Brexit Delayed

Brexit has been delayed until Halloween, a fitting deadline for what has turned into a three-year nightmare for the British populace. UK Prime Minister Theresa May had pushed for a shorter extension, out until the end of June, in hopes that the UK would not have to participate in the upcoming EU elections. However, it is now clear that they will do so, potentially creating an awkward dynamic for both the UK and the EU.

In the meantime, the shadow of Brexit will likely continue to have a negative impact on UK consumer spending, business investment, and the Pound. For institutional cash investors, it means another six months of uncertainty over the impact Brexit may have on short- and long-term portfolios.

Of course, the UK has the option to leave the EU sooner than October 31st. Given the lack of movement so far though, it seems likely that the UK will run right up against the deadline. As we reported in our March whitepaper, Brexit: An Overview, no single Leave option is palatable for all relevant stakeholders. Staying within the customs union is a non-starter for hardline Conservatives, while a hard Brexit has little support from centrists and left-leaning MPs (Ministers of Parliament). This deep divide was evidenced by the defeat of eight separate plans proposed by various MPs over the course of a week at the end of March.

No End to the Political Impasse

This deep divide in opinion within the UK, much less between the UK and the EU, has drained May of essentially all her authority. She survived a challenge to her leadership at the end of 2018, but since then has seen her proposed Brexit withdrawal deal defeated twice. As a result, she’s promised her resignation in exchange for the approval of any permanent deal. However, given the longer extension it seems likely she will remain at the helm for the foreseeable future.

In the meantime, May has broken from her coalition and reached across the aisle to Labour MPs in hopes of brokering a bipartisan deal. Indications are that the talks, which are set to conclude next week, have made progress but may not amount to any substantive agreement. While the two sides are in general agreement over the use of the Irish backstop, there is significant disagreement over Britain’s future trading autonomy. Labour is adamant that an agreement should leave the UK within the customs union, whereas May believes such an arrangement would not honor the Brexit vote, as it would reduce the UK’s autonomy in brokering future trade deals.

Should the sides not come to a concrete agreement, all options remain on the table. May has already stated that she would put forward different Brexit options for indicative votes. However, given the results from March it is unlikely any single proposal would garner majority support from Parliament. Outside of this there remains the long-talked-about possibility of a second referendum, a snap election, a major renegotiation with the EU, or even a revoking of Article 50 (which would see the UK remain in the EU). These remain relatively remote possibilities though, for a variety of reasons.

Worst-Case Scenarios Still Possible

If all else fails, a no-deal Brexit could still occur. A no-deal has been voted down by MPs twice now, and has been completely ruled out by May. But as long as there is no concrete plan for Brexit, it remains a distinct possibility. As we also covered in our whitepaper, a no-deal outcome poses a significant tail-risk to the UK economic outlook. In a worst-case scenario, the Bank of England estimates that the economy could experience a recession more severe than experienced during the financial crisis, with GDP declining by close to 8%, unemployment rising by 3%, and inflation spiking 4%. This combination of factors could significantly reduce the living standards of UK citizens, and almost certainly would have global ramifications.

Those impacts would be in addition to those already being felt. According to the Bank of England, studies assessing the impact of Brexit to date estimate that GDP is about 2% lower than it would have been if the UK had voted to remain.

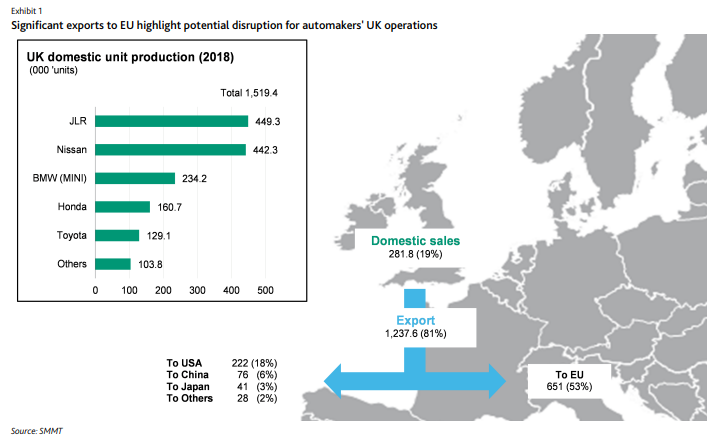

Uncertainty around the outcome has the potential to disrupt supply chains and investment plans of global auto firms such as Toyota, Honda, and BMW, which have significant operating scale inside the UK.

Auto Production in UK

Source: Moody’s, ‘No-deal’ Brexit scenario will hurt automakers’ production capability

UK-based manufacturing firms in the pharmaceutical, electronic, and chemical space could be impacted by weakening sentiment. Furthermore, implementation of tariffs has the potential to significantly raise their cost of production and lower their sales. Financial institutions with considerable exposure to the UK, such as RBS and Lloyds, could also see reduced profitability from lower GDP growth and lower interest rates, as well as greater tail risk to asset quality.

For now, then, it makes sense for investors to maintain a wait-and-see approach. Even after these past two-plus years of negotiations, the outcome is far from certain. The deadline extension has helped ease nerves and reduced political scrutiny on Theresa May and her government. Based on their track record however, it remains to be seen whether they will reach a solution palatable to enough stakeholders. If not, we’ll just be at the same place in six months.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.