Coming to Terms with Banking System Liquidity

During the weekend following Silicon Valley Bank’s collapse, it became apparent that the bank run which drove SVB to insolvency was spreading, placing extreme liquidity pressures on a few regional lenders. Bank balance sheets remained fundamentally stable, although, the volume and speed of deposit outflows at some banks was overwhelming available liquid resources. Many banks had significant stocks of highly liquid Treasury securities in hold-to-maturity portfolios. However, selling a single security from this lot would mean realizing large losses across the whole portfolio, a move which in part precipitated the bank run on SVB and would likely worsen ongoing runs at any other bank.

On Sunday of that weekend, the Federal Reserve introduced the Bank Term Funding Program (BTFP) to alleviate liquidity pressures. Through the BTFP, banks could pledge high quality collateral such as Treasuries in hold-to-maturity portfolios and receive a loan equal to the collateral’s par value up to a 1-year term. The BTFP was effective in providing banks with an additional liquidity facility but was always meant to be temporary and was closed on March 11th, 2024. While bank’s still have multiple emergency liquidity sources such as the Fed’s Discount Window, Standing Reop Facility, and Federal Home Loan Bank Advances, why weren’t these enough in March 2023, and will they be enough moving into an increasingly uncertain macro environment?

Bank Term* Funding Program

*Finite Term

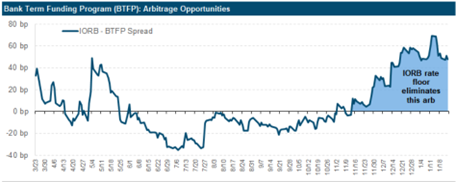

As we have mentioned in the previous blogs: ‘Tightening Financial Conditions May Cause Us to Lose Circulation’ and ‘Quantitative Tightening (QT) Is Coming to An End – What Does It Mean to Cash Investors?’, falling reserve levels are bringing bank funding and liquidity metrics to the front of investors’ minds. Perhaps this signals that it’s a poor time to end a liquidity program like the BTFP, particularly when this program provided $163B1 of loans as of February 28th, 2024. However, while it was initially successful in relieving liquidity stress, the program’s Overnight Indexed Swap (OIS) + 10bps rate proved an opportunistically cheap source of funding, particularly as 1-year OIS rates fell late in 2023. This arbitrage opening has likely driven banks to tap the BTFP, not due to funding stress, but to capitalize on a rare, and profitable opportunity, provided by the Fed. Since November, interest on reserve balances (IORB), or what banks get paid for balances held at the Fed, exceeded the BTFP rate, allowing a bank to borrow from the BTFP and earn at one point over 60bps above their cost of capital, just by placing the borrowed funds in the bank’s Fed account2.

Source: Credit Sights

This risk-free arbitrage opportunity led to increased BTFP usage as the borrowing rate dropped further below IORB. It also led the Fed to floor the BTFP rate at the IORB when they confirmed in January that the program would end as scheduled3. This should mean the BTFP’s sunset will remain uneventful. However, it also means banks have lost the emergency liquidity facility with stabilized the banking sector in March 2023.

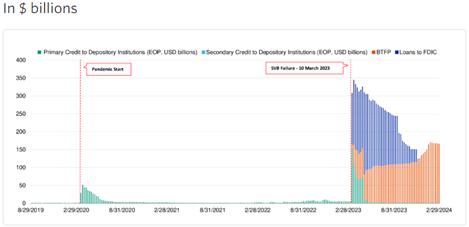

Source: Moody’s

However, banks still have access to more traditional government provided liquidity programs: the Discount Window (DW), Standing Repo Facility (SRF), and Federal Home Loan Bank Advances (FHLB Advances). Unfortunately, these programs were already in place during the March banking crisis and were clearly insufficient. At a time when liquidity is becoming increasingly important, what could prevent these programs from becoming an effective lifeline for banks facing a future liquidity crisis?

