Corporate Treasurers Ignoring Bank Exposures Before Prime Money Market Fund Transition

New Liquidity/Risk Survey Identifies Opportunity Costs Associated with Bank Deposits and Government Securities

Many corporate treasurers are keeping their cash in bank deposits, U.S. Treasuries and government money market funds as they assess the impact of ongoing reforms that are changing the risk and liquidity profiles of prime money funds. According to the 2016 Liquidity Risk Survey of 130 treasury professionals by Strategic Treasurer and Capital Advisors Group, most are ignoring emerging bank exposures and accepting the opportunity costs associated with low returns from what have traditionally been the safest havens for corporate cash.

At the same time, however, many are also reporting new flexibility in their cash investment policies and acknowledging new risks while accommodating greater latitude in investment choices to navigate the new, uncertain cash investment landscape.

Uncertainty Drives Cash to the Sidelines

Nearly half the survey respondents (45%) said they “don’t know yet” how their cash investment strategies may change when institutional prime money market funds abandon fixed $1-per-share pricing and adopt SEC-mandated floating net asset values (NAVs), liquidity gates and redemption fees this October. Prime funds for decades have been the easiest choice for cash managers seeking liquidity, safety, and yield, but the new restrictions on them have created uncertainty about their utility going forward.

Allowing money market fund managers to impose gates and fees when balances fall to predetermined trigger points creates the possibility that investors may not have access to their cash when they need it, and floating NAVs create the potential for losses upon redemptions. Moreover, because only institutions will be allowed to invest in the new prime funds, there will be more shared liquidity risk associated with the possibility of “hot money” withdrawals. For example, if a few major institutional investors that account for a large percentage of fund assets exit quickly during a period of economic stress, they may trigger gates and fees blocking other investors’ access to their cash.

Responding to those and other uncertainties surrounding the utility of the newly constituted prime money funds, more than a third (34%) of survey participants indicated they will move cash to Treasury and government agency funds in spite of low potential returns. Treasury and government funds are seen as the safest and most liquid repositories of corporate cash. Unlike the reconstituted prime funds, they will continue to feature fixed NAVs and will not impose liquidity gates or redemption fees.

Exposure to Bank Deposits Continues

More than three quarters (77%) of those surveyed also reported they are continuing to hold cash in bank deposits in spite of changes in banks’ risk return profiles. Since the 2012 expiration of temporary unlimited federal insurance guarantees on deposits beyond the $250,000 minimum, the overwhelming majority of corporate cash deposits are uninsured. Furthermore, Dodd-Frank and Basel III reforms enacting liquidity coverage ratio (LCR) requirements are prompting many banks to limit availability and provide lower returns on deposits relative to other cash investments.

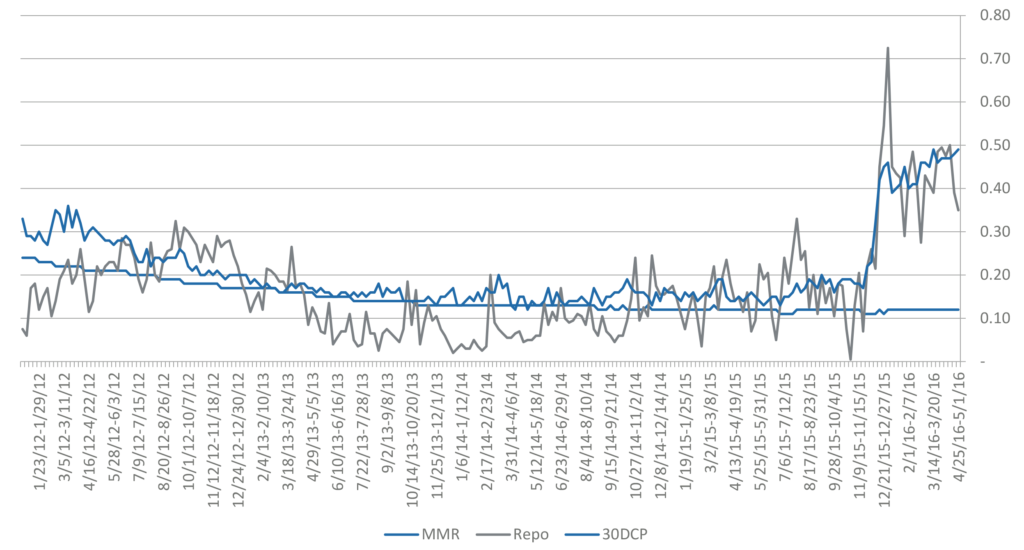

In addition to exposure to potential credit problems at major banks during times of stress, heavy reliance on bank deposits also creates opportunity costs compared to other cash investment vehicles with higher yields. These costs became apparent following the December 2015 interest rate hike by the Fed, when banks failed to increase interest rates paid on bank deposits to keep pace with increases in yields on overnight government Repo and commercial paper investments (Figure 1).

Figure 1: MMDA Rates vs. Overnight Gov’t Repo Rates & 30D A1/P1 CP

Sources:

MMR – FDIC weekly national money market rates for deposits greater than $100,000

Repo – Overnight General Collateral Repo rate backed by government collateral from Bloomberg (Index: USRG1T)

30-Day CP – 30-day non-financial corporate rates from Bloomberg (Index:DCP030D)

However, the survey also indicated treasurers may be increasingly cognizant of bank exposures, with more firms setting limits on uninsured bank deposits than in the previous year’s survey.

Investment Policies and Risk Frameworks Evolve

More than 20% percent of firms said they have not revised their investment policies in the past two years, an additional indication that many corporate treasurers have been slow to react to changes in the risk management landscape. However, many of those who did say they are are revisiting their investment policies are allowing more latitude in choices of investments as alternatives to bank deposits, prime money funds, and government securities. Two reported policy changes aimed at broadening available alternatives to bank deposits and money funds included new permitted asset classes (18%) and lower minimum credit rating requirements (9%).

Survey results also indicated that frameworks for credit and risk management are evolving. More firms reported they are diversifying maturity dates of credit facilities and other types of debt to limit exposures. And nearly three quarters (73%) of respondents said they were either formally or informally monitoring credit counterparties, up from less than two thirds (64%) in the 2015 survey.

Action Items for Treasury Professionals

Heading into 2017, the survey highlighted four areas where treasury professionals are concentrating:

- Liquidity Management: Corporate treasurers will be focusing on plans for moving excess funds currently parked in bank deposits and money funds into other investments to strike an appropriate balance of safety of principal, liquidity and yield.

- Counterparty Risk Management: The evolving liquidity and risk environment is creating a need for a clear process to manage and monitor counterparty exposures, beyond NRSRO guidelines, including monthly reporting and alignment with the firm’s investment policy.

- Debt Diversification: A deliberate plan to diversify debt maturity dates may reduce overall risk.

- Targeted Benchmarking: Monitoring treasury staffing and investment debt practices and setting annual benchmarks may help identify investments needed for better tools and a proper level of resources.

Treasury Groups Bolster their Resources

To address the challenges of the new cash management landscape, treasury departments also reported they are continuing to add resources. The survey highlighted a multi-year trend toward staff increases in treasury groups, with more reporting an increase than a decrease in staff for the past three years of the survey.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.