.

Figure 2: Effect of Bank Mergers since 1994

Source: FDIC Top 50 Commercial Banks and Savings Institutions by Deposits

Uneven Recovery in Credit Strength

As discussed in a few of our whitepapers, underlying credit strength in the largest financial institutions deteriorated dramatically in the years after the crisis, largely due to poor loan quality, volatile swings in the capital markets and lax risk management practices. Reduced government support assumptions also have contributed to lower credit ratings of major banks. Even as several larger firms regain some credit strength, the recovery has been uneven.

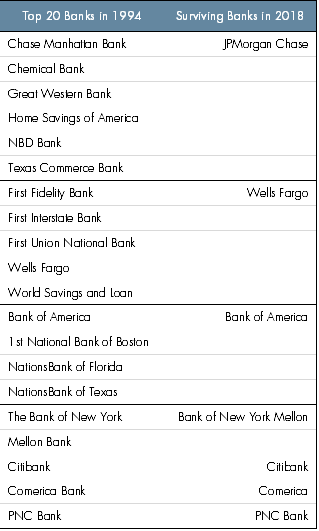

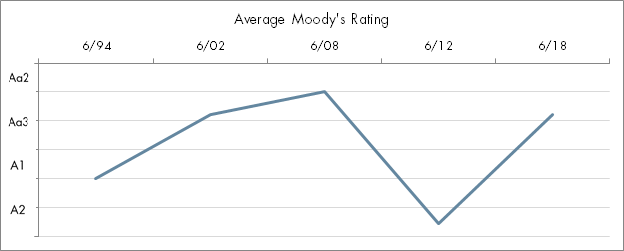

Figure 3 lists the average Moody’s deposit credit ratings of the Top 20 U.S. banks since 1994. It shows that the average rating improved from A1 to close to Aa2 in 2008 before collapsing back to A2 by 2012. After several years of profitability and capital building, the group’s average rating has since improved to Aa3. However, the rolling back of crisis-era regulations, including exempting banks with assets under $250 billion from rigorous capital adequacy tests and relaxing of the Volcker Rule, calls into question the long-run stability of banking ratings. In addition, excessive lending and lower underwriting standards in consumer and commercial loans, high leveraged and high yield debt burden, and rising interest expenses all signal a probable turning point in bank credit strengths soon.

High credit concentration and a worsening outlook present clear challenges for corporations in managing counterparty risk. We should note that these challenges are not unique to U.S. banks. As many practitioners are keenly aware, financial situations at Eurozone banks are perhaps more challenging than their stateside counterparts.

Figure 3: Average Ratings Trend among Top 20 U.S. Banks

Source: Moody’s Investor Services

High Counterparty Correlation Due to Complex Derivatives

A lesson from the last financial crisis was that counterparty risk among large financial intermediaries is highly correlated. In addition to having common capital markets activities, their use of derivatives as a risk-mitigating technique was remarkably similar. For example, before 2008, AIG was the single largest counterparty for most investment banks’ collateralized debt obligations (CDOs). The near-failure of AIG brought to light the catastrophic consequences that many large banks would have faced had AIG gone under. The $5-billion-plus “London Whale” trading loss at JPMorgan Chase in 2012 was another example of how a bank with a presumably strong risk management track record could fall victim to complex derivatives losses.

Counterparty Management Principles for Corporate Treasurers

Given the importance and complexity of counterparty risk management, how should a treasury organization approach this subject? Individual practices may vary, but we believe the following principles should apply to all counterparty situations.

Managing Counterparty Risk, not Reacting to It

All too often, counterparty risk becomes a high priority only after the creditworthiness of a major counterparty is in question. Although well-disciplined risk management practices may seem arduous and time consuming, hoping that everything will be fine is not the right strategy. Likewise, simply picking banks deemed “too-big-to-fail” and expecting the government to come to the rescue is no longer the prudent course of action, as the political environment has become less tolerant of bailing out big banks with taxpayer funds. The time to start doing something about counterparty risk is now.

Developing a Detailed and Conservative Umbrella Risk Policy

One of the reasons counterparty risk management may seem daunting is that a corporation may have multiple access points to the same financial institutions. Getting the overall picture is not always easy. We think that even though specific policies for deposits, cash sweeps, investments, credits and derivatives may be sufficient, the selection criteria and monitoring procedures governed by a common umbrella risk policy may minimize unforeseen counterparty risk. This umbrella risk policy may detail the steps through which counterparties are selected, how limits are calculated and tracked and the measures to take when counterparty performance deteriorates.

Diversifying Risk by Setting Limits According to Risk Profiles

As with all credit risk management, a primary means of counterparty risk mitigation is through diversification. Although this principle is widely recognized and, additional measures used to fine-tune exposure limits in accordance with predefined risk levels may enhance effectiveness. For example, counterparties with stronger credit profiles may have higher limits. Fundamental indicators, such as credit ratings, and market risk indicators, such as credit default swaps (CDS) or bond implied ratings, may be used for this purpose – though we caution investors to recognize the inherent shortcomings in credit ratings and CDS levels and to use them with caution.

Looking to Professional Managers for Counterparty Expertise

Overseeing counterparty risk management can be a daunting task. In addition to solvency risk, corporate treasurers often need to be concerned with other forms of risk such as asset collateral, asset service and operational risk. The technology required to track exposures and monitor limits may, by itself, necessitate the engagement of specialists in counterparty risk management.

On the other hand, there may be external resources available to corporate treasurers such as risk managers at their relationship banks, money market funds and separate account managers. Certain treasury organizations may also benefit from CounterpartyIQ® (I&II), our proprietary web-based counterparty risk tool.

Counterparty Risk Management Best Practices

For implementation of specific counterparty risk measures, corporate treasurers may do well by looking to some of the common best practices among financial intermediaries and adapt them for their own use. The following are samples of these practices:

- Standardize contracts

- Use products with a central clearinghouse

- Consider requiring delivery versus payment (DVP)

- Match collateral and margin posting with counterparty risk assessment

- Use tri-party repurchase agreements and third-party custodians

Conclusion – Managing Counterparty Risk as an Integrated Process

The financial crisis taught us that counterparties can fail with little warning. Despite recent attempts by financial intermediaries and regulators to improve counterparty strength, corporate treasurers continue to face mounting challenges due to evolving credit conditions, the complex nature of today’s intermediaries and widespread use of derivatives.

Counterparty risk, at its very core, is the solvency risk of the financial intermediary. Corporate treasurers may improve risk management by being proactive and developing a detailed and integrated risk policy across business lines, diversifying risk by setting appropriate exposure limits and seeking out professional resources where available. By taking heed of the financial industry’s own best practices and tackling the subject directly and systemically, corporations may find the task not as daunting as they had feared.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.