Discount Window

^Discounting the…

The most notorious of the Fed’s liquidity facilities, the DW allows banks to borrow against high quality collateral such as Treasury and Agency securities for varying periods of time. The Primary Credit Facility allows perhaps illiquid but solvent banks to borrow up to 90-days at a rate relative to FOMC’s target range, the primary credit rate was 5.50% as of 3/20/244. The Secondary Credit Facility allows banks in true financial distress to borrow against high quality collateral, typically overnight, and at a rate above the primary credit rate, the secondary credit rate was 6.00% as of 3/20/245. The separation of the DW into the Primary and Secondary Credit Facilities was done in 2003 to try to distinguish solvent banks borrowing from the DW to cover temporary liquidity shortfalls and those borrowing due to true financial distress. However, as was clear 2008 and again in 2023, many banks remain reluctant to borrow, or be ready to borrow, from the DW out of fear they will be perceived as insolvent6.

While banks did tap the DW in 2023 Fed Vice Chair for Supervision Michael Barr, highlighted in a 2023 speech that the failed banks had trouble identifying and moving collateral to allow for additional DW barrowing. To this end, he suggested banks have collateral earmarked for DW usage and regularly test the window to ensure operational preparedness7. However, the Fed has been attempting to destigmatize DW borrowing for decades to little effect, so thinking banks will be more willing to borrow in the future may be wishful.

Standing* Repo Facility:

*Not to Be Stood On

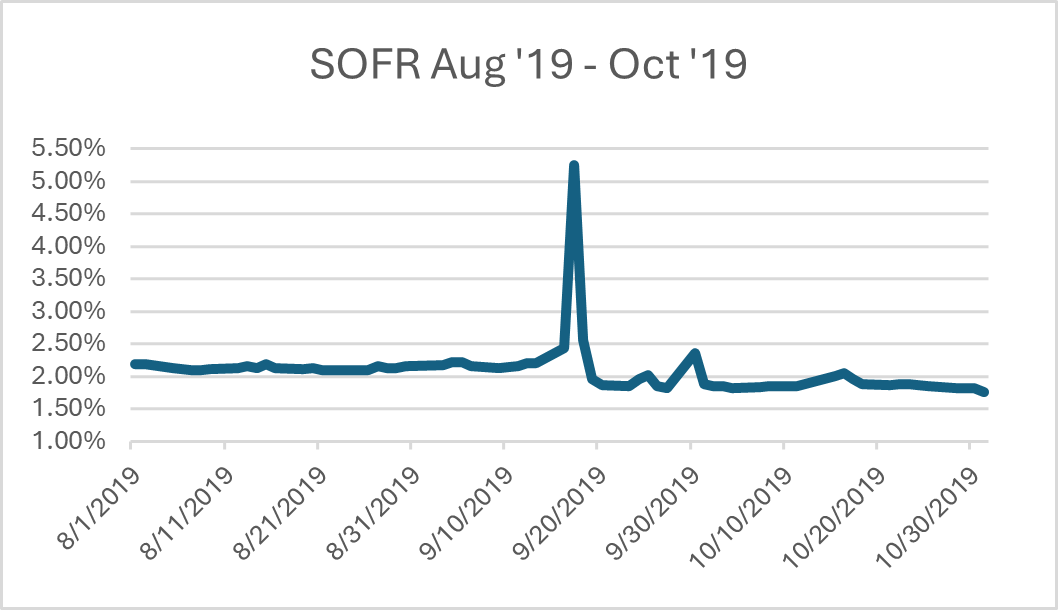

Introduced in 2021, the SRF allows banks to post high quality collateral for overnight loans from the Fed at a rate set at the upper end of FOMC target range8. The Fed used a precursor to this program in 2019 to effectively tamp down funding stress when falling reserves caused SOFR to jump over 3 percentage-points9. The 2019 rate spike was, in short, driven by corporate tax payments and increased Treasury issuance sharply reducing the supply of reserves, while simultaneously increasing the amount of Treasuries to be financed in the reop market that day10.

Source: Federal Reserve Bank of New York

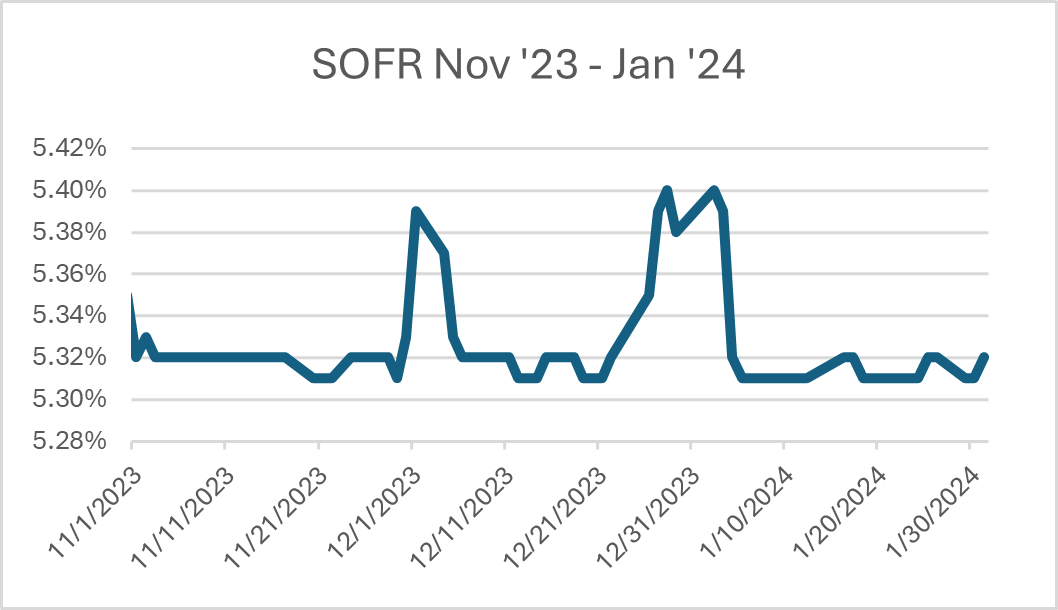

Banks attempting to limit the size of their balance sheets and increase liquidity at year end, led to similar, albeit much smaller, jumps in SOFR in December 2023 highlighting that liquidity may be nearing uncomfortably low levels. While there was some repo activity from the Fed in December and March of 2023, repo usage through 2023 was minimal compared to 2019 – 2020 levels11. The overnight nature of the SRF means it’s used more to prevent overnight rates from moving too high as happened in 2019 rather than address a broader liquidity issue.

Federal Home* Loan Bank Advances

*Not Just for Homes

In 1932, the Federal Home Loan Bank System was created to support mortgage lending and other community development projects primarily by providing reliable liquidity resources to lending institutions12. FHLB Advances are the cornerstone of this process, allowing member banks to post high quality, often housing-oriented collateral such as mortgages, Treasurys, or agency securities for loans maturing from overnight to 30-years, priced just above treasury yields of a comparable maturity13.

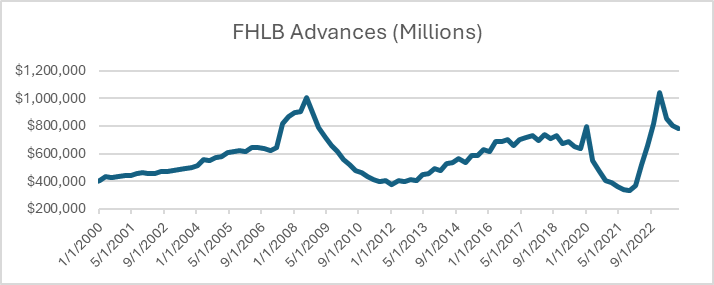

Advances have been very successful in providing lending institutions with the necessary liquidity to continue financing the domestic housing market. However, banks have increasingly relied on advances to supplement liquidity profiles particularly in times of stressed markets or tight financial conditions. Since 2000, FHLB Advances have been at their highest during the 2008 financial crisis and 2023 banking crisis14. Additionally, when financial conditions are tightening, banks usually increase their usage of advances, likely to offset declining system wide deposit levels.

Source: FRED

While helpful to banks’ liquidity profiles, the Federal Housing Finance Agency highlighted this as a problem in their FHLBank System at 100: Focusing on the Future report issued in November 202315. Specifically, the report highlighted the different responsibilities the FHLBank system has in providing liquidity to support housing and community development compared to the Fed’s role as lender of last resort to distress financial institutions. Proposed changes to the FHLB System would attempt to curtail the use of FHLB Advances as a supplemental liquidity source, which could lower banks’ auxiliary liquidity sources during stressed markets.

Post BTFP Liquidity Considerations

The BTFP was essential to calming markets during the 2023 banking crisis. While its sunset may not pose an immediate threat to bank liquidity, it does reduce the number of available liquidity facilities that do not rely upon functioning markets. The DW, SRF, and FHLB Advances proved inadequate in March 2023, and may prove to be inadequate during the next crisis. One caveat is that the Fed retains the ability to dust off the BTFP if need be. Additionally, it is important to highlight that large, federally regulated banks subject to strict capital and liquidity requirements, appeared far more prepared heading into the crisis, and largely didn’t need to rely on these facilities. For cash investors, it may be prudent to focus on these larger, more stable, and more liquid institutions which don’t need to rely as heavily on government facilities for support.

1 Moody’s, Declines in TGA and ON RRP lift bank reserves, but declines in reserves coming, March 1, 2024: https://www.moodys.com/research/Banks-US-Declines-in-TGA-and-ON-RRP-lift-bank-Sector-Comment–PBC_1399890?token=IocFCLEalkjDaqpx2Mw2vs6jwQ1G%2F5XB&cid=Y08N0JE2XZC2681&mkt_tok=NzUwLVZQWC00NzEAAAGRqIY7yxO9MHsp5B1mKeRqciy1kbKFlt2-he1C0WGOcx4LfkbHOKkOyTGhpnMmFS53Qb6XkASBI_qagy0vM1RTVzzX8OKscJNZ5q8cG-np1LcN

2 Credit Sights, U.S. Banks: Fed Shurts BTFP Door, Closes Arb Window, January 24, 2024: https://v2.creditsights.com/articles/559740

3 Board of Governors of the Federal Reserve System, Federal Reserve Board announces the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11, January 24, 2024: https://www.federalreserve.gov/newsevents/pressreleases/monetary20240124a.htm

4 Board of Governors of the Federal Reserve System, Discount Window Lending: https://www.federalreserve.gov/regreform/discount-window.htm

5 The Federal Reserve, Discount Window: https://www.frbdiscountwindow.org/

6 Federal Reserve Bank of New York, History of Discount Window Sigma, August 10, 2015: https://libertystreeteconomics.newyorkfed.org/2015/08/history-of-discount-window-stigma/

7 Board of Governors of the Federal Reserve System, The Importance of Effective Liquidity Risk Management, December 1, 2023: https://www.federalreserve.gov/newsevents/speech/barr20231201a.htm

8 Federal Reserve Bank of New York, The Fed’s Latest Tool: A Standing Repo Facility, January 13, 2022: https://libertystreeteconomics.newyorkfed.org/2022/01/the-feds-latest-tool-a-standing-repo-facility/

9Federal Reserve Bank of New York, Secured Overnight Financing Rate Data: https://www.newyorkfed.org/markets/reference-rates/sofr

10 The Board of Governors of the Federal Reserve System, What Happened In Money Markets in September of 2019, February 27, 2020: https://www.federalreserve.gov/econres/notes/feds-notes/what-happened-in-money-markets-in-september-2019-20200227.html

11 Federal Reserve Bank of New York, Repo Operations: https://www.newyorkfed.org/markets/desk-operations/repo#search-operations

12 Federal Deposit Insurance Corporation, Federal Home Loan Bank System: https://www.fdic.gov/resources/bankers/affordable-mortgage-lending-center/guide/part-3-docs/federal-home-loan-bank-system.pdf

13 Federal Deposit Insurance Corporation, Advances: https://www.fdic.gov/resources/bankers/affordable-mortgage-lending-center/guide/part-3-docs/advances.pdf

14 Federal Reserve Bank of St. Louis,

15 Federal Housing Finance Agency, FHLBank System at 100: Focusing On The Future, November 7, 2023: https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/FHLBank-System-at-100-Report.pdf

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